QUBT Stock: Buy Or Sell Before Earnings? Quantum Computing Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

QUBT Stock: Buy or Sell Before Earnings? A Quantum Computing Investment Analysis

Quantum computing is rapidly emerging as a transformative technology, promising to revolutionize various sectors, from medicine and finance to materials science and artificial intelligence. This burgeoning field has attracted significant investor interest, with companies like Q-CTRL (QUBT) leading the charge. But with QUBT's earnings announcement looming, many investors are grappling with a critical question: should they buy, sell, or hold before the release? This in-depth analysis explores the factors to consider before making your investment decision.

Understanding QUBT's Position in the Quantum Computing Market

Q-CTRL, trading under the ticker symbol QUBT, specializes in developing and commercializing quantum control technology. This isn't about building the actual quantum computers themselves; instead, they focus on improving the stability and reliability of existing and future quantum computers. This is crucial because even the most advanced quantum computers are incredibly sensitive to noise and errors. QUBT's technology aims to mitigate these issues, making quantum computing more practical and accessible.

This approach offers a distinct advantage. Instead of competing directly with giants like IBM and Google in the hardware space, QUBT is providing essential infrastructure and software solutions. This positions them as a key player regardless of which hardware platform ultimately dominates the market. Their technology is platform-agnostic, making it a potentially safer bet for investors concerned about the long-term viability of specific hardware approaches.

Factors to Consider Before QUBT Earnings

Several factors will significantly influence QUBT's stock price following its earnings release:

- Revenue Growth: Investors will closely scrutinize QUBT's revenue figures. Sustained growth indicates strong market adoption of their control technology and a healthy financial outlook. Any significant deviation from expectations could trigger market volatility.

- Customer Acquisition: The number of new customers and strategic partnerships secured will be a key performance indicator. Landing major players in the quantum computing industry would be a strong positive signal.

- Research and Development (R&D) Spending: While increased R&D spending might seem negative at first glance, it signals QUBT's commitment to innovation and long-term growth. This investment suggests confidence in their future and a desire to maintain a competitive edge.

- Guidance: The company's outlook for future quarters will be pivotal. Positive guidance, including projections for revenue growth and profitability, will likely boost investor confidence. Conversely, cautious guidance or lowered expectations could negatively impact the stock price.

- Market Sentiment: The overall sentiment surrounding the quantum computing industry will also play a role. Positive news or breakthroughs in the broader field could benefit QUBT, while negative news could have the opposite effect.

QUBT Stock: Buy, Sell, or Hold? A Cautious Approach

Predicting short-term stock movements is inherently risky. While QUBT operates in an exciting and potentially lucrative sector, investing in any pre-earnings stock involves uncertainty. Before making a decision, investors should:

- Conduct thorough due diligence: Analyze QUBT's financial statements, understand its business model, and assess its competitive landscape.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversification helps mitigate risk.

- Consider your risk tolerance: Quantum computing is a high-growth, high-risk sector. Only invest what you can afford to lose.

- Monitor market trends: Stay informed about developments in the quantum computing industry and broader market conditions.

The information provided here is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions. The future of QUBT and the quantum computing industry is brimming with potential, but informed decision-making is paramount. The earnings announcement will undoubtedly be a pivotal moment, but remember that long-term investment strategies are often more successful than trying to time the market based on short-term fluctuations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on QUBT Stock: Buy Or Sell Before Earnings? Quantum Computing Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lady Gaga Fans In Malaysia A Concert Of Chaos And Excitement

May 16, 2025

Lady Gaga Fans In Malaysia A Concert Of Chaos And Excitement

May 16, 2025 -

T Mobiles Champ Connections A Conversation With Max Homa

May 16, 2025

T Mobiles Champ Connections A Conversation With Max Homa

May 16, 2025 -

Fatal Second Link Accident Singaporean Driver To Face Charges In Johor

May 16, 2025

Fatal Second Link Accident Singaporean Driver To Face Charges In Johor

May 16, 2025 -

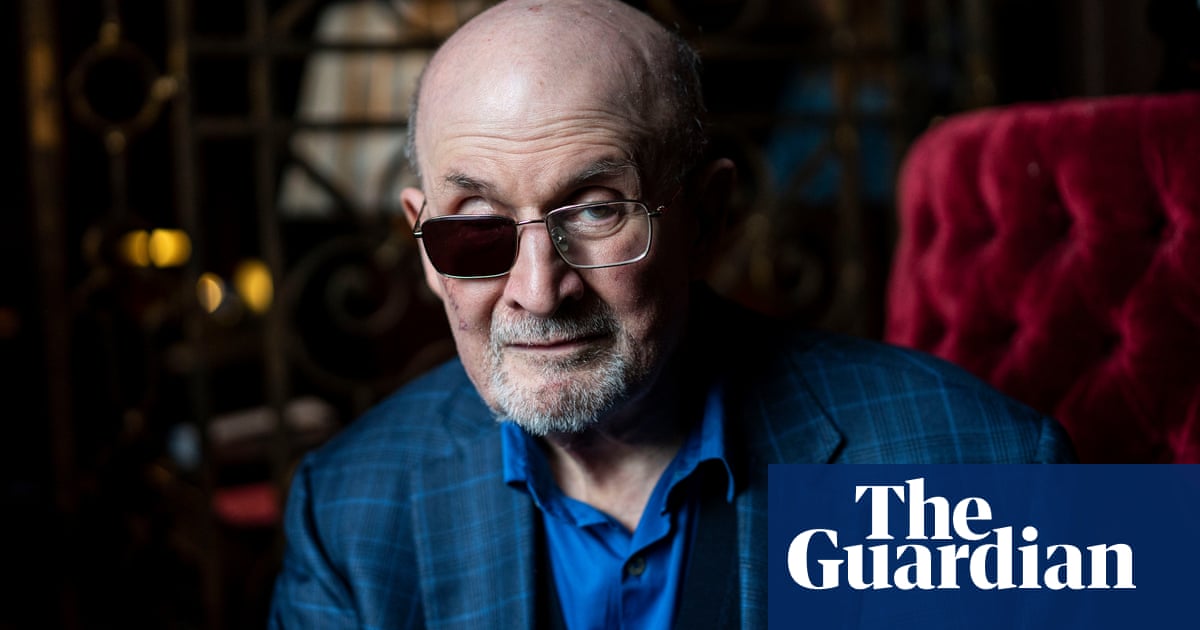

25 Years Man Who Stabbed Salman Rushdie Sentenced

May 16, 2025

25 Years Man Who Stabbed Salman Rushdie Sentenced

May 16, 2025 -

Wsj Exposes Possible United Health Fraud Connection To The Luigi Mangione Murder Case

May 16, 2025

Wsj Exposes Possible United Health Fraud Connection To The Luigi Mangione Murder Case

May 16, 2025