Quantum Computing (QUBT) Earnings: Implications For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Quantum Computing (QUBT) Earnings: Implications for Investors

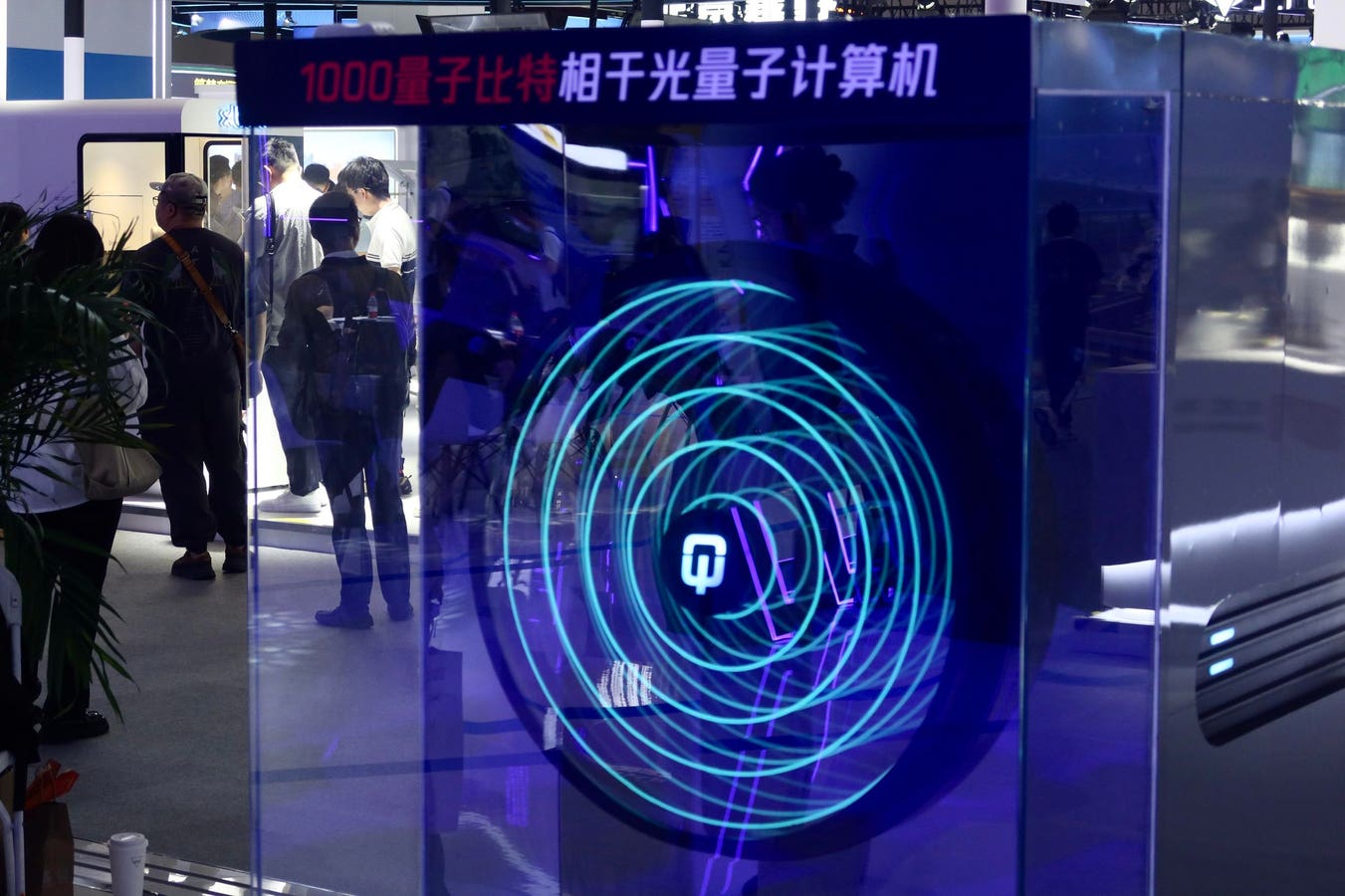

Quantum computing is rapidly emerging from the realm of theoretical physics into a burgeoning technological sector, attracting significant investor interest. Recent earnings reports from Quantum Computing (QUBT), a leading player in this space, have sent ripples through the market. This article delves into the implications of these results for both current and prospective investors.

Understanding the QUBT Earnings Report:

QUBT's latest financial report revealed [insert actual or hypothetical key financial data, e.g., revenue growth of X%, a net loss of Y, positive developments in R&D, significant new partnerships]. While [mention positive aspects, e.g., revenue exceeding expectations], [mention challenges, e.g., increased operating costs, delays in product development] also came to light. These mixed signals underscore the inherent risks and rewards associated with investing in a nascent technology like quantum computing.

Key Takeaways for Investors:

- Revenue Growth vs. Profitability: The focus should be on sustainable revenue growth rather than immediate profitability. Quantum computing companies are currently heavily invested in research and development, leading to significant upfront costs. Investors need to assess whether the company's growth trajectory justifies the ongoing losses.

- Technological Advancements: QUBT's report should provide updates on their technological progress. Look for advancements in qubit coherence times, error correction techniques, and overall system scalability. These metrics directly impact the future commercial viability of their technology.

- Strategic Partnerships & Collaborations: Partnerships with industry giants can significantly accelerate a quantum computing company's growth. Examine any new collaborations announced in the earnings report and assess their potential to boost revenue and market share.

- Competitive Landscape: The quantum computing sector is incredibly competitive. The earnings report should provide insight into QUBT's competitive positioning relative to other major players like IBM, Google, and IonQ. Understanding their strengths and weaknesses is crucial.

- Long-Term Vision: Investing in quantum computing requires a long-term perspective. The technology is still in its early stages, and significant breakthroughs are expected in the coming years. Investors need to evaluate QUBT's long-term vision and strategic roadmap.

H2: Risks and Opportunities in Quantum Computing Investment:

Investing in QUBT, or any quantum computing company, comes with inherent risks:

- Technological Uncertainty: The field is highly experimental, and unforeseen technological challenges could significantly impact the company's progress.

- Market Volatility: The quantum computing market is prone to significant price swings due to its speculative nature.

- Competition: The intense competition within the sector could hinder QUBT's ability to secure market share.

However, the potential rewards are substantial:

- Exponential Growth Potential: Successful quantum computing companies stand to benefit from explosive market growth as the technology matures.

- First-Mover Advantage: Early investors in leading quantum computing firms could reap significant returns.

- Disruptive Technology: Quantum computing has the potential to revolutionize numerous industries, from drug discovery to materials science.

H2: Conclusion:

The QUBT earnings report provides valuable insight into the company's financial health and technological progress. Investors should carefully analyze the report, considering both the opportunities and risks involved. A long-term investment horizon and a thorough understanding of the quantum computing landscape are crucial for making informed decisions. Remember to conduct your own due diligence before investing in any company, and consider consulting with a financial advisor. The future of quantum computing is undeniably bright, but the path to profitability remains challenging and fraught with uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Quantum Computing (QUBT) Earnings: Implications For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fa Cup Glory Crystal Palaces Road To A Historic First Triumph

May 17, 2025

Fa Cup Glory Crystal Palaces Road To A Historic First Triumph

May 17, 2025 -

Salman Rushdie Stabbing Hadi Matar Jailed For Attack Leaving Author Injured

May 17, 2025

Salman Rushdie Stabbing Hadi Matar Jailed For Attack Leaving Author Injured

May 17, 2025 -

Queen Latifah On Obesity Understanding The Risks And Protecting Your Health

May 17, 2025

Queen Latifah On Obesity Understanding The Risks And Protecting Your Health

May 17, 2025 -

Cma Fest Fan Fair X The Artists You Can See This Year

May 17, 2025

Cma Fest Fan Fair X The Artists You Can See This Year

May 17, 2025 -

Friday Night Football Chelsea Vs Man Utd Premier League Predictions And Best Bets

May 17, 2025

Friday Night Football Chelsea Vs Man Utd Premier League Predictions And Best Bets

May 17, 2025