Post-Lehman Record: Nomura's Acquisition Of Macquarie's Asset Management Business

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Lehman Record: Nomura's Acquisition of Macquarie's Asset Management Business Signals Shift in Global Finance

The financial world is buzzing after Nomura Holdings, Inc., a leading Japanese financial services group, announced its acquisition of Macquarie Asset Management's (MAM) infrastructure and real estate assets. This landmark deal, marking the largest acquisition by a Japanese financial institution since the Lehman Brothers collapse in 2008, signals a significant shift in the global landscape of asset management and infrastructure investment.

The acquisition, valued at a substantial amount (specific figures are yet to be officially released pending regulatory approvals), encompasses a considerable portfolio of infrastructure and real estate assets managed by MAM. This strategic move allows Nomura to significantly expand its global reach and solidify its position as a major player in the increasingly competitive asset management sector.

<h3>A Bold Move with Far-Reaching Implications</h3>

This isn't just a simple asset purchase; it represents a bold strategic maneuver by Nomura. The acquisition provides immediate access to a vast network of global clients and a proven track record of successful infrastructure and real estate investments. For Nomura, this deal offers several key benefits:

- Expanded Global Footprint: MAM’s global presence provides Nomura with immediate access to new markets and diversification beyond its traditional strongholds.

- Enhanced Investment Capabilities: The acquisition brings in specialized expertise and a seasoned team with extensive experience in managing large-scale infrastructure and real estate projects.

- Increased Market Share: This strategic move catapults Nomura into a higher echelon of global asset management firms, boosting its market share and competitive advantage.

- Diversification of Revenue Streams: Adding infrastructure and real estate to Nomura's portfolio diversifies its revenue streams and reduces reliance on any single sector.

<h3>What Does This Mean for Investors and the Broader Market?</h3>

This acquisition has significant implications for investors and the global financial markets. It suggests a growing appetite for infrastructure and real estate investments, particularly in the context of a global economic landscape that's becoming increasingly complex and uncertain. The deal also underscores the ongoing consolidation within the asset management industry, with larger firms seeking to acquire smaller players to gain scale and market share.

For investors, this could signal increased opportunities in infrastructure and real estate-related investments, particularly through Nomura's expanded offerings. The increased competition in the asset management space may also lead to better pricing and improved services for clients.

<h3>Challenges and Future Outlook</h3>

While the acquisition presents numerous advantages, Nomura will undoubtedly face challenges in integrating MAM’s operations into its existing structure. Regulatory hurdles and potential cultural differences will need to be navigated effectively. Successfully managing the integration process will be crucial to realizing the full potential of this significant investment.

The future outlook for Nomura, following this historic acquisition, appears bright. By acquiring MAM’s assets, Nomura has positioned itself for considerable growth and solidified its standing as a global financial powerhouse. This strategic move underscores the ongoing transformation of the global financial landscape and the increasing importance of infrastructure and real estate investments in a post-pandemic world. The long-term success of this acquisition, however, will depend on Nomura's ability to effectively integrate MAM's operations and capitalize on the opportunities presented by this landmark deal. The financial community will be watching closely to see how this ambitious endeavor unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Lehman Record: Nomura's Acquisition Of Macquarie's Asset Management Business. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

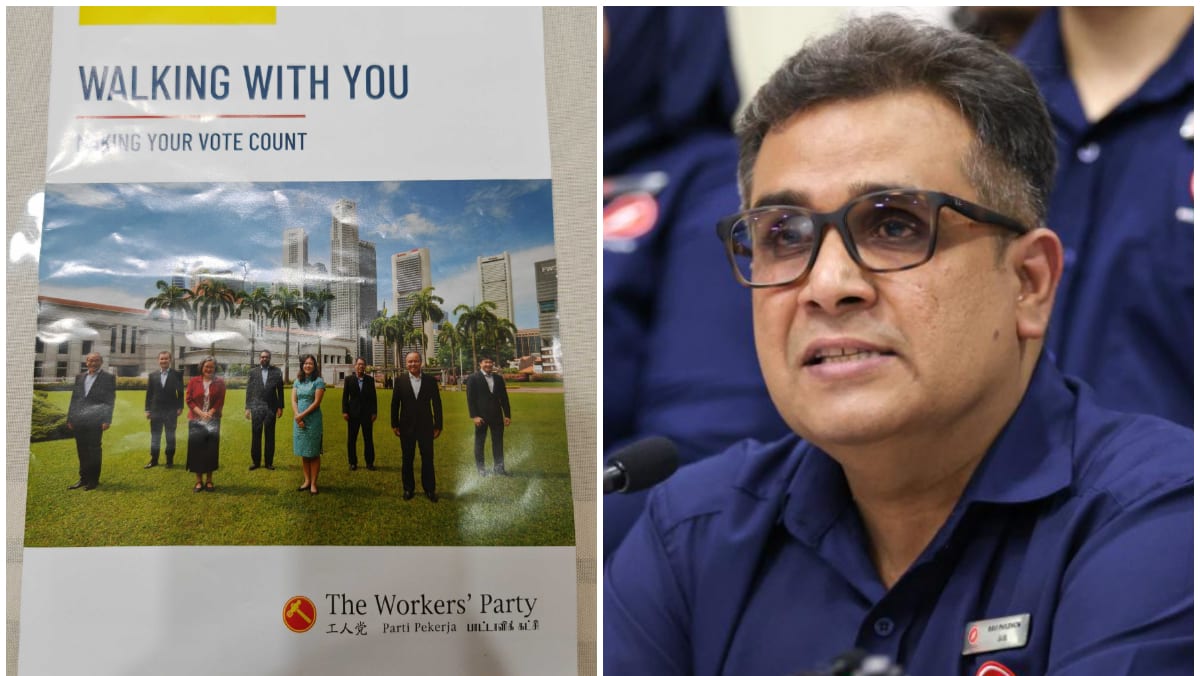

Jalan Kayu Smc Red Dot Uniteds Strategic Withdrawal For Workers Party In Ge 2025

Apr 22, 2025

Jalan Kayu Smc Red Dot Uniteds Strategic Withdrawal For Workers Party In Ge 2025

Apr 22, 2025 -

Ryan Cooglers Sinners Exploring The Personal Stakes In A Jim Crow Vampire Story

Apr 22, 2025

Ryan Cooglers Sinners Exploring The Personal Stakes In A Jim Crow Vampire Story

Apr 22, 2025 -

Club Statement Transparency And Accountability In Club Finances

Apr 22, 2025

Club Statement Transparency And Accountability In Club Finances

Apr 22, 2025 -

Exploring The Uncharted A New Red Dead Redemption 2 Area Found

Apr 22, 2025

Exploring The Uncharted A New Red Dead Redemption 2 Area Found

Apr 22, 2025 -

Wrestle Mania 41 Complete Guide To Matches Card And News

Apr 22, 2025

Wrestle Mania 41 Complete Guide To Matches Card And News

Apr 22, 2025