Q1 2024 Outlook: DBS, OCBC, And UOB Face Pressure To Revise Guidance Due To Global Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Q1 2024 Outlook: Singapore's Banking Giants Face Pressure to Revise Guidance Amidst Global Uncertainty

Singapore's banking titans, DBS, OCBC, and UOB, are facing mounting pressure to revise their financial guidance for the first quarter of 2024. Global economic uncertainty, fueled by persistent inflation, rising interest rates, and geopolitical tensions, casts a long shadow over their projected performance. Analysts are closely scrutinizing the banks' ability to navigate this challenging landscape and maintain profitability.

Mounting Headwinds for Singapore's Banking Trio

The optimistic outlook projected at the start of the year is now being challenged by a confluence of factors. These include:

-

Slowing Global Growth: The global economic slowdown is impacting lending activity and potentially increasing the risk of loan defaults, particularly in sectors sensitive to interest rate hikes. This directly affects the banks' net interest income, a key driver of profitability.

-

Geopolitical Instability: The ongoing war in Ukraine and rising tensions in other regions contribute to market volatility and investor apprehension, leading to reduced investment and potentially higher credit risks.

-

Inflationary Pressures: While inflation may be easing in some regions, it remains stubbornly high in others, putting pressure on consumer spending and business investment. This could lead to decreased demand for banking services and a potential increase in non-performing loans.

-

Regulatory Scrutiny: The banking sector is always subject to stringent regulatory oversight. Any changes in regulations or increased scrutiny could impact profitability and operational efficiency.

Pressure Mounts for Revised Guidance

Several financial analysts have already voiced concerns about the banks' initial guidance, suggesting that the current macroeconomic climate necessitates a downward revision. The pressure is particularly intense given the recent performance of other global banking institutions.

DBS, OCBC, and UOB's Response:

While all three banks have yet to officially revise their Q1 2024 guidance, their upcoming earnings announcements will be under intense scrutiny. Investors will be closely watching for any indications of weakening performance and any adjustments to their financial projections. Any revisions are likely to significantly impact investor confidence and the banks' share prices.

What to Watch For:

-

Net Interest Margin (NIM): A key indicator of profitability, the NIM is likely to be a major focus of discussion. Analysts will be looking for any signs of compression due to increased competition or changes in interest rate environments.

-

Loan Growth: The rate of loan growth will provide insight into the health of the economy and the demand for credit. A slowdown in loan growth could signal weakening economic conditions.

-

Non-Performing Loans (NPLs): An increase in NPLs would be a significant cause for concern, reflecting rising credit risk.

-

Management Commentary: The tone and substance of management’s commentary during earnings calls will be crucial in understanding their outlook for the remainder of the year.

The Road Ahead:

The first quarter of 2024 will be a critical period for DBS, OCBC, and UOB. Their ability to successfully navigate the current global uncertainty will not only determine their short-term financial performance but also shape their long-term strategic direction. The market awaits their responses with bated breath. The upcoming earnings reports will offer crucial insights into the resilience of these banking giants and their capacity to adapt to a rapidly changing global landscape. Investors and analysts alike will be paying close attention to every detail.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Q1 2024 Outlook: DBS, OCBC, And UOB Face Pressure To Revise Guidance Due To Global Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Wind And Solar Power Projects Indigenous Ownership Transforming Southern Saskatchewans Energy Landscape

May 05, 2025

New Wind And Solar Power Projects Indigenous Ownership Transforming Southern Saskatchewans Energy Landscape

May 05, 2025 -

Could Nasa Cut 7 Billion In Yearly Waste Experts Weigh In

May 05, 2025

Could Nasa Cut 7 Billion In Yearly Waste Experts Weigh In

May 05, 2025 -

Pacers Vs Cavs Full Schedule Viewing Options And Winning Probabilities

May 05, 2025

Pacers Vs Cavs Full Schedule Viewing Options And Winning Probabilities

May 05, 2025 -

Nardo Ospita Enrico Galiano Evento Di Presentazione Libro A Cura Di Libreria Fiore

May 05, 2025

Nardo Ospita Enrico Galiano Evento Di Presentazione Libro A Cura Di Libreria Fiore

May 05, 2025 -

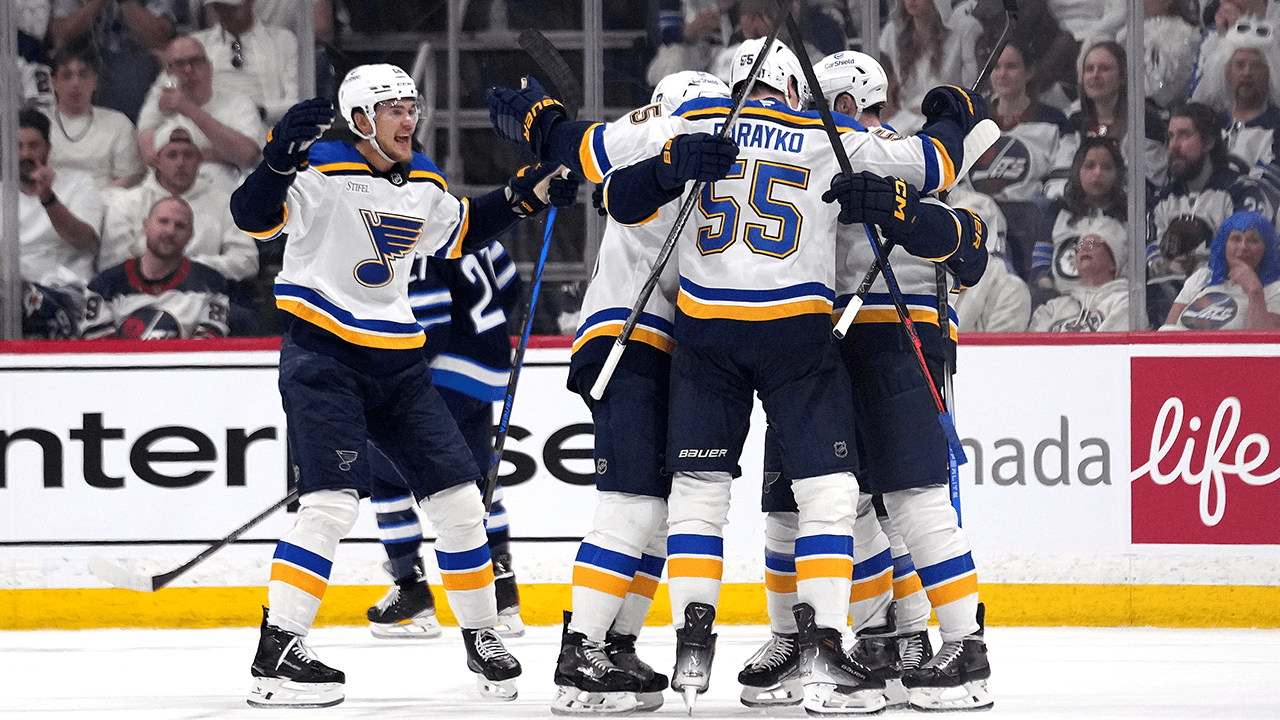

Understanding Faksas Top Shelf Achievement

May 05, 2025

Understanding Faksas Top Shelf Achievement

May 05, 2025