PAP's Chee Hong Tat Defends Planned GST Increase Ahead Of GE2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PAP's Chee Hong Tat Defends Planned GST Increase Ahead of GE2025

Singapore's political landscape is heating up as the next General Election (GE2025) draws closer. A key point of contention remains the planned increase in the Goods and Services Tax (GST), a topic defended vigorously by Minister Chee Hong Tat, a prominent member of the ruling People's Action Party (PAP). His recent pronouncements highlight the government's rationale for this unpopular but potentially necessary fiscal measure.

The planned GST hike, from 7% to 9%, is a significant policy shift with potentially far-reaching consequences for Singaporean households. While acknowledging the public's concerns, Chee Hong Tat has consistently emphasized the need for the increase to fund crucial social spending and infrastructure projects essential for Singapore's long-term sustainability.

The Rationale Behind the GST Increase:

Chee Hong Tat's defense rests on several pillars:

-

Aging Population and Healthcare Costs: Singapore faces a rapidly aging population, placing immense strain on its healthcare system. The increased GST revenue is earmarked to bolster healthcare funding, ensuring the nation can continue providing quality care for its elderly citizens. This directly addresses the rising costs of healthcare and the need for long-term care solutions.

-

Infrastructure Development and Upgrading: Maintaining and upgrading Singapore's infrastructure – from public transport to housing – requires substantial investment. The GST increase is intended to help finance these crucial projects, ensuring Singapore remains a competitive and liveable city-state. This includes investments in sustainable infrastructure and smart nation initiatives.

-

Addressing Future Economic Challenges: The global economic landscape is ever-shifting, presenting both opportunities and challenges. The government argues that having a robust financial foundation, bolstered by the increased GST revenue, is crucial to navigate future uncertainties and maintain Singapore's economic competitiveness. This includes bolstering resilience against economic shocks and investing in future growth areas.

-

Targeted Support Measures for Vulnerable Groups: While acknowledging the impact on lower-income households, Chee Hong Tat has consistently highlighted the government's commitment to mitigating the effects of the GST hike through various assistance schemes and initiatives. These include enhanced rebates, subsidies, and other forms of financial aid specifically designed to cushion the blow for the most vulnerable segments of the population. The government's commitment to social safety nets remains a key aspect of the argument.

Opposition and Public Sentiment:

Despite the government's efforts to explain the rationale, the proposed GST increase remains a contentious issue. Opposition parties have criticized the move, arguing that there are alternative ways to fund necessary projects without placing an additional burden on citizens. Public sentiment is mixed, with concerns about the impact on household budgets and the perceived lack of transparency in government spending.

The Road to GE2025:

The GST increase is likely to feature prominently in the upcoming General Election. The PAP's ability to effectively communicate the necessity of the measure and the accompanying support measures will be crucial in garnering public support. The debate promises to be intense, with the opposition parties likely to capitalize on public anxieties surrounding the rising cost of living. The coming months will be critical in shaping public opinion and influencing the outcome of the GE2025. This will undoubtedly be a key factor shaping the political discourse and the electoral strategies of all participating parties. The effectiveness of the government's communication strategy and its ability to build public trust will play a significant role in determining the outcome.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on PAP's Chee Hong Tat Defends Planned GST Increase Ahead Of GE2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Find The Wordle Answer April 25 2025 Hints And Solution

Apr 28, 2025

Find The Wordle Answer April 25 2025 Hints And Solution

Apr 28, 2025 -

Thunderbolts Director Explains Baron Zemos Absence

Apr 28, 2025

Thunderbolts Director Explains Baron Zemos Absence

Apr 28, 2025 -

Saying Goodbye To Vera Remembering A Life Well Lived

Apr 28, 2025

Saying Goodbye To Vera Remembering A Life Well Lived

Apr 28, 2025 -

Ellie Taylor And Joel Dommett Join Bbc Radio 2

Apr 28, 2025

Ellie Taylor And Joel Dommett Join Bbc Radio 2

Apr 28, 2025 -

Last Minute Injury Abrahams Path To Romas Starting Xi Against Venezia

Apr 28, 2025

Last Minute Injury Abrahams Path To Romas Starting Xi Against Venezia

Apr 28, 2025

Latest Posts

-

Survey Reveals Most Managers Believe Ai Impacts Employee Confidence

Apr 29, 2025

Survey Reveals Most Managers Believe Ai Impacts Employee Confidence

Apr 29, 2025 -

Cook Islands Reports Dengue Fever Outbreak Amidst Regional Surge In Cases

Apr 29, 2025

Cook Islands Reports Dengue Fever Outbreak Amidst Regional Surge In Cases

Apr 29, 2025 -

Tj Watts Career Cut Short Steelers Release Injured Star Linebacker

Apr 29, 2025

Tj Watts Career Cut Short Steelers Release Injured Star Linebacker

Apr 29, 2025 -

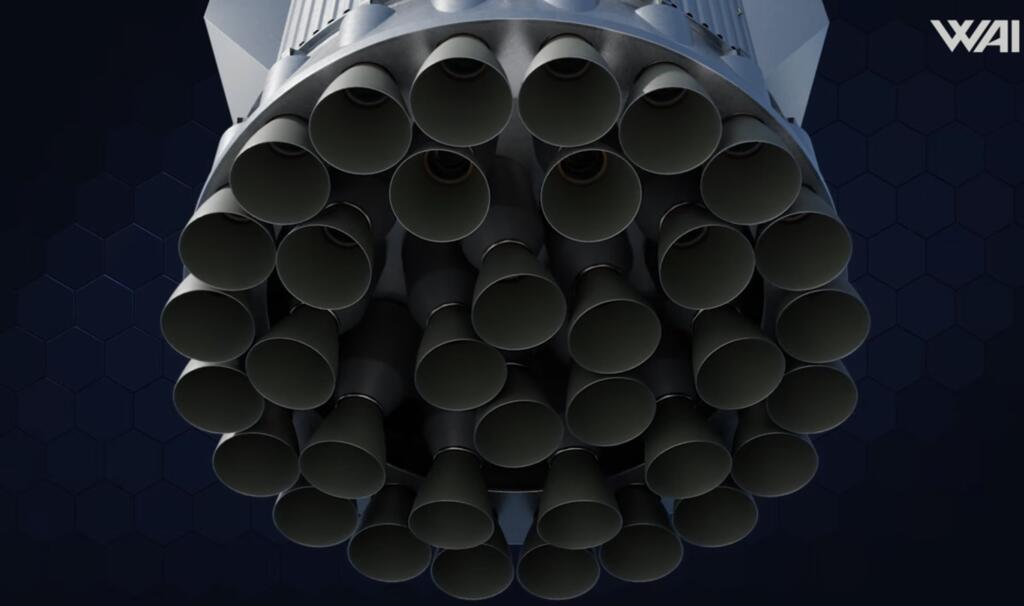

Space X Starships Powerful Upgrade 35 Raptor 3 Engines On New Booster

Apr 29, 2025

Space X Starships Powerful Upgrade 35 Raptor 3 Engines On New Booster

Apr 29, 2025 -

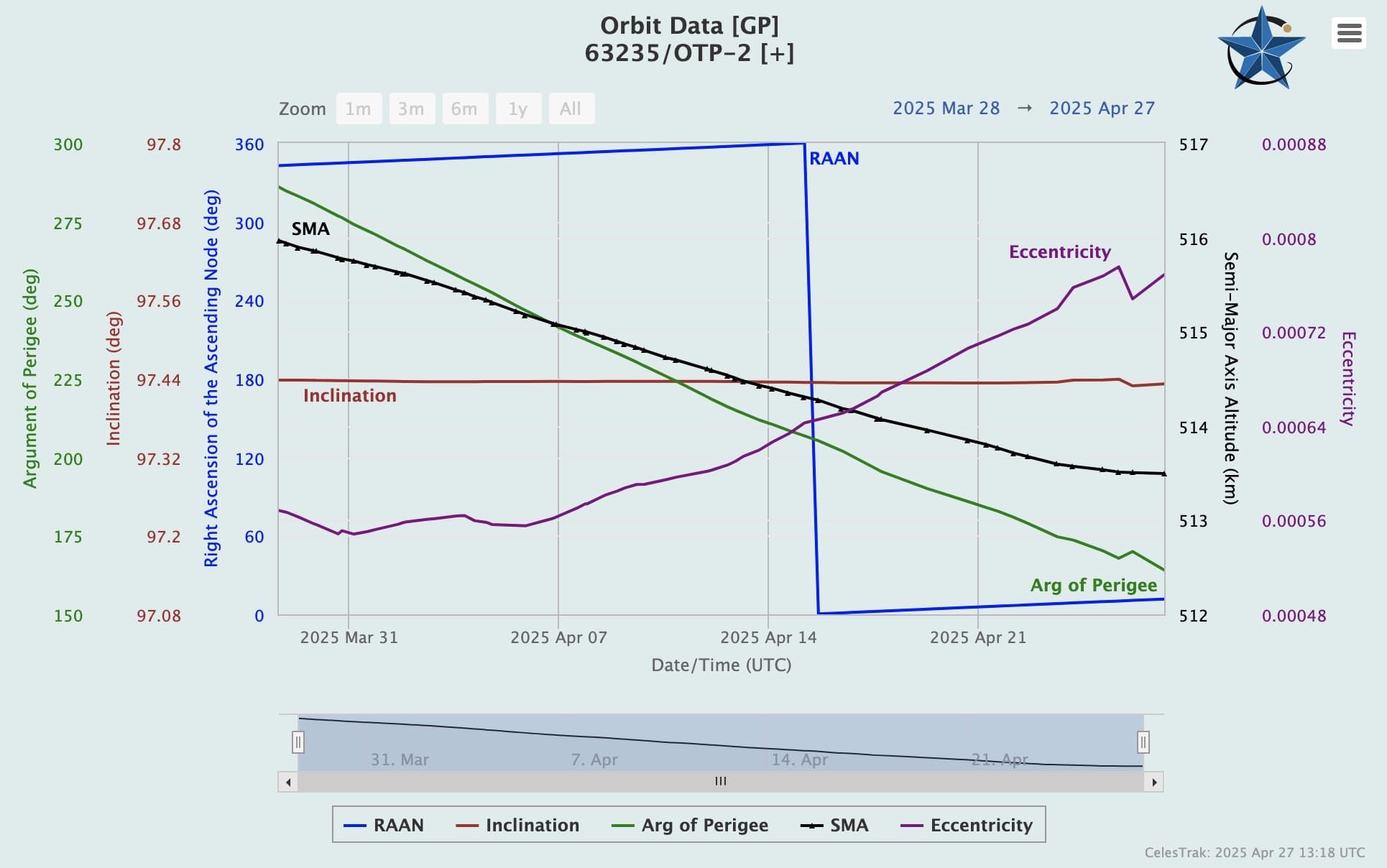

Otp 2 Satellite A Deep Dive Into Its Propellantless Propulsion System

Apr 29, 2025

Otp 2 Satellite A Deep Dive Into Its Propellantless Propulsion System

Apr 29, 2025