Pre-"Liberation Day" Tariff Tensions: Analysis Of The Latest Fed Minutes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Pre-"Liberation Day" Tariff Tensions: Analysis of the Latest Fed Minutes

The release of the latest Federal Reserve minutes has sent ripples through financial markets, adding another layer of complexity to the already fraught economic landscape just days before the anticipated "Liberation Day" – a symbolic date marking a potential easing of international trade tensions. While the minutes didn't explicitly mention the upcoming trade developments, analysts are dissecting the language for clues regarding the Fed's response to potential tariff-related inflation and economic slowdown.

Inflationary Pressures and the Fed's Dilemma

The minutes revealed ongoing concerns about persistent inflation, even as some economic indicators suggest a potential cooling. This presents a classic dilemma for the Federal Reserve: how to combat inflation without triggering a recession. The looming threat of further tariffs adds a significant variable to this equation. Increased import costs due to tariffs directly translate to higher prices for consumers, exacerbating inflationary pressures and potentially forcing the Fed to adopt a more aggressive monetary policy stance. This could involve further interest rate hikes, a move that carries its own risks of slowing economic growth.

Analyzing the Language: Subtle Signals from the Fed

While the minutes didn't offer concrete pronouncements on future policy, several key phrases suggest a cautious approach. The repeated mention of "data dependency" indicates the Fed is closely monitoring incoming economic data before making any significant policy shifts. This suggests that the impact of any tariff changes on inflation and economic growth will heavily influence the Fed's next move. The absence of strong hawkish rhetoric, however, could be interpreted as a willingness to wait and see how "Liberation Day" plays out before committing to further rate increases.

The "Liberation Day" Wildcard: Uncertainty Remains

The uncertainty surrounding "Liberation Day" itself adds further complexity to the situation. The exact nature and scope of any tariff adjustments remain unclear, creating a significant degree of market volatility. This uncertainty is reflected in the Fed minutes, with officials acknowledging the unpredictable nature of global trade dynamics and their impact on the US economy. The potential for either a significant easing of trade restrictions or a further escalation adds to the challenges facing the central bank.

Market Reactions and Future Outlook

Market reactions to the minutes have been mixed, with some investors interpreting the cautious language as a signal of potential future rate cuts if the economy slows significantly. However, others remain concerned about the persistent inflationary pressures and the potential for further aggressive policy tightening. The coming days and weeks will be crucial in determining the actual impact of "Liberation Day" on the US economy and the Fed's subsequent response.

Key Takeaways:

- Inflation remains a primary concern for the Fed.

- The impact of potential tariff changes on inflation is a critical factor influencing future monetary policy.

- The Fed's approach is data-dependent, suggesting flexibility in response to "Liberation Day" developments.

- Market reactions to the minutes are mixed, reflecting the uncertainty surrounding future economic prospects.

- The coming weeks will be crucial for assessing the full impact of "Liberation Day" and the Fed's subsequent actions.

This situation underscores the interconnectedness of global trade, monetary policy, and domestic economic stability. The upcoming "Liberation Day" represents a significant turning point, and the Fed's response will be closely watched by investors and policymakers worldwide. Further analysis of economic indicators in the coming weeks will be essential for a clearer understanding of the economic trajectory in the face of these ongoing uncertainties.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Pre-"Liberation Day" Tariff Tensions: Analysis Of The Latest Fed Minutes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beyond The Headlines Mickey Rourkes Honest Account Of His Life And Cbb Experience

Apr 10, 2025

Beyond The Headlines Mickey Rourkes Honest Account Of His Life And Cbb Experience

Apr 10, 2025 -

Czech Star Machac Secures Monte Carlo Masters Second Round Berth

Apr 10, 2025

Czech Star Machac Secures Monte Carlo Masters Second Round Berth

Apr 10, 2025 -

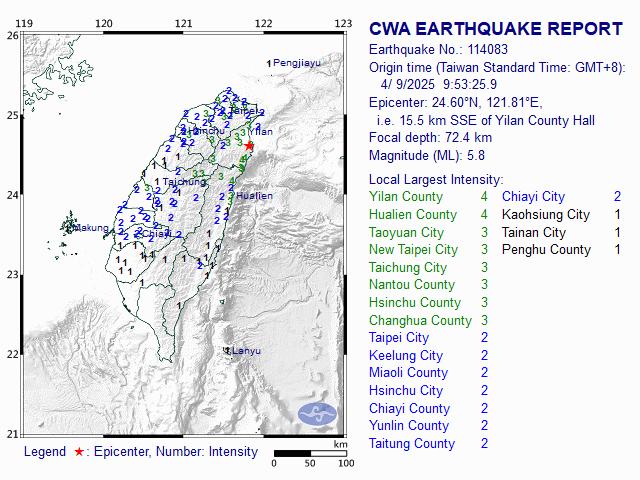

Earthquake In Northern Taiwan Tremors Felt No Injuries Reported

Apr 10, 2025

Earthquake In Northern Taiwan Tremors Felt No Injuries Reported

Apr 10, 2025 -

Runway Lights Damaged Japan Airlines Plane Makes Emergency Landing

Apr 10, 2025

Runway Lights Damaged Japan Airlines Plane Makes Emergency Landing

Apr 10, 2025 -

Shin Tae Yong Terima Jabatan Wakil Presiden Federasi Sepak Bola Korsel

Apr 10, 2025

Shin Tae Yong Terima Jabatan Wakil Presiden Federasi Sepak Bola Korsel

Apr 10, 2025