Post-Trump Uncertainty: Bullock Plays Down Prospects For Significant Rate Reductions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Trump Uncertainty: Bullock Plays Down Prospects for Significant Rate Reductions

The Federal Reserve's recent pronouncements on interest rates have sent ripples through the financial markets, leaving investors grappling with post-Trump uncertainty. While many had hoped for significant rate reductions under a new administration, Federal Reserve Governor Michelle Bowman, speaking on Tuesday, tempered those expectations. Her comments, coupled with the ongoing economic data, suggest a more nuanced approach to monetary policy than some had anticipated.

Bowman's Cautious Tone Amidst Economic Volatility

Governor Bowman's address focused on the need for a data-driven approach to interest rate adjustments. She emphasized the importance of monitoring inflation and employment figures before making any significant changes to monetary policy. This cautious tone stands in contrast to some predictions of aggressive rate cuts to stimulate economic growth. The current economic climate, characterized by fluctuating inflation and a mixed employment picture, necessitates a measured response from the Federal Reserve, according to Bowman.

This cautious approach is significant for several reasons:

- Inflation Concerns: Persistent inflation remains a key concern for the Federal Reserve. While recent data suggests a potential slowdown, the central bank remains vigilant, unwilling to risk fueling further price increases with premature rate cuts.

- Employment Data Inconsistencies: The labor market shows mixed signals. While unemployment remains relatively low, wage growth has been inconsistent, making it difficult to predict the impact of rate changes on employment.

- Geopolitical Instability: Global uncertainties, including the ongoing war in Ukraine and rising geopolitical tensions, add further complexity to the economic outlook and influence the Fed's decision-making.

Market Reaction and Investor Sentiment

The markets reacted to Bowman's comments with a degree of apprehension. While some saw her caution as a sign of responsible monetary policy, others expressed concern about the lack of immediate, substantial rate reductions. Investor sentiment remains fragile, highlighting the ongoing uncertainty surrounding the economic outlook and the Federal Reserve's future actions. Many analysts now believe the possibility of a "soft landing" – a scenario where inflation is controlled without triggering a recession – is increasingly uncertain.

Looking Ahead: A Data-Driven Approach to Monetary Policy

The Federal Reserve's commitment to a data-driven approach suggests that future interest rate decisions will be contingent on upcoming economic indicators. Close monitoring of inflation, employment numbers, and global economic developments will be crucial in shaping the central bank's strategy. Investors should brace themselves for further volatility in the coming months, as the Federal Reserve navigates the complex challenges of balancing economic growth with inflation control in a post-Trump era of significant geopolitical uncertainty. The coming months will be critical in determining the trajectory of interest rates and the overall health of the US economy. Further analysis of key economic indicators will be vital for both investors and policymakers in understanding the evolving landscape. The focus remains squarely on the data, and any significant shifts in interest rate policy will likely be justified by concrete and compelling evidence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Trump Uncertainty: Bullock Plays Down Prospects For Significant Rate Reductions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Apple Warren Buffett Disminuye Su Participacion En Un 13 Por Que

Apr 11, 2025

Apple Warren Buffett Disminuye Su Participacion En Un 13 Por Que

Apr 11, 2025 -

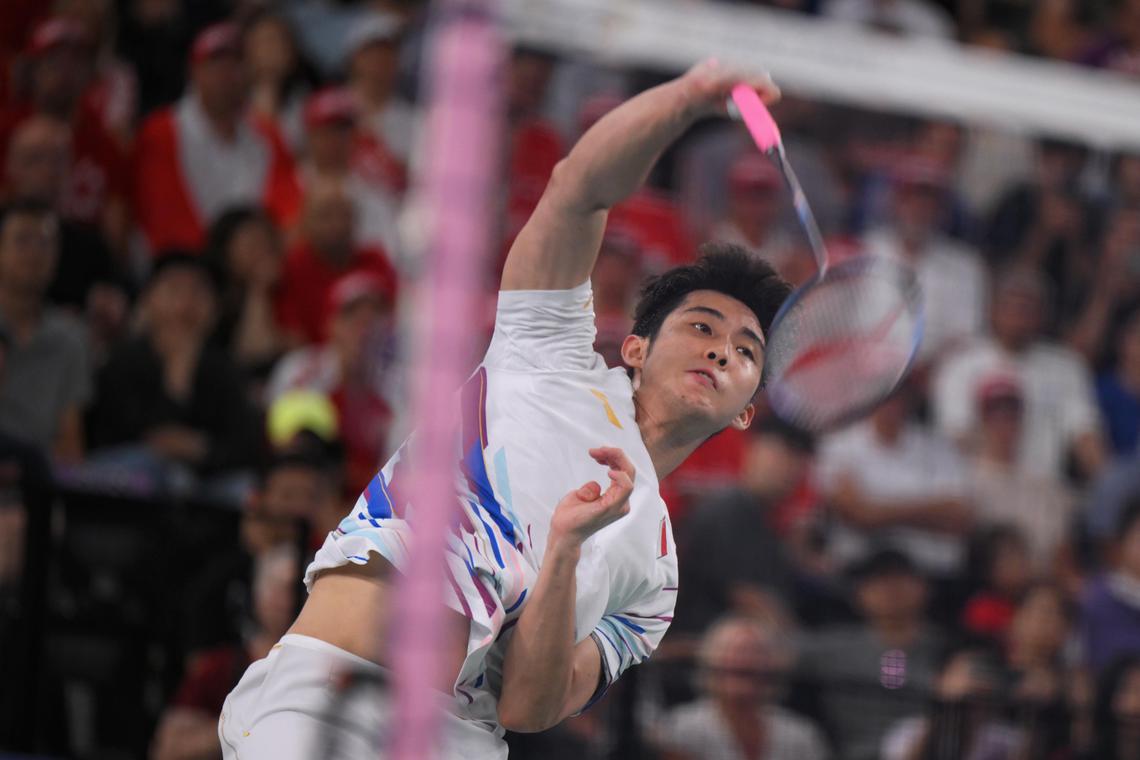

Singapores Loh Kean Yew Reaches Asia Championships Quarterfinals

Apr 11, 2025

Singapores Loh Kean Yew Reaches Asia Championships Quarterfinals

Apr 11, 2025 -

Toss Result Delhi Capitals Bowl First In Match Against Royal Challengers Bangalore

Apr 11, 2025

Toss Result Delhi Capitals Bowl First In Match Against Royal Challengers Bangalore

Apr 11, 2025 -

Aurovilles Cdac Partnership A Governance Power Struggle

Apr 11, 2025

Aurovilles Cdac Partnership A Governance Power Struggle

Apr 11, 2025 -

Daredevil Born Again Gandolfini Teases Insane Punisher Appearance In Episode 9

Apr 11, 2025

Daredevil Born Again Gandolfini Teases Insane Punisher Appearance In Episode 9

Apr 11, 2025