Post-Nasdaq Sell-Off: Which Is More Attractive – Palo Alto Networks Or Nvidia?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Nasdaq Sell-Off: Palo Alto Networks vs. Nvidia – Which Tech Giant is the Better Buy?

The recent Nasdaq sell-off has left many investors wondering where to put their money. Two tech giants, Palo Alto Networks (PANW) and Nvidia (NVDA), have emerged as potential candidates, but which offers a more attractive investment opportunity in this volatile market? Both companies boast strong fundamentals and future growth prospects, but their distinct business models and market positions present contrasting risk-reward profiles.

This analysis delves into the strengths and weaknesses of each company, comparing their financial performance, growth potential, and overall investment attractiveness in the post-sell-off landscape. We'll consider factors such as revenue growth, profitability, valuation, and market competition to help you make an informed decision.

Palo Alto Networks: Cybersecurity Strength in a Turbulent World

Palo Alto Networks, a cybersecurity leader, has consistently delivered strong financial results, showcasing resilience even amidst economic uncertainty. Their robust cybersecurity solutions are in high demand, benefiting from the ever-increasing need for robust network protection in both the enterprise and consumer markets.

- Strengths: Market leadership in next-generation firewalls, strong recurring revenue streams through subscription services, consistent profitability, and a growing portfolio of cloud-based security solutions.

- Weaknesses: High valuation compared to some competitors, potential for increased competition in the crowded cybersecurity market, and dependence on enterprise spending.

Growth Potential for PANW: Palo Alto Networks' future growth hinges on continued innovation in cloud security, expansion into emerging markets, and strategic acquisitions. Their focus on AI-powered threat detection and prevention positions them well for long-term success.

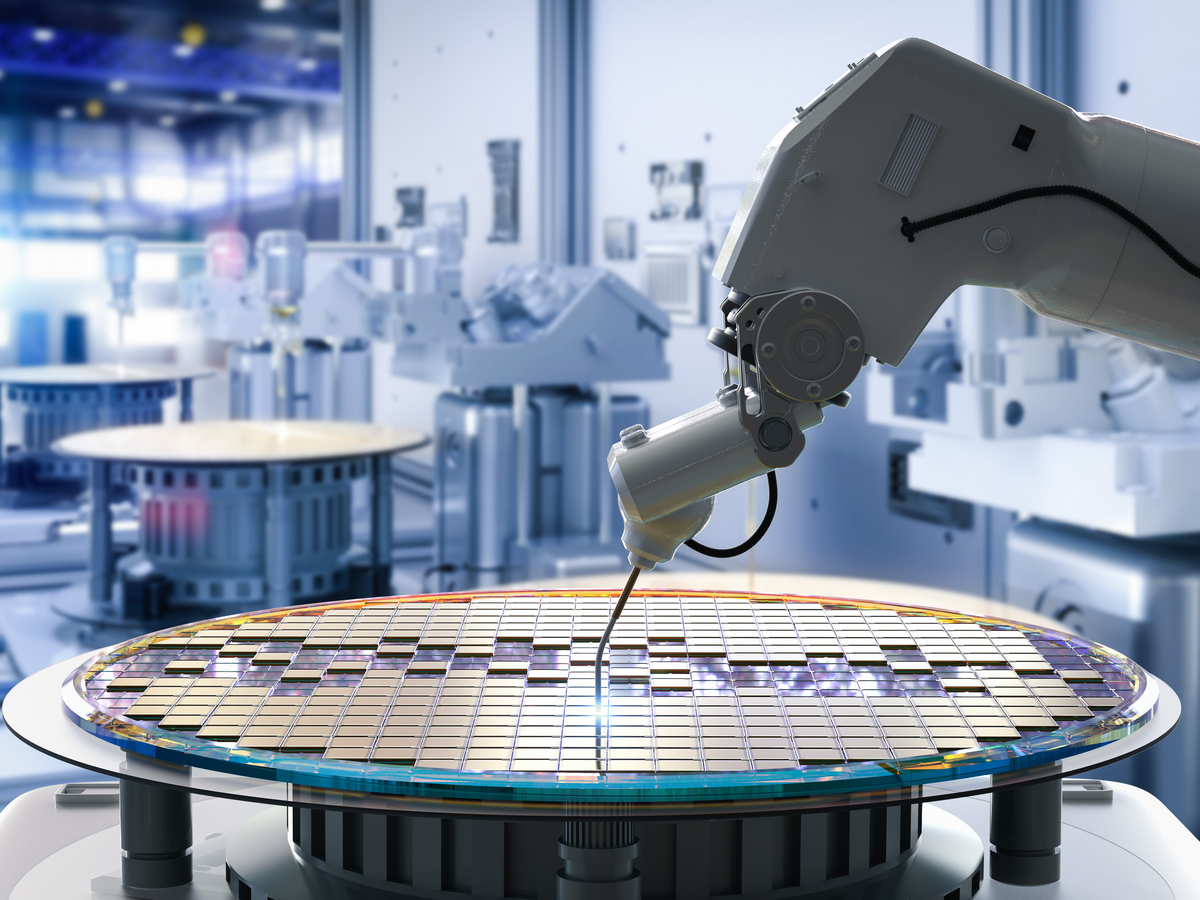

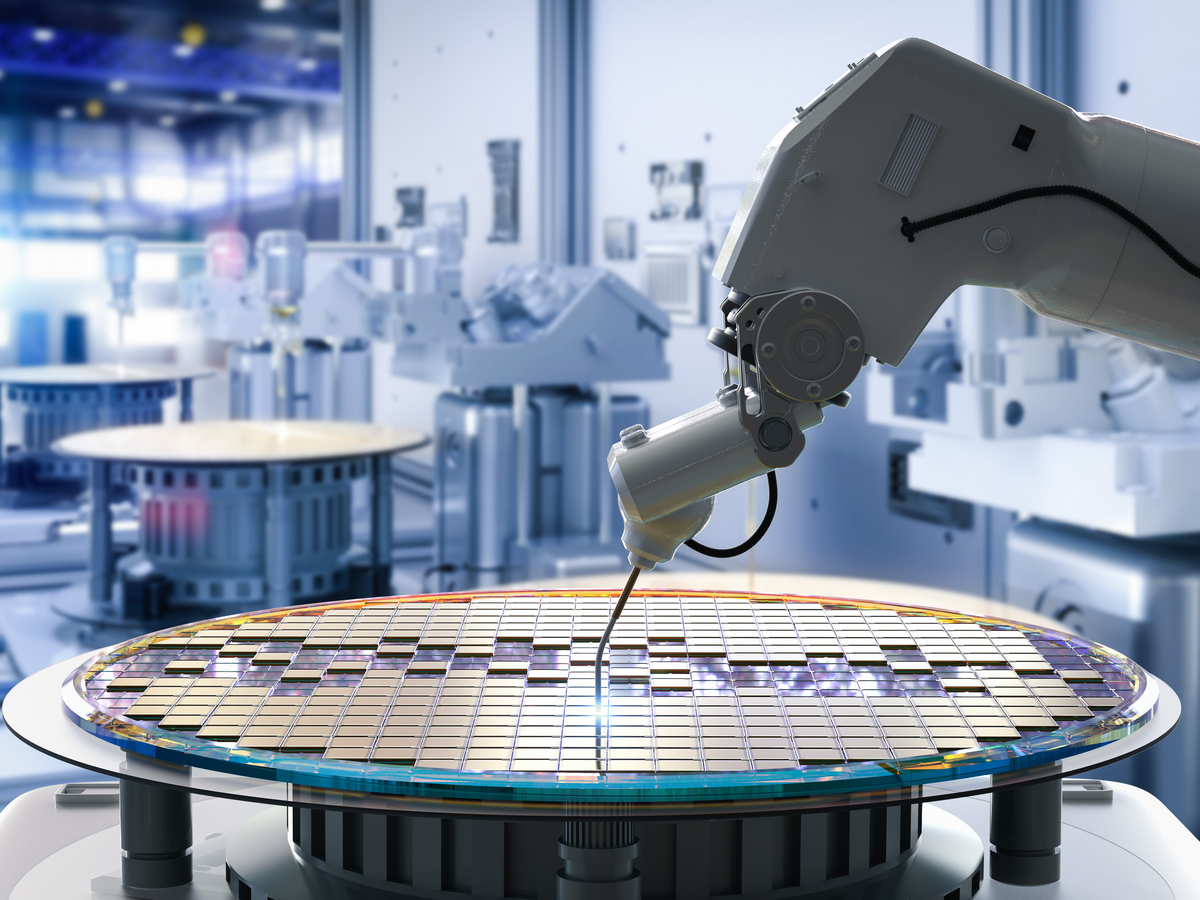

Nvidia: Riding the AI Wave

Nvidia, a dominant force in graphics processing units (GPUs), is experiencing explosive growth fueled by the burgeoning artificial intelligence (AI) revolution. Their high-performance GPUs are essential for training and deploying AI models, driving significant demand and revenue growth.

- Strengths: Market dominance in AI hardware, exceptionally high growth rates, strong brand recognition, and diversification into related markets such as autonomous vehicles.

- Weaknesses: High valuation reflecting high growth expectations, potential for competition from emerging chip manufacturers, and dependence on the continued growth of the AI market.

Growth Potential for NVDA: Nvidia's growth potential is largely tied to the continued adoption of AI across various industries. However, the company is actively diversifying its product portfolio, mitigating risk associated with reliance on a single market.

Head-to-Head Comparison: PANW vs. NVDA

| Feature | Palo Alto Networks (PANW) | Nvidia (NVDA) |

|---|---|---|

| Sector | Cybersecurity | Semiconductor/AI |

| Growth Rate | Solid, consistent growth | Explosive, high growth |

| Valuation | Relatively high | Extremely high |

| Risk Profile | Moderate | High (but potentially higher reward) |

| Market Position | Strong leader | Dominant market leader |

The Verdict: A Matter of Risk Tolerance

Both Palo Alto Networks and Nvidia offer compelling investment opportunities, but their profiles cater to different risk appetites. Palo Alto Networks presents a more conservative investment, offering solid growth with a lower risk profile. Nvidia, on the other hand, presents a higher-risk, higher-reward scenario, with potentially explosive growth but also greater vulnerability to market shifts.

The optimal choice depends on your individual investment strategy and tolerance for risk. Conservative investors might prefer the stability of Palo Alto Networks, while growth-focused investors willing to accept higher volatility might find Nvidia more appealing. It's crucial to conduct thorough due diligence and consider your personal financial goals before making any investment decision. Consult with a financial advisor for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Nasdaq Sell-Off: Which Is More Attractive – Palo Alto Networks Or Nvidia?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Government Grants Tik Tok 75 Day Extension

Apr 07, 2025

Us Government Grants Tik Tok 75 Day Extension

Apr 07, 2025 -

Ramnavami 2025 History Rituals And The Triumph Of Rama

Apr 07, 2025

Ramnavami 2025 History Rituals And The Triumph Of Rama

Apr 07, 2025 -

Financial Market Downturn A Guide To Navigating The Uncertainty

Apr 07, 2025

Financial Market Downturn A Guide To Navigating The Uncertainty

Apr 07, 2025 -

Bitcoin Price Alert Potential For Misleading Buy Signal From Metric Name

Apr 07, 2025

Bitcoin Price Alert Potential For Misleading Buy Signal From Metric Name

Apr 07, 2025 -

Immersive Sci Fi Action The Tron Ares Teaser Breakdown

Apr 07, 2025

Immersive Sci Fi Action The Tron Ares Teaser Breakdown

Apr 07, 2025