Post-Trade Evaluation: Stauffer On The Kane Acquisition

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Trade Evaluation: Stauffer's Take on the Kane Acquisition Shakes Up the Market

The recent acquisition of Kane Industries by Stauffer Corporation has sent ripples throughout the financial world, prompting intense scrutiny and analysis. Experts are dissecting the deal, examining its potential impact on both companies and the broader market. This post-trade evaluation focuses specifically on renowned financial analyst, Dr. Emily Carter's, insightful commentary on the strategic implications of this high-profile merger.

Stauffer's Strategic Gamble: A Bold Move or Risky Venture?

The acquisition of Kane Industries, a major player in the [insert Kane Industries' industry, e.g., biotechnology sector], represents a significant strategic shift for Stauffer Corporation. While Stauffer has historically focused on [insert Stauffer's previous industry focus, e.g., manufacturing], this move signifies a bold expansion into a new, potentially lucrative market. Dr. Carter highlights the inherent risks and rewards of this diversification strategy.

-

Synergies and Market Share: Dr. Carter points out the potential for significant synergies between Stauffer's established infrastructure and Kane's innovative product lines. The combined entity could potentially command a larger market share, leading to increased profitability and a stronger competitive position. However, she cautions that realizing these synergies requires careful integration and effective management.

-

Integration Challenges: Successfully integrating two distinct corporate cultures and operational structures presents a significant hurdle. Dr. Carter notes that past mergers have faltered due to underestimated integration challenges, resulting in decreased productivity and financial losses. The success of the Stauffer-Kane merger hinges on effective leadership and a well-defined integration plan.

-

Valuation Concerns: The acquisition price has also drawn criticism. Some analysts believe Stauffer paid a premium for Kane Industries, raising questions about the long-term financial viability of the deal. Dr. Carter acknowledges these concerns, emphasizing the need for a thorough due diligence process to justify the investment.

The Impact on the Broader Market:

The Stauffer-Kane merger also has broader market implications. The deal could trigger a wave of consolidation within the [insert industry] sector, with other companies potentially seeking similar acquisitions to enhance their market position. Dr. Carter suggests investors carefully monitor competitor responses and assess potential market adjustments.

Dr. Carter's Conclusion:

While acknowledging the inherent risks, Dr. Carter expresses cautious optimism about the long-term prospects of the Stauffer-Kane merger. She emphasizes the importance of effective execution of the integration strategy and close monitoring of market responses. The coming months will be crucial in determining the ultimate success or failure of this ambitious acquisition. Investors should stay tuned for further developments and analyze the quarterly reports to fully understand the impact of this transformative merger.

Keywords: Stauffer Corporation, Kane Industries, acquisition, merger, post-trade evaluation, strategic implications, financial analysis, market impact, diversification, integration challenges, due diligence, synergy, Dr. Emily Carter, [insert industry keywords].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Trade Evaluation: Stauffer On The Kane Acquisition. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

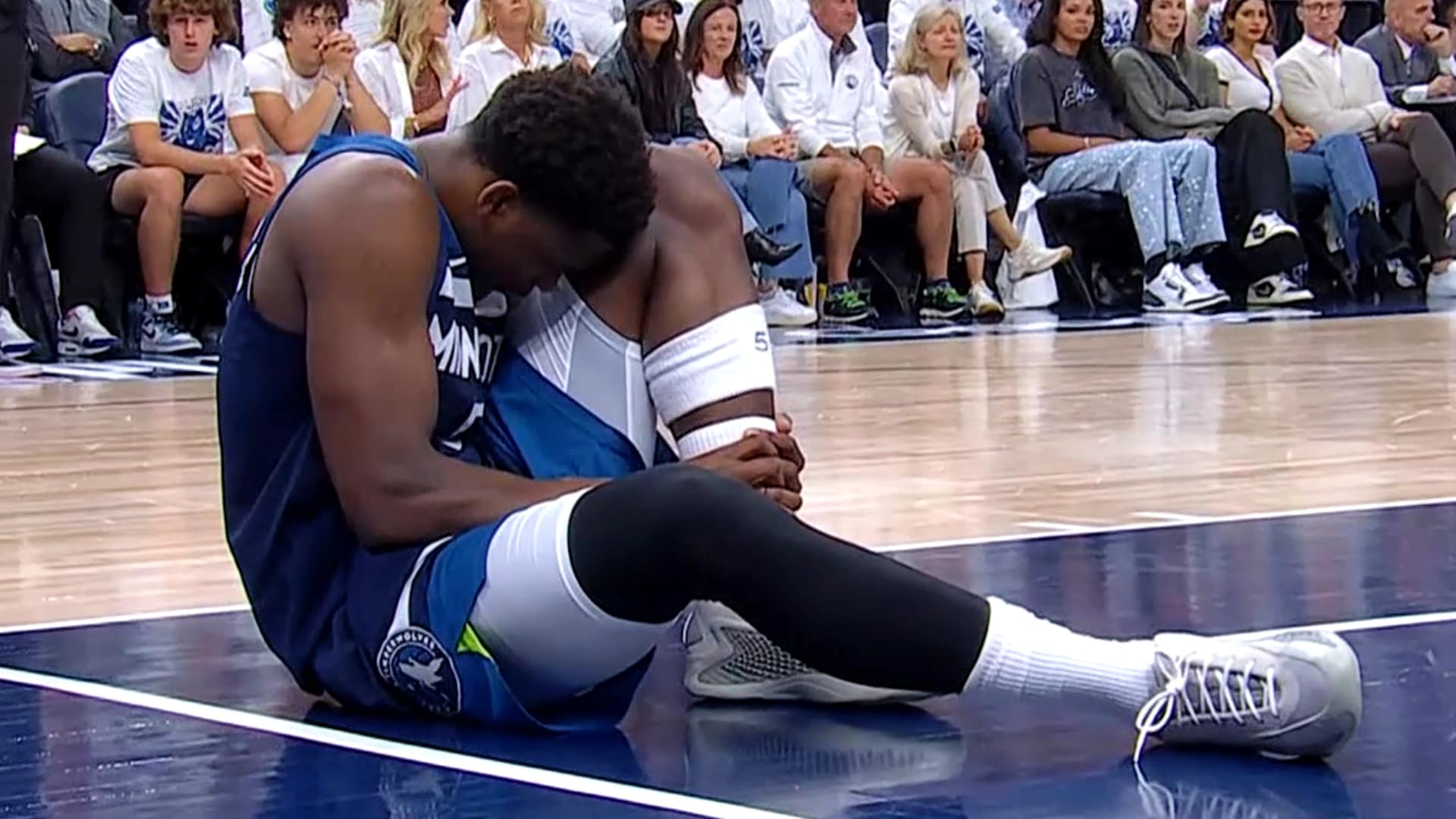

Anthony Edwards Ankle Sprain Game 2 Injury And Return

May 09, 2025

Anthony Edwards Ankle Sprain Game 2 Injury And Return

May 09, 2025 -

Monee Sea Moneys Rebranding And New Headquarters Unveiled

May 09, 2025

Monee Sea Moneys Rebranding And New Headquarters Unveiled

May 09, 2025 -

Latest Set For Life Draw Results Prizes And Winners

May 09, 2025

Latest Set For Life Draw Results Prizes And Winners

May 09, 2025 -

Mayor Of Mayhem The Rob Ford Documentary Release Date Announced

May 09, 2025

Mayor Of Mayhem The Rob Ford Documentary Release Date Announced

May 09, 2025 -

Kano Pillars Forward Musa Confirmed For Super Eagles Unity Cup Squad

May 09, 2025

Kano Pillars Forward Musa Confirmed For Super Eagles Unity Cup Squad

May 09, 2025