Post-Earnings Sell-Off? Analyzing Nvidia's Stock After The May 28th Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Earnings Sell-Off? Analyzing Nvidia's Stock After the May 28th Report

Nvidia (NVDA) sent shockwaves through the market following its May 28th earnings report, prompting a significant sell-off despite beating analysts' expectations. While the company delivered impressive revenue and earnings per share (EPS), exceeding projections, the post-earnings reaction raises questions about investor sentiment and the future trajectory of the stock. This analysis delves into the reasons behind the sell-off, examines key aspects of the report, and considers potential implications for Nvidia investors.

Nvidia's Strong Financials: A Closer Look

Nvidia's Q1 2024 earnings report showcased remarkable growth. Revenue surged to $7.19 billion, significantly surpassing the anticipated $6.52 billion. EPS also exceeded expectations, reaching $1.09 compared to the projected $0.92. This strong performance was driven primarily by the booming demand for its high-performance GPUs, crucial for artificial intelligence (AI) applications, data centers, and gaming.

- Data Center Dominance: The data center segment emerged as a standout performer, fueled by the insatiable appetite for AI processing power. This sector's growth underscores Nvidia's strategic position in the rapidly expanding AI landscape.

- Gaming Strength Persists: Despite concerns about a potential slowdown in the gaming market, Nvidia's gaming revenue remained robust, indicating continued demand for its high-end graphics cards.

- Automotive Growth Trajectory: While still a relatively smaller segment compared to data centers and gaming, Nvidia's automotive revenue showed promising growth, highlighting the potential of its technology in the autonomous vehicle sector.

Why the Sell-Off? Deciphering Investor Sentiment

Despite the impressive financial results, Nvidia's stock experienced a notable decline following the earnings release. Several factors may have contributed to this post-earnings sell-off:

- Guidance Concerns: While Q1 results were stellar, some analysts expressed concerns about Nvidia's Q2 guidance. While still indicating strong growth, the projected figures might not have met the exceptionally high expectations set by the market's bullish sentiment.

- Valuation Concerns: Nvidia's stock price had already experienced a substantial surge leading up to the earnings report. The sell-off could be attributed to profit-taking by investors who believed the stock was overvalued, despite the strong fundamentals.

- Macroeconomic Uncertainty: The broader macroeconomic environment, characterized by persistent inflation and rising interest rates, might have played a role in the market's reaction. Investors often become more risk-averse during periods of economic uncertainty.

- Competition: Although Nvidia currently dominates the market, increased competition in the AI chip sector could be a factor contributing to investor apprehension.

The Road Ahead for Nvidia Stock

The post-earnings sell-off presents both challenges and opportunities for Nvidia investors. The company's long-term growth prospects remain strong, particularly given its leading position in the AI revolution. However, investors should carefully consider the aforementioned factors before making any investment decisions. Monitoring the company's progress in key areas, such as data center expansion and AI innovation, will be crucial in gauging future stock performance.

Keywords: Nvidia, NVDA, Stock, Earnings, Earnings Report, Sell-Off, AI, Artificial Intelligence, GPU, Graphics Processing Unit, Data Center, Gaming, Automotive, Investment, Stock Market, Q1 2024, May 28th, Market Analysis, Investor Sentiment, Valuation, Macroeconomic Uncertainty, Competition

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Earnings Sell-Off? Analyzing Nvidia's Stock After The May 28th Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

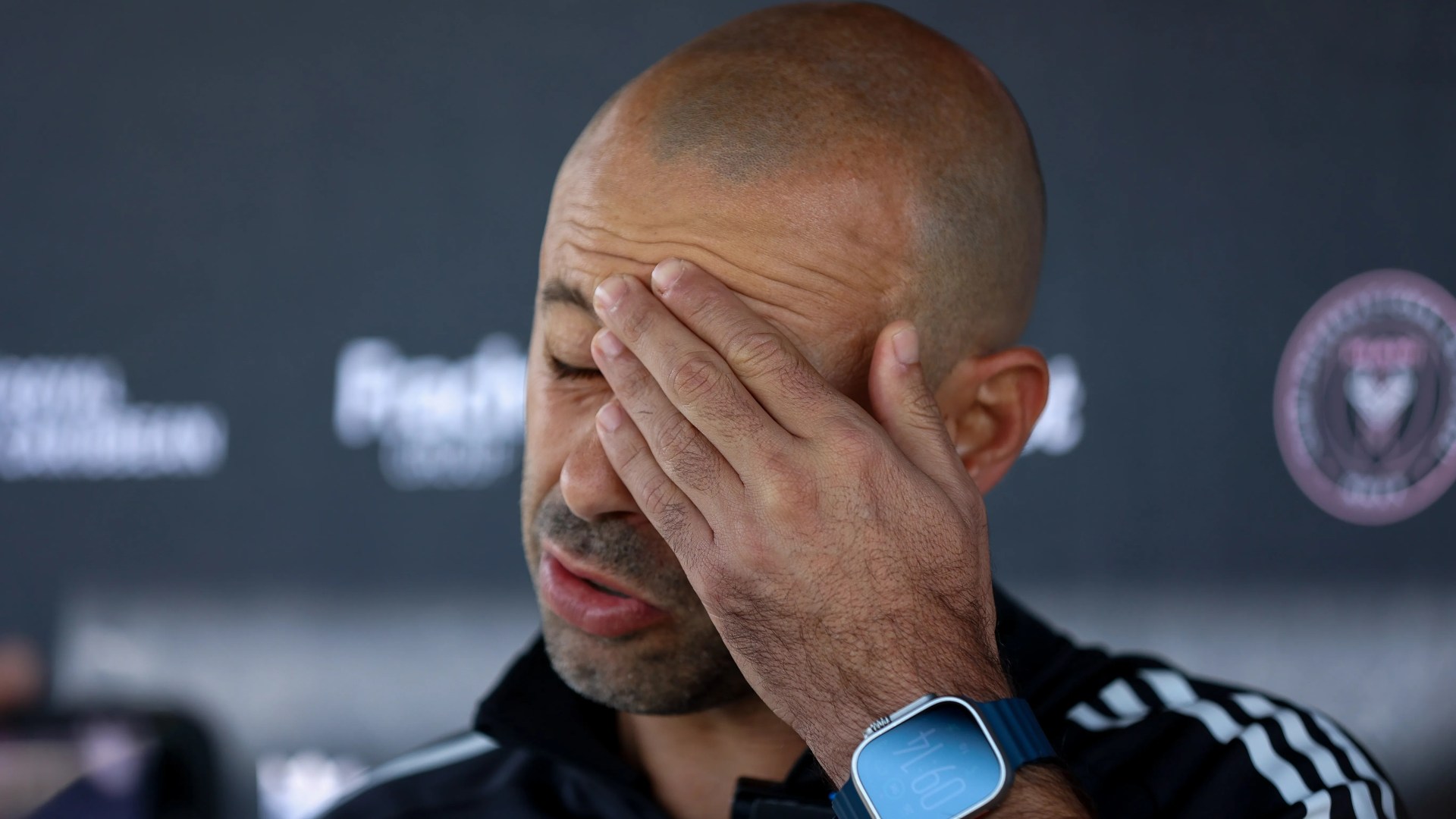

Pressure Mounts On Beckham Messis Mls Disaster Threatens Mascheranos Position

May 13, 2025

Pressure Mounts On Beckham Messis Mls Disaster Threatens Mascheranos Position

May 13, 2025 -

Draper Vs Moutet In Depth Preview Form Analysis And Tournament Performance

May 13, 2025

Draper Vs Moutet In Depth Preview Form Analysis And Tournament Performance

May 13, 2025 -

Record Breaking Win Pacers Cruise To Victory With 41 Point Halftime Advantage

May 13, 2025

Record Breaking Win Pacers Cruise To Victory With 41 Point Halftime Advantage

May 13, 2025 -

Full Flower Moon On May 12 2025 A Skywatchers Guide

May 13, 2025

Full Flower Moon On May 12 2025 A Skywatchers Guide

May 13, 2025 -

Xperia 1 Vii Leaked Images Show Off Design And Potential Specs

May 13, 2025

Xperia 1 Vii Leaked Images Show Off Design And Potential Specs

May 13, 2025

Latest Posts

-

New York Knicks Defeat Boston Celtics Brunsons Impact In The Nba Playoffs

May 13, 2025

New York Knicks Defeat Boston Celtics Brunsons Impact In The Nba Playoffs

May 13, 2025 -

El Salvadors Bitcoin Dominance Challenged Metaplanets Massive 127 M Buy

May 13, 2025

El Salvadors Bitcoin Dominance Challenged Metaplanets Massive 127 M Buy

May 13, 2025 -

Trent Grishams 2 Hrs Lead Yankees To Victory Over Mariners

May 13, 2025

Trent Grishams 2 Hrs Lead Yankees To Victory Over Mariners

May 13, 2025 -

Unsung Wwii Film Showcases Young Humphrey Bogart And Lauren Bacall

May 13, 2025

Unsung Wwii Film Showcases Young Humphrey Bogart And Lauren Bacall

May 13, 2025 -

Justin Baldoni Breaks Silence On Social Media Following Blake Lively Legal Dispute

May 13, 2025

Justin Baldoni Breaks Silence On Social Media Following Blake Lively Legal Dispute

May 13, 2025