Post-Nasdaq Sell-Off: Which Is Cheaper – Palo Alto Networks Stock Or Nvidia Stock?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Nasdaq Sell-Off: Palo Alto Networks vs. Nvidia – Which Tech Stock is the Better Buy?

The recent Nasdaq sell-off has left many investors wondering where to park their money. Two tech giants, Palo Alto Networks (PANW) and Nvidia (NVDA), have seen significant price fluctuations, prompting the question: which stock offers a more compelling value proposition after the dip? This analysis delves into the current market landscape, comparing the strengths and weaknesses of each company to help you make an informed investment decision.

The Tech Sector Shake-Up: Understanding the Sell-Off

The recent downturn in the Nasdaq reflects a broader market correction, driven by factors including rising interest rates, inflation concerns, and a potential economic slowdown. While both Palo Alto Networks and Nvidia are considered growth stocks, their sensitivity to macroeconomic shifts varies. Understanding these underlying market forces is crucial before comparing individual stocks.

Palo Alto Networks (PANW): Cybersecurity's Steady Hand

Palo Alto Networks is a leading cybersecurity company, providing a comprehensive suite of network security solutions. Its relatively stable revenue stream, driven by consistent demand for robust cybersecurity measures, makes it a comparatively safer bet during market uncertainty.

- Strengths: Strong market position, recurring revenue model (subscription services), consistent growth, and a focus on cloud security – a rapidly expanding market segment.

- Weaknesses: Higher valuation compared to some competitors, potential for increased competition, and dependence on enterprise spending, which can be affected by economic downturns.

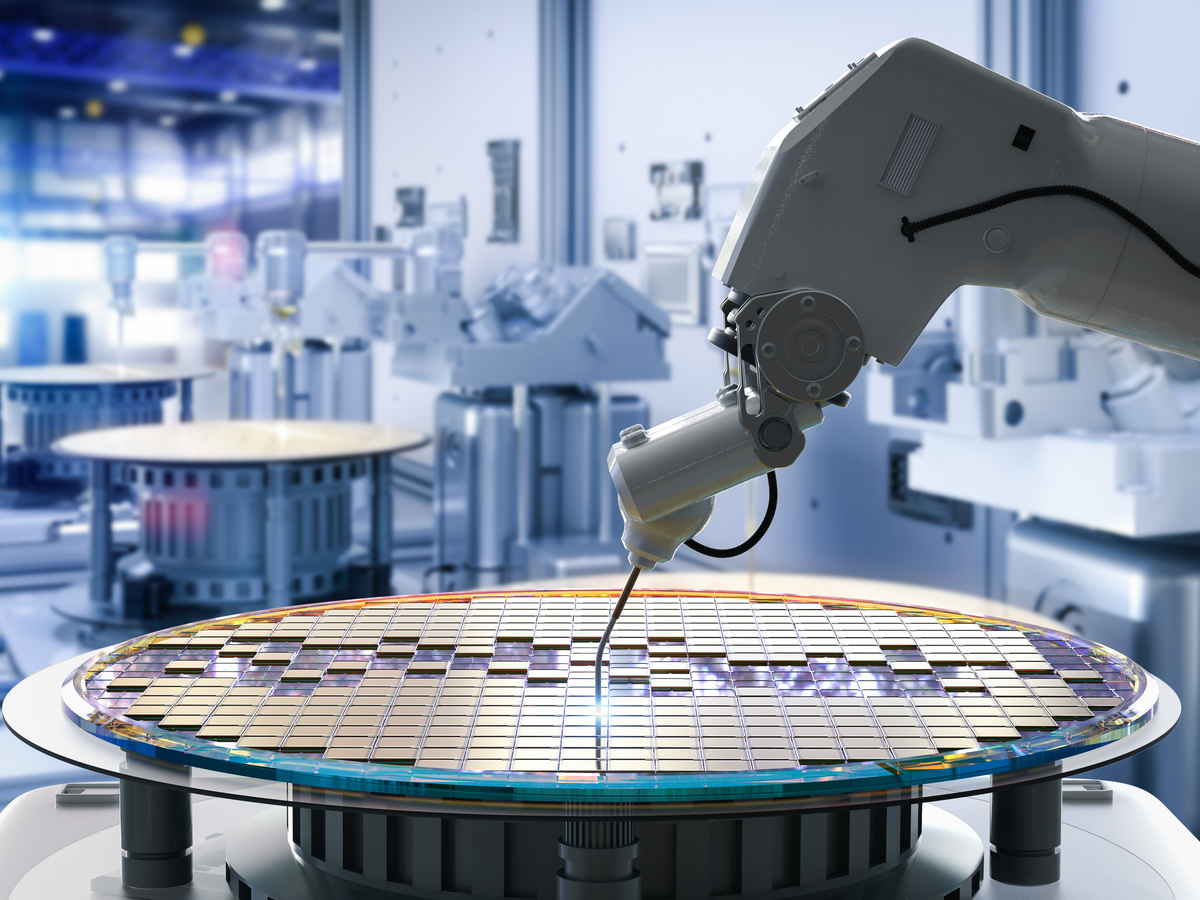

Nvidia (NVDA): The AI Powerhouse Facing Headwinds

Nvidia dominates the graphics processing unit (GPU) market, crucial for artificial intelligence (AI) development, gaming, and data centers. While its long-term prospects remain strong, the recent sell-off reflects concerns about slowing growth in certain sectors, particularly gaming.

- Strengths: Dominant market share in GPUs, crucial role in the booming AI sector, significant growth potential in data centers and autonomous vehicles.

- Weaknesses: High dependence on a few key sectors (gaming, data centers), susceptibility to macroeconomic shifts affecting consumer spending and enterprise investment, and a potentially overvalued stock price despite recent corrections.

Comparing Valuation and Growth Potential:

Determining which stock is "cheaper" requires a nuanced approach beyond simply looking at the current stock price. Consider these factors:

- Price-to-Earnings Ratio (P/E): Compare the P/E ratios of PANW and NVDA to gauge their relative valuations against their earnings. A lower P/E ratio generally suggests a cheaper stock. However, remember that growth stocks often command higher P/E ratios due to anticipated future growth.

- Revenue Growth: Analyze the revenue growth trajectory of both companies. Consistent and accelerating revenue growth signals a healthier and potentially more valuable company.

- Future Market Outlook: Consider the long-term market prospects for cybersecurity and AI. Both sectors are expected to experience robust growth, but the rate of growth and potential disruptions could impact each company's performance.

The Verdict: It Depends on Your Risk Tolerance

There's no single definitive answer to which stock is "cheaper." Palo Alto Networks offers a more defensive position with a relatively stable revenue stream, suitable for investors prioritizing lower risk. Nvidia, despite its recent downturn, holds significant long-term growth potential in the rapidly expanding AI market, but carries higher risk.

The optimal choice depends on your individual investment strategy, risk tolerance, and time horizon. Conduct thorough due diligence, consult with a financial advisor, and consider diversifying your portfolio to mitigate risk. Remember, past performance is not indicative of future results. This analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Nasdaq Sell-Off: Which Is Cheaper – Palo Alto Networks Stock Or Nvidia Stock?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tariffs And Streaming Costs The Impact On Your Wallet

Apr 08, 2025

Tariffs And Streaming Costs The Impact On Your Wallet

Apr 08, 2025 -

Mary Berry Reveals Traumatic Health Battle Bake Off Star Speaks Out

Apr 08, 2025

Mary Berry Reveals Traumatic Health Battle Bake Off Star Speaks Out

Apr 08, 2025 -

Analyzing The Facebook Ad Strategies Of Trump And Biden To Win Over Older Women

Apr 08, 2025

Analyzing The Facebook Ad Strategies Of Trump And Biden To Win Over Older Women

Apr 08, 2025 -

Rs 20 16 Lakh Crore Vanishes Stock Market Freefall In Wake Of Trump Tariffs

Apr 08, 2025

Rs 20 16 Lakh Crore Vanishes Stock Market Freefall In Wake Of Trump Tariffs

Apr 08, 2025 -

From Favorites To Underdogs A Comprehensive Ranking Of The 95 Masters Players

Apr 08, 2025

From Favorites To Underdogs A Comprehensive Ranking Of The 95 Masters Players

Apr 08, 2025