Polkadot (DOT) Price Forecast: Assessing The Sustained Downturn

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Polkadot (DOT) Price Forecast: Assessing the Sustained Downturn

The cryptocurrency market has seen its share of volatility lately, and Polkadot (DOT), a prominent player in the blockchain space, hasn't been immune. While DOT once soared to impressive heights, it's currently experiencing a sustained downturn, leaving many investors wondering about the future. This article delves into the current state of Polkadot's price, explores potential reasons behind the decline, and offers a considered price forecast, acknowledging the inherent uncertainties of the cryptocurrency market.

Understanding the Current Market Sentiment for DOT

Polkadot's price has been significantly impacted by the broader cryptocurrency market correction. The overall bearish sentiment, fueled by factors like regulatory uncertainty, macroeconomic conditions, and the lingering effects of past market crashes, has heavily influenced DOT's performance. Currently trading [insert current price and date], DOT is significantly below its all-time high, prompting concern amongst holders and prospective investors.

Factors Contributing to Polkadot's Price Decline:

Several factors are contributing to the sustained downturn in Polkadot's price:

-

Macroeconomic Factors: Global economic instability, high inflation rates, and rising interest rates have led to a risk-off sentiment in the market, impacting even established cryptocurrencies like DOT.

-

Regulatory Uncertainty: The ongoing regulatory scrutiny surrounding cryptocurrencies globally creates uncertainty and discourages investment. Lack of clear regulatory frameworks impacts investor confidence.

-

Competition in the Blockchain Space: Polkadot faces stiff competition from other layer-1 blockchains offering similar functionalities. This competitive landscape contributes to price pressure.

-

Technological Developments: While Polkadot is constantly evolving, the pace of innovation in the blockchain space is rapid. Failure to keep pace with competitors can hinder adoption and, consequently, price appreciation.

Polkadot (DOT) Price Forecast: A Cautious Outlook

Predicting cryptocurrency prices is inherently speculative. However, by analyzing current market conditions and historical trends, we can formulate a cautious outlook.

Short-Term (Next 3-6 Months): Given the current market sentiment and the factors mentioned above, a short-term price recovery for DOT seems unlikely. We could see continued consolidation within a range, potentially experiencing further minor dips depending on broader market movements. A price range between [insert conservative price range] seems plausible.

Medium-Term (Next 12-18 Months): The medium-term forecast hinges on several factors, including successful implementation of Polkadot's roadmap, increased adoption of its technology, and a more positive regulatory landscape. If these conditions are met, a gradual price recovery is possible, potentially reaching [insert moderate price target]. However, continued bearish market conditions could extend the downturn.

Long-Term (Beyond 18 Months): The long-term outlook for Polkadot depends on its ability to maintain its technological edge and attract developers and users. Successful partnerships and the continued development of its ecosystem are crucial. If Polkadot can successfully solidify its position in the blockchain space, a significant price appreciation is possible in the long run, although this is highly dependent on various unpredictable factors.

Disclaimer: This price forecast is purely speculative and should not be considered financial advice. Investing in cryptocurrencies carries significant risk, and investors should conduct their own thorough research before making any investment decisions. The cryptocurrency market is highly volatile, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Polkadot (DOT) Price Forecast: Assessing The Sustained Downturn. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Qatari Donated Jet The Story Behind The New Air Force One Plane

May 22, 2025

Qatari Donated Jet The Story Behind The New Air Force One Plane

May 22, 2025 -

Key Committee Votes To Advance Trumps Controversial Policy Bill

May 22, 2025

Key Committee Votes To Advance Trumps Controversial Policy Bill

May 22, 2025 -

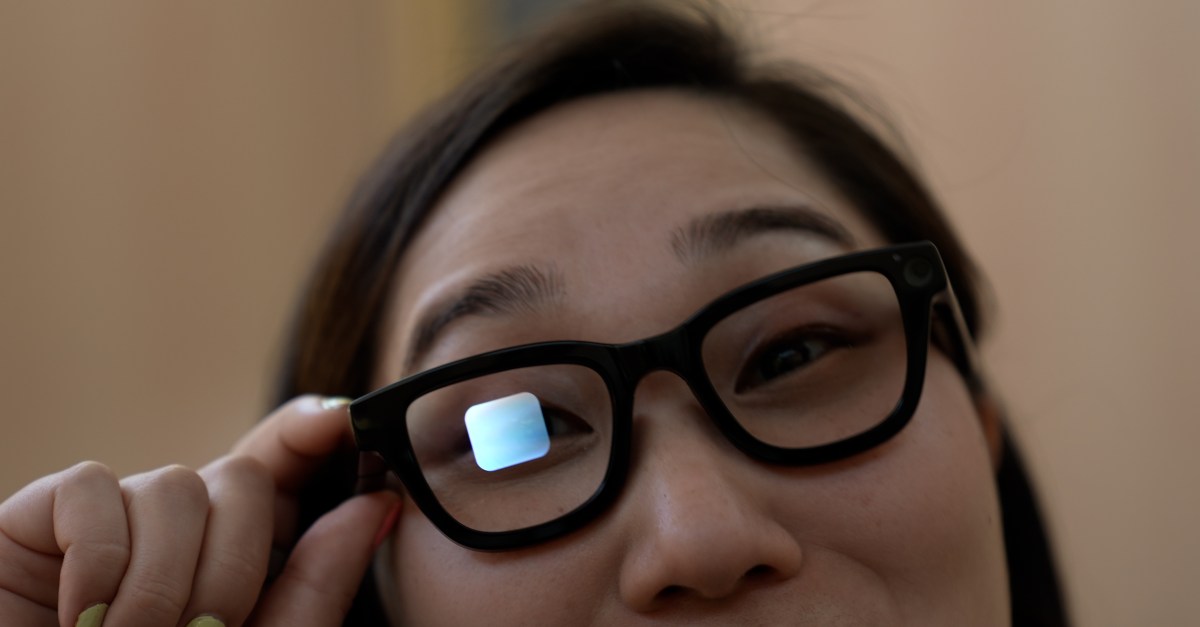

Googles Ai Smart Glasses Prototype Features Performance And Impressions

May 22, 2025

Googles Ai Smart Glasses Prototype Features Performance And Impressions

May 22, 2025 -

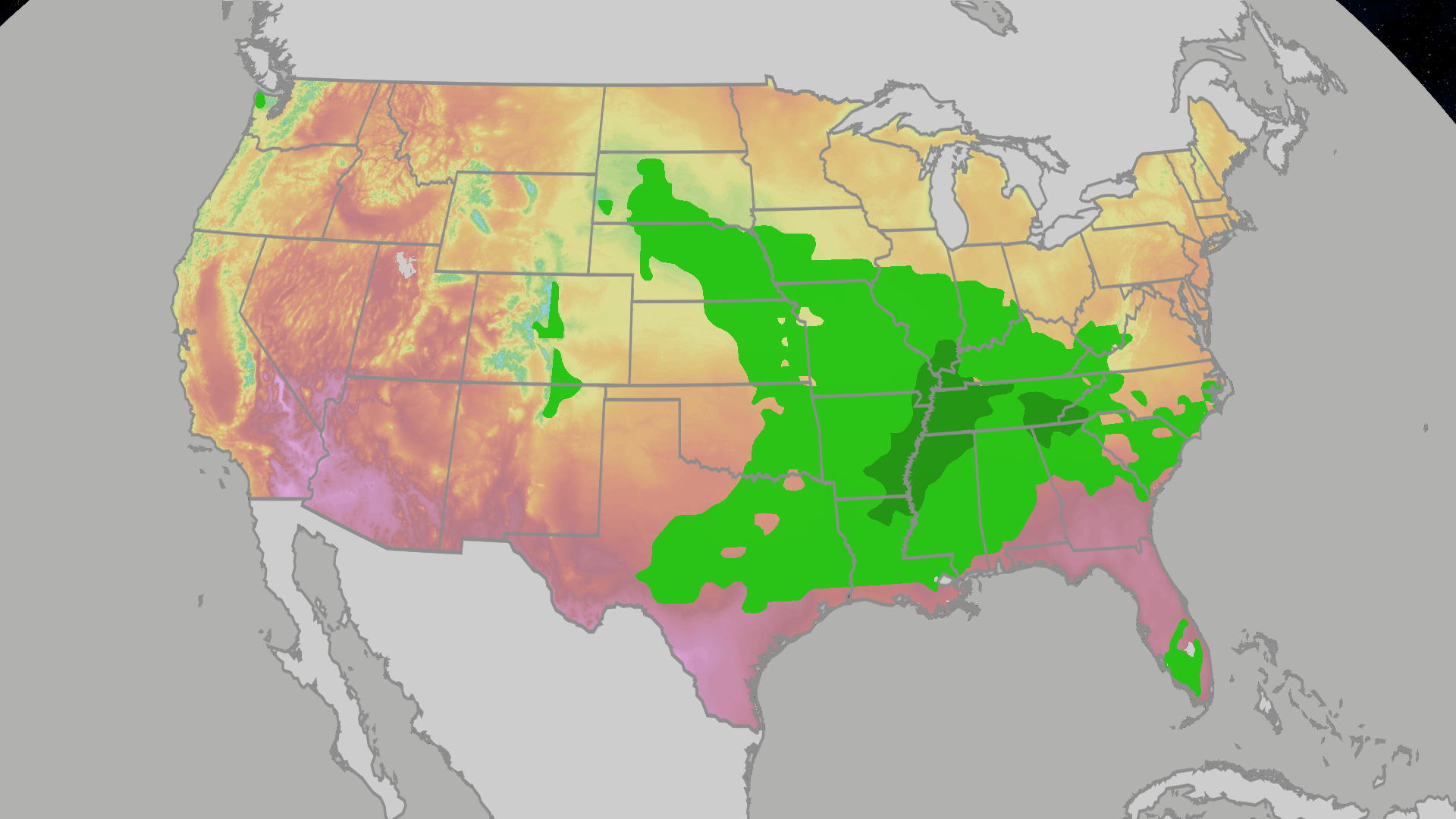

Rainy Memorial Day Weekend Storm System Could Impact Your Holiday

May 22, 2025

Rainy Memorial Day Weekend Storm System Could Impact Your Holiday

May 22, 2025 -

Tottenhams Europa League Triumph 1 0 Victory Over Manchester United Secures 2025 Title

May 22, 2025

Tottenhams Europa League Triumph 1 0 Victory Over Manchester United Secures 2025 Title

May 22, 2025