Palo Alto Networks Vs. Nvidia: Which Stock To Buy After The Nasdaq Sell-Off?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Palo Alto Networks vs. Nvidia: Which Stock to Buy After the Nasdaq Sell-Off?

The recent Nasdaq sell-off has left many investors wondering where to park their money. Two tech giants, Palo Alto Networks (PANW) and Nvidia (NVDA), have emerged as potential winners, but choosing between them requires careful consideration. Both companies offer compelling investment opportunities, but their strengths lie in different sectors, making a direct comparison crucial. This article will delve into the specifics of each company, analyzing their performance, future prospects, and ultimately, helping you determine which stock might be the better buy after the market downturn.

Understanding the Landscape: Post-Sell-Off Opportunities

The recent market volatility presents both risks and rewards. While many tech stocks suffered, companies demonstrating resilience and strong growth potential stand out. Palo Alto Networks and Nvidia, while both in the tech sector, operate in distinct markets, providing diversification within the investment portfolio.

Palo Alto Networks (PANW): Cybersecurity Strength in a Volatile World

Palo Alto Networks is a cybersecurity leader, offering a comprehensive suite of security solutions for enterprises and individuals. Their strong performance amidst increasing cyber threats positions them favorably.

- Key Strengths: Robust product portfolio, strong customer base, recurring revenue model, consistent growth.

- Growth Potential: The increasing sophistication of cyberattacks and the growing reliance on digital infrastructure fuel PANW's growth. Expansion into cloud security and AI-driven threat detection further enhances their prospects.

- Risk Factors: Intense competition within the cybersecurity market, potential economic slowdowns impacting enterprise spending.

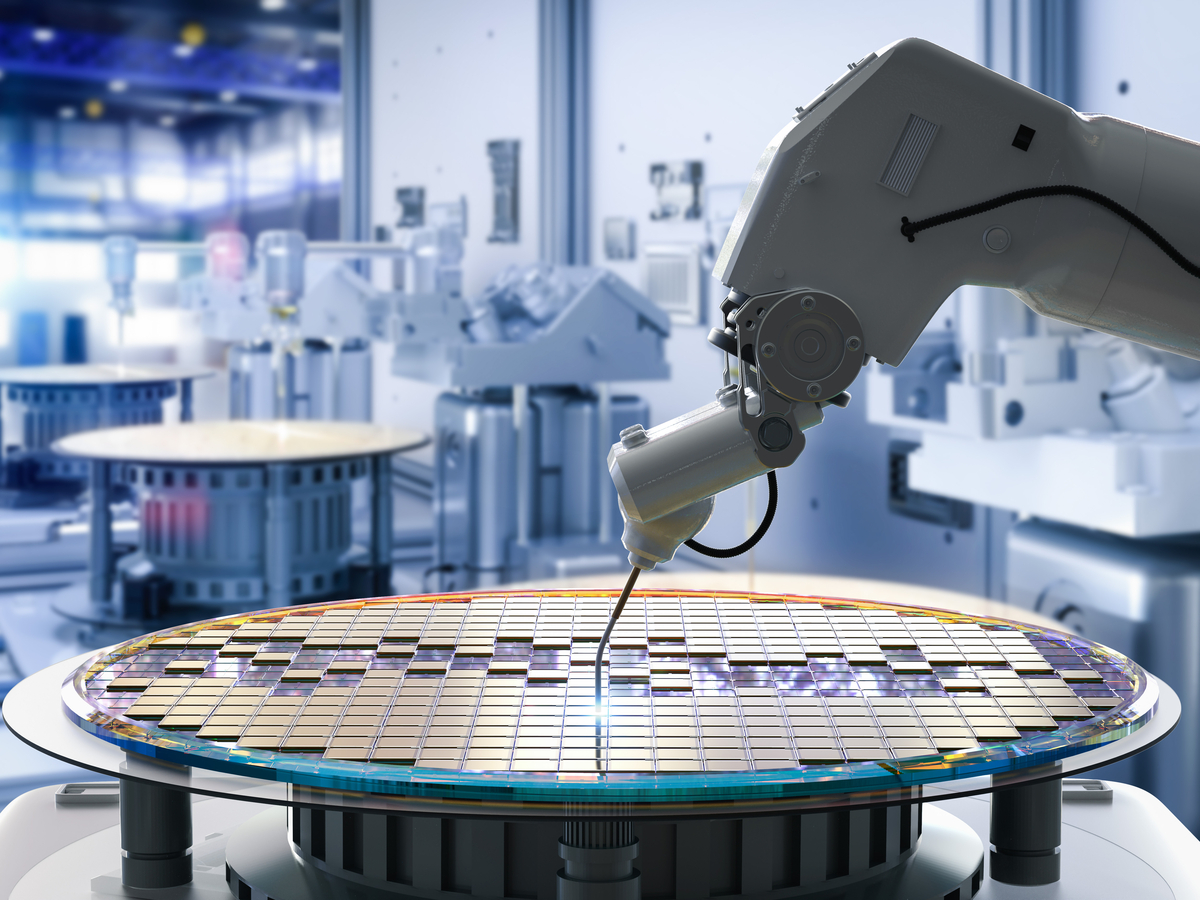

Nvidia (NVDA): The AI Powerhouse

Nvidia's dominance in the GPU market, particularly its crucial role in artificial intelligence (AI) development, has catapulted it to the forefront of technological innovation.

- Key Strengths: Market leadership in GPUs, essential role in AI development, strong partnerships with major tech companies, diverse revenue streams.

- Growth Potential: The booming AI sector drives significant demand for Nvidia's GPUs. Their expansion into data centers, autonomous vehicles, and other AI-related applications fuels further growth potential.

- Risk Factors: High valuation, dependence on a few key customers, potential competition from emerging GPU manufacturers.

Head-to-Head Comparison: PANW vs. NVDA

| Feature | Palo Alto Networks (PANW) | Nvidia (NVDA) |

|---|---|---|

| Industry | Cybersecurity | Semiconductors, AI |

| Growth Driver | Increasing cyber threats | AI boom, data center growth |

| Valuation | Relatively lower | High |

| Risk Profile | Moderate | Higher |

| Revenue Model | Subscription-based | Hardware and software |

Which Stock to Choose?

The choice between Palo Alto Networks and Nvidia depends heavily on your risk tolerance and investment horizon.

-

Conservative Investors: Palo Alto Networks, with its relatively lower valuation and established market position, offers a more conservative approach. Its recurring revenue model provides stability.

-

Aggressive Investors: Nvidia presents a higher-growth, higher-risk opportunity. Its exposure to the rapidly expanding AI market offers potentially substantial returns, but comes with increased volatility.

Conclusion:

Both Palo Alto Networks and Nvidia offer exciting investment prospects after the Nasdaq sell-off. The optimal choice hinges on individual investor profiles. Thorough due diligence, considering your risk tolerance, and understanding the long-term growth potential of each company are crucial before making an investment decision. Remember to consult with a financial advisor before making any investment choices. The information provided here is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Palo Alto Networks Vs. Nvidia: Which Stock To Buy After The Nasdaq Sell-Off?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sg 60 Celebration 140 Coffee Shops Offer Cheaper Food And Drinks

Apr 08, 2025

Sg 60 Celebration 140 Coffee Shops Offer Cheaper Food And Drinks

Apr 08, 2025 -

Multiple Vehicle Collision On Don Valley Parkway Southbound Lanes Closed

Apr 08, 2025

Multiple Vehicle Collision On Don Valley Parkway Southbound Lanes Closed

Apr 08, 2025 -

Gemma Atkinson Shares Wedding Update Feeling Married To Gorka

Apr 08, 2025

Gemma Atkinson Shares Wedding Update Feeling Married To Gorka

Apr 08, 2025 -

Louisa Lytton Confirms East Enders Departure Ruby Allens Exit Explained

Apr 08, 2025

Louisa Lytton Confirms East Enders Departure Ruby Allens Exit Explained

Apr 08, 2025 -

Maxs New Movie Lineup For April 2025 A Streaming Preview

Apr 08, 2025

Maxs New Movie Lineup For April 2025 A Streaming Preview

Apr 08, 2025