Paul Atkins Confirmed As SEC Chair: A Commitment To Apolitical Securities Regulation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Paul Atkins Confirmed as SEC Chair: A Commitment to Apolitical Securities Regulation

The Senate confirmed Paul Atkins as a commissioner of the Securities and Exchange Commission (SEC), signaling a potential shift towards a more politically neutral approach to securities regulation. This appointment, lauded by some and criticized by others, has ignited a debate about the future direction of the SEC and its role in protecting investors. Atkins, known for his conservative stance and emphasis on deregulation, brings a wealth of experience and a distinct perspective to the agency. But will his appointment truly deliver on the promise of apolitical regulation, or will partisan divides continue to shape the SEC's decisions?

Atkins' Background and Regulatory Philosophy

Atkins' career has been deeply intertwined with the financial industry and regulatory oversight. Before this appointment, he served as a commissioner at the SEC from 2002 to 2006. During his previous tenure, he advocated for a less interventionist approach, emphasizing market efficiency and the importance of reducing regulatory burdens on businesses. This philosophy aligns with his stated commitment to fostering a strong and competitive capital market, free from excessive government intervention. His critics, however, argue that this approach prioritizes the interests of corporations over the protection of investors.

Implications for Investors and the Market

The confirmation of Atkins as a commissioner raises several key questions for investors and the broader financial market. Will his influence lead to a relaxation of enforcement actions against corporate wrongdoers? Will the SEC prioritize deregulation over investor protection? Will the balance of power within the SEC shift, potentially leading to a more lenient approach to rulemaking?

Some argue that Atkins' emphasis on deregulation could stimulate economic growth by reducing compliance costs for businesses. They believe that a more streamlined regulatory environment will attract investment and foster innovation. However, others express concerns that a less stringent regulatory framework could expose investors to greater risks and increase the likelihood of corporate malfeasance. The debate highlights the inherent tension between fostering economic growth and ensuring robust investor protection.

The Importance of Apolitical Regulation

The integrity of the SEC hinges on its ability to function independently from political influence. A politically neutral regulatory body is crucial for maintaining investor confidence and ensuring the fairness and efficiency of the financial markets. Atkins' appointment, therefore, underscores the ongoing challenge of maintaining this crucial balance. His commitment to apolitical regulation will be a critical factor in shaping his legacy and determining the success of his tenure.

What to Expect Moving Forward

The coming months will be crucial in observing how Atkins' presence shapes the SEC's agenda. We can expect increased scrutiny of proposed regulations, a potential shift in enforcement priorities, and ongoing debate surrounding the appropriate balance between regulatory oversight and market efficiency. Key areas to watch include:

- Enforcement Actions: Will the SEC become less aggressive in pursuing enforcement actions against companies accused of securities fraud or other violations?

- Rulemaking: Will new regulations be proposed and adopted at a slower pace?

- Investor Protection: Will the SEC maintain its focus on protecting retail investors from fraud and market manipulation?

The appointment of Paul Atkins to the SEC is a significant event with far-reaching consequences for the financial industry. Whether his appointment leads to a truly apolitical regulatory environment or exacerbates existing partisan divisions remains to be seen. The coming years will offer a crucial test of his commitment to independent oversight and his ability to navigate the complex political landscape surrounding securities regulation. This situation warrants continued attention from investors, regulators, and anyone concerned about the health and stability of the US financial markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Paul Atkins Confirmed As SEC Chair: A Commitment To Apolitical Securities Regulation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dogecoin Fallout Elon Musk Returns To Teslas Boardroom

Apr 25, 2025

Dogecoin Fallout Elon Musk Returns To Teslas Boardroom

Apr 25, 2025 -

How To Train Your Dragon Ride A Look At Universals Cutting Edge Animatronics

Apr 25, 2025

How To Train Your Dragon Ride A Look At Universals Cutting Edge Animatronics

Apr 25, 2025 -

Leaked Nvidia Information Suggests Rtx 5000 Series Gpu Supply Increase

Apr 25, 2025

Leaked Nvidia Information Suggests Rtx 5000 Series Gpu Supply Increase

Apr 25, 2025 -

Analyzing Byds Financials And Technological Advantages In The Chinese Ev Market A Li Dar Focus

Apr 25, 2025

Analyzing Byds Financials And Technological Advantages In The Chinese Ev Market A Li Dar Focus

Apr 25, 2025 -

Ian Wright And Eni Aluko Dispute Aluko Denies Assault Highlights Clickbait Issue

Apr 25, 2025

Ian Wright And Eni Aluko Dispute Aluko Denies Assault Highlights Clickbait Issue

Apr 25, 2025

Latest Posts

-

Arsenal Psg Doue Et Dembele Demarrent Suivez La Demi Finale En Direct

Apr 29, 2025

Arsenal Psg Doue Et Dembele Demarrent Suivez La Demi Finale En Direct

Apr 29, 2025 -

Swiatek Escapes Shnaiders Challenge Reaches Madrid Quarters

Apr 29, 2025

Swiatek Escapes Shnaiders Challenge Reaches Madrid Quarters

Apr 29, 2025 -

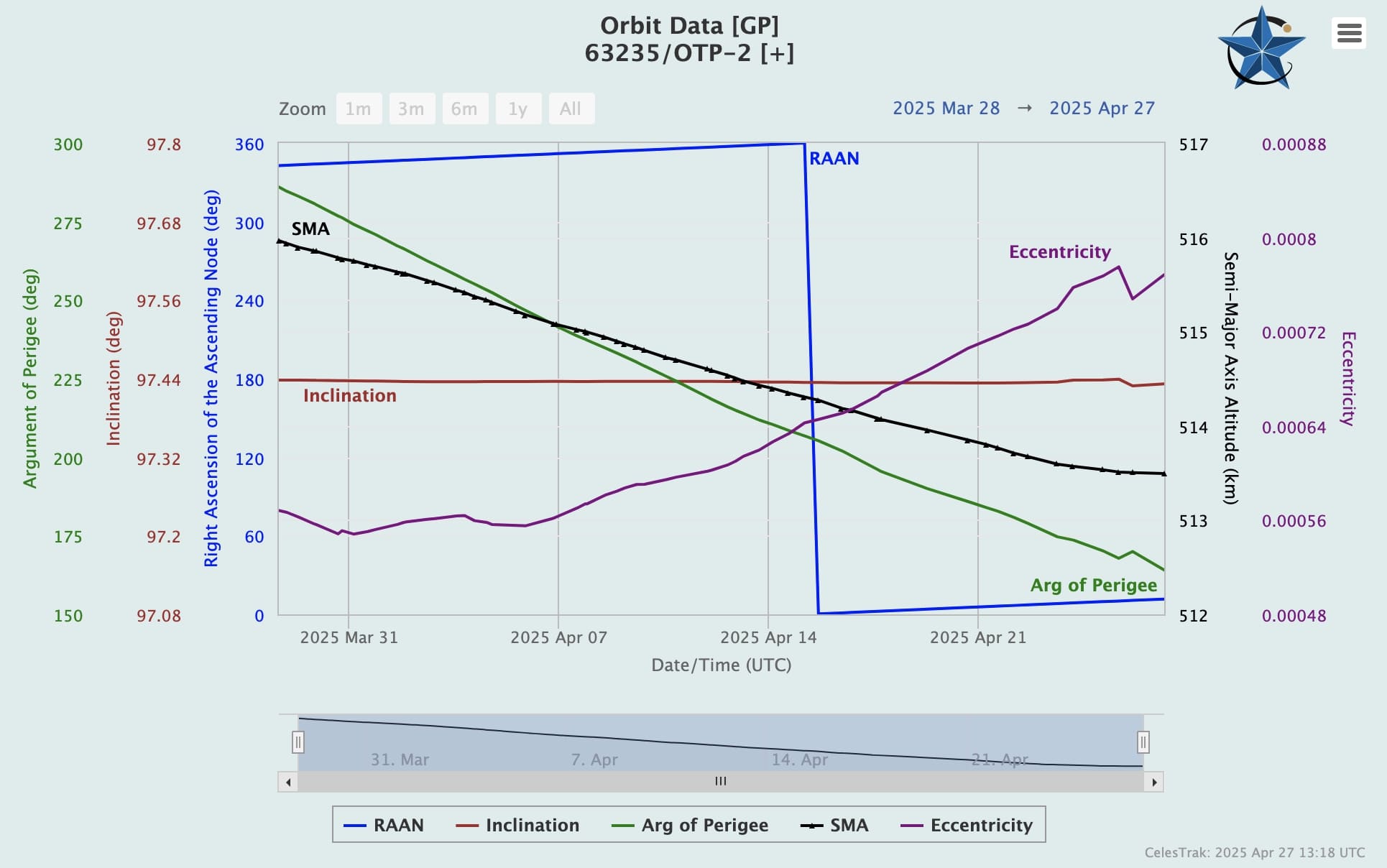

Propellantless Satellite Drive Shows Promise Otp 2s Orbital Decline Rate Decreases

Apr 29, 2025

Propellantless Satellite Drive Shows Promise Otp 2s Orbital Decline Rate Decreases

Apr 29, 2025 -

Fired Ftc Commissioners Fight For Their Jobs

Apr 29, 2025

Fired Ftc Commissioners Fight For Their Jobs

Apr 29, 2025 -

Update Stronghold Fire Reaches 3 000 Acres Further Spread Expected

Apr 29, 2025

Update Stronghold Fire Reaches 3 000 Acres Further Spread Expected

Apr 29, 2025