Pre-Fed Meeting Jitters: Markets Slide On Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Pre-Fed Meeting Jitters: Markets Slide on Uncertainty

Wall Street braces for potential interest rate hikes as the Federal Reserve's upcoming meeting casts a shadow over global markets.

The global financial markets experienced a noticeable downturn this week, largely attributed to pre-meeting jitters ahead of the Federal Reserve's highly anticipated monetary policy announcement. Uncertainty surrounding the potential for further interest rate hikes has sent ripples of anxiety through investors, leading to a significant slide in various market indices. This volatile period highlights the considerable influence the Fed holds over global economic sentiment and the ever-present challenges of navigating uncertain economic landscapes.

Interest Rate Hike Speculation Fuels Market Volatility

The primary driver of the market's recent decline is the widespread speculation surrounding the Fed's decision regarding interest rates. Economists and analysts are divided, with some predicting a continuation of the aggressive interest rate hike strategy employed throughout 2023 to combat inflation, while others foresee a pause or even a potential rate cut in the near future. This uncertainty creates a climate of risk aversion, prompting investors to adopt a more cautious approach and potentially liquidate assets.

- Inflation Remains a Key Concern: Persistent inflation, despite recent easing, remains a significant factor influencing the Fed's decision-making process. The central bank's mandate is to maintain price stability, and any perceived weakness in controlling inflation could lead to further aggressive rate hikes.

- Economic Data Under Scrutiny: Recent economic data releases, including employment figures and consumer price index (CPI) reports, are being intensely scrutinized for any clues about the future direction of the economy. Any deviation from expectations could trigger significant market fluctuations.

- Geopolitical Risks Add to the Mix: Beyond domestic economic factors, geopolitical events and global uncertainties also contribute to the overall market anxiety. These external factors amplify the existing uncertainty surrounding the Fed's policy decision and further destabilize the market.

Impact Across Market Sectors

The pre-Fed meeting jitters are not limited to a single sector; the impact is widespread. Technology stocks, often sensitive to interest rate changes, have experienced significant declines. The bond market has also shown signs of instability, reflecting investor concerns about rising interest rates and potential decreased bond yields. Even traditionally stable sectors have felt the pressure, highlighting the pervasive nature of the current market sentiment.

Strategies for Navigating Market Uncertainty

For investors, the current market climate underscores the importance of a well-diversified portfolio and a long-term investment strategy. While short-term market fluctuations are inevitable, a long-term perspective can help mitigate the impact of volatility. Considering the following strategies may prove beneficial:

- Diversification: Spread investments across various asset classes to reduce exposure to any single market segment.

- Risk Management: Implement effective risk management strategies to protect your portfolio from substantial losses.

- Professional Advice: Seek guidance from financial advisors to navigate the complexities of the current market environment.

Looking Ahead: What to Expect Post-Fed Meeting

The upcoming Fed meeting will undoubtedly be a pivotal moment for the markets. Regardless of the Fed's decision, volatility is likely to persist in the short term as investors digest the implications of the announcement. The market's reaction will depend largely on the Fed's communication, the clarity of its future intentions, and the overall tone conveyed regarding its assessment of the economy. Careful monitoring of post-meeting statements and subsequent economic data releases will be crucial for investors navigating this period of uncertainty. The coming weeks will be critical in determining the trajectory of the global economy and the markets’ response to the Fed's decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Pre-Fed Meeting Jitters: Markets Slide On Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Di Mens Lacrosse Kirsts Record Breaking Goal Scoring Career

May 07, 2025

Di Mens Lacrosse Kirsts Record Breaking Goal Scoring Career

May 07, 2025 -

Uclas Nba Success Five Bruins Clinch Conference Semifinal Berths

May 07, 2025

Uclas Nba Success Five Bruins Clinch Conference Semifinal Berths

May 07, 2025 -

Cavaliers Vs Pacers Siakams Breakout Game Highlights Nbas Underrated Talent

May 07, 2025

Cavaliers Vs Pacers Siakams Breakout Game Highlights Nbas Underrated Talent

May 07, 2025 -

Institutional Investors Drive Billions Into Crypto Assets

May 07, 2025

Institutional Investors Drive Billions Into Crypto Assets

May 07, 2025 -

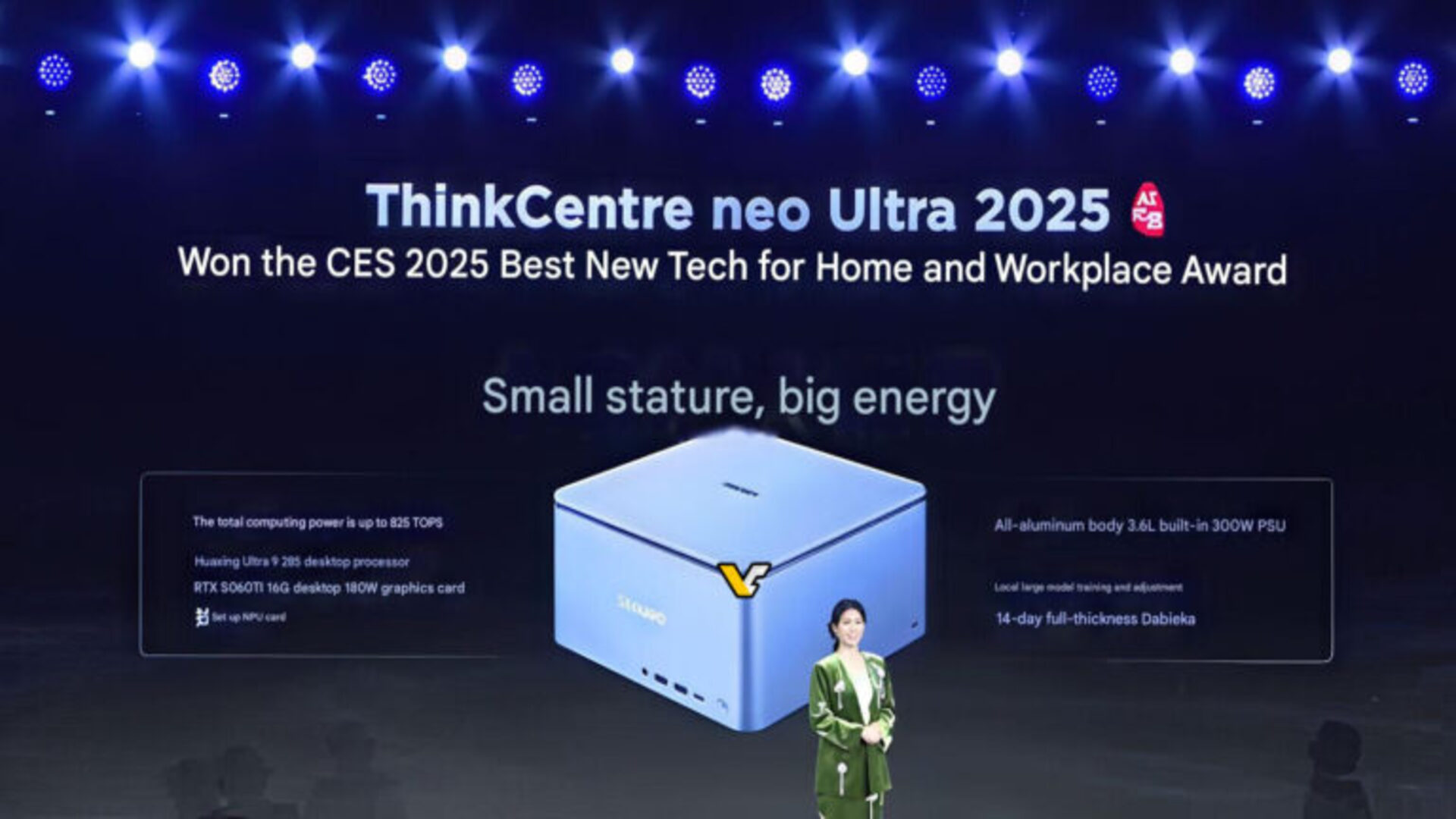

Lenovos High Performance Workstation Takes On Apples Mac Studio

May 07, 2025

Lenovos High Performance Workstation Takes On Apples Mac Studio

May 07, 2025

Latest Posts

-

Jokics Humorous Take On Free Throw Merchant Jeers During Games

May 08, 2025

Jokics Humorous Take On Free Throw Merchant Jeers During Games

May 08, 2025 -

Will Andrew Wiggins Return Elevate The Miami Heat Next Season

May 08, 2025

Will Andrew Wiggins Return Elevate The Miami Heat Next Season

May 08, 2025 -

Ukraines Naval Drone Strikes Confirmation Of Russian Su 30 Downed

May 08, 2025

Ukraines Naval Drone Strikes Confirmation Of Russian Su 30 Downed

May 08, 2025 -

Dallas Stars Eliminate Avalanche In Game 7 Thriller

May 08, 2025

Dallas Stars Eliminate Avalanche In Game 7 Thriller

May 08, 2025 -

Cassius Turvey Murder Trial Jack Brearley And Brodie Palmer Found Guilty

May 08, 2025

Cassius Turvey Murder Trial Jack Brearley And Brodie Palmer Found Guilty

May 08, 2025