QUBT Stock: Buy Or Sell Before Earnings? Your Quantum Computing Investment Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

QUBT Stock: Buy or Sell Before Earnings? Your Quantum Computing Investment Guide

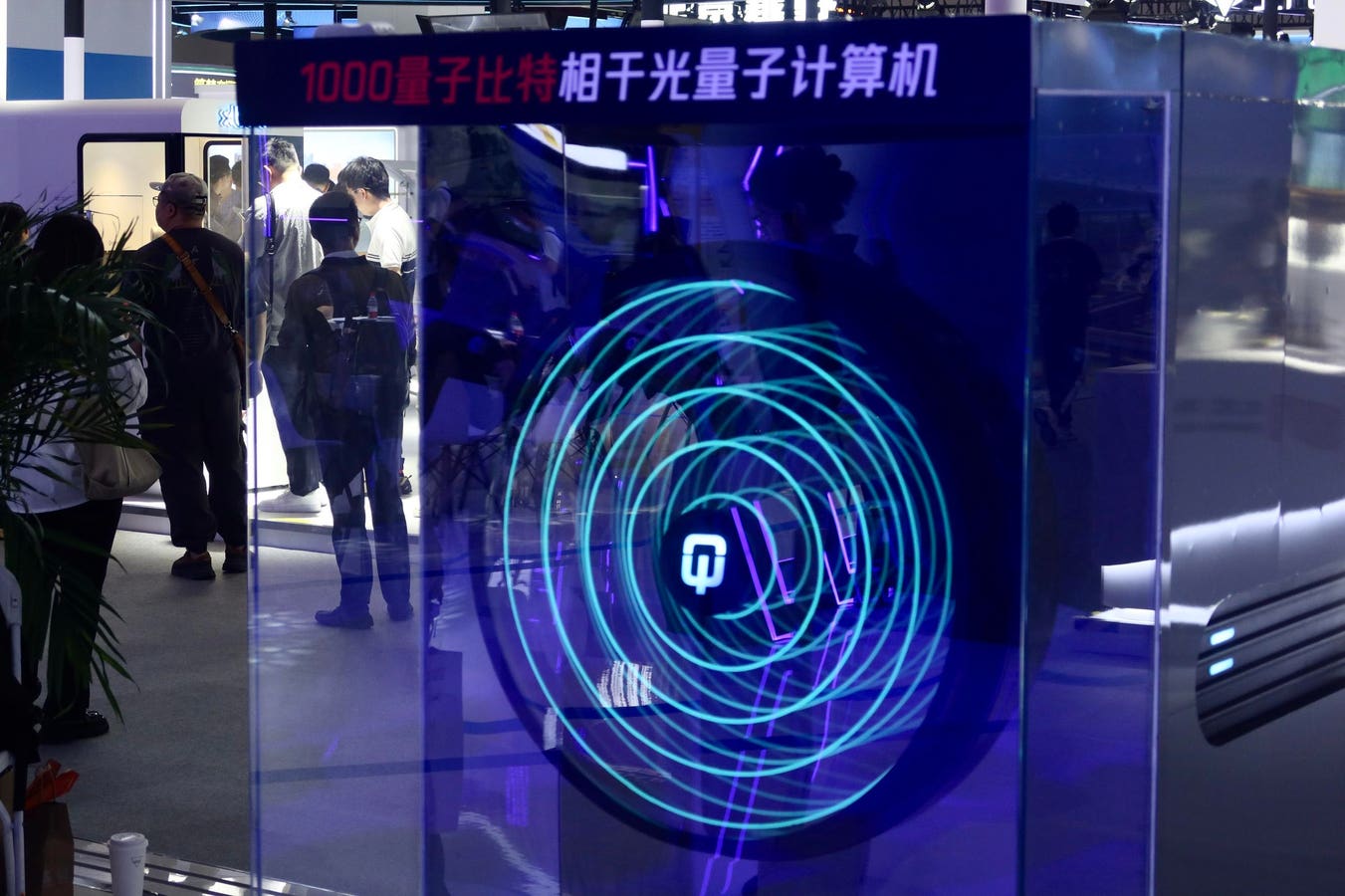

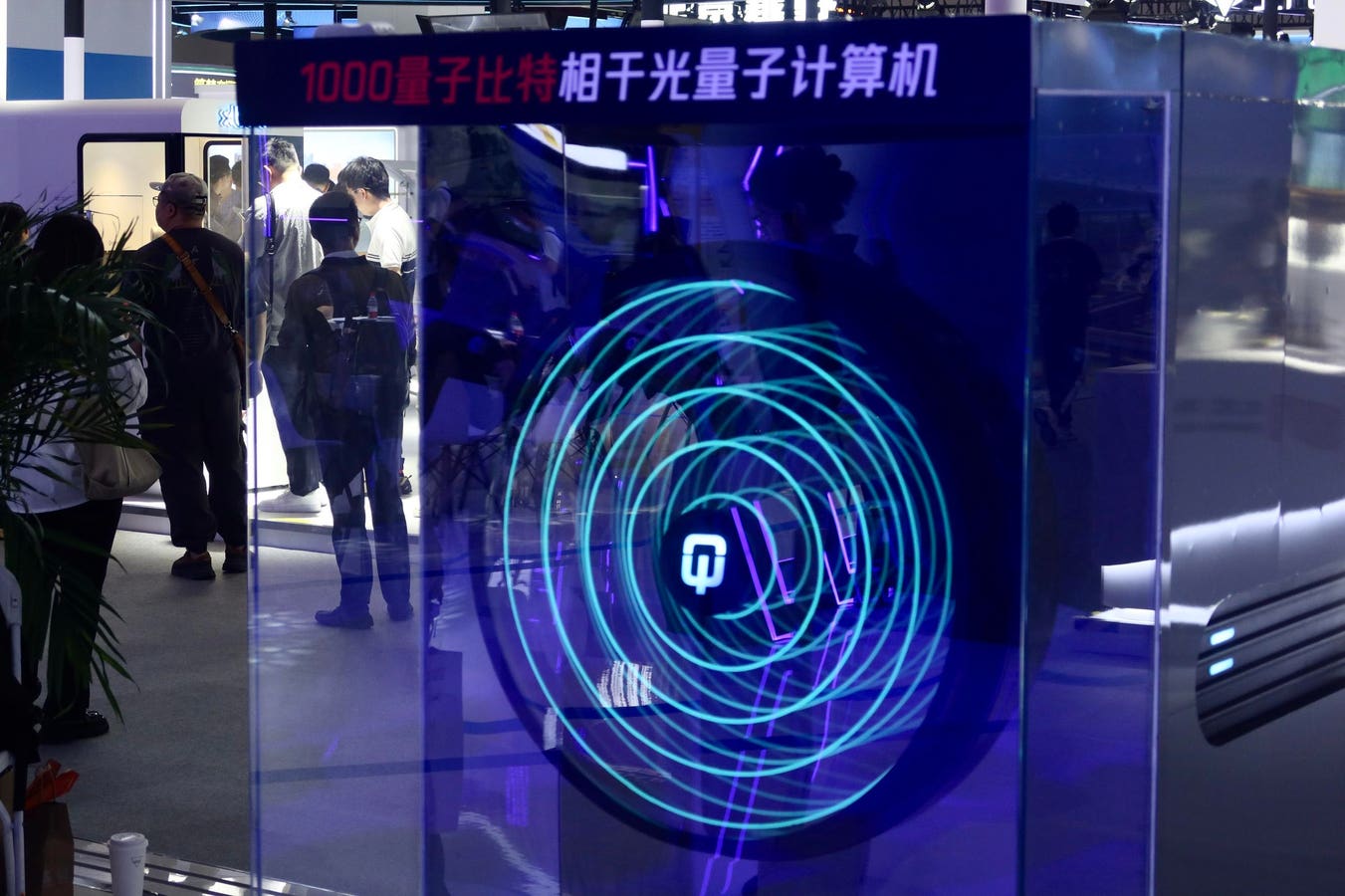

The quantum computing sector is buzzing, and QUBT stock is at the heart of the excitement. But with earnings season looming, many investors are asking: is now the time to buy, sell, or hold? This comprehensive guide will delve into the current market landscape, analyzing QUBT's performance, potential risks, and future outlook to help you make an informed investment decision.

Understanding QUBT and the Quantum Computing Market

Before diving into the buy-or-sell question, it's crucial to understand what QUBT represents. QUBT (replace with the actual company name if different; for SEO purposes, replace with the ticker symbol and full company name throughout the article) is a [Insert company description, e.g., leading developer of quantum computing software and hardware solutions]. The quantum computing market is still nascent but holds immense potential, promising revolutionary advancements in various sectors, including medicine, materials science, and finance. This potential fuels investor interest, but also introduces significant risk.

Analyzing QUBT's Recent Performance and Financials

QUBT's stock price has [Describe recent performance, e.g., experienced significant volatility in recent months, influenced by factors such as X, Y, and Z]. Examining the company's recent financial reports is critical. Key metrics to consider include:

- Revenue Growth: Is QUBT demonstrating consistent revenue growth, indicating market traction?

- Profitability: Is the company profitable, or is it still operating at a loss? What is the projected path to profitability?

- Research and Development (R&D) Spending: Significant investment in R&D is expected in this innovative sector. How does QUBT's R&D spending compare to its competitors?

- Debt Levels: High debt levels can pose a risk, especially for a company operating in a high-risk, high-reward sector like quantum computing.

Analyzing these metrics alongside industry benchmarks provides a clearer picture of QUBT's financial health and future prospects.

Factors to Consider Before Earnings Announcement

The period before earnings announcements is often characterized by increased market volatility. Several factors influence investor sentiment around QUBT:

- Earnings Expectations: Analyst estimates and market sentiment surrounding QUBT's upcoming earnings report play a significant role. Exceeding expectations can lead to a price surge, while falling short might trigger a sell-off.

- Competition: The quantum computing sector is fiercely competitive. News about competitors' advancements or partnerships can impact QUBT's stock price.

- Technological Breakthroughs: Any significant technological breakthroughs announced by QUBT or its competitors will significantly influence investor confidence.

- Market Sentiment: The overall market sentiment toward technology stocks and the broader economy can impact QUBT's performance irrespective of its specific earnings.

Should You Buy, Sell, or Hold QUBT Stock Before Earnings?

There's no easy answer to this question. The decision depends entirely on your risk tolerance, investment horizon, and personal assessment of QUBT's prospects. However, here's a framework to guide your decision:

- Buy: If you believe QUBT has strong long-term potential and are comfortable with the inherent risks in the quantum computing sector, buying before earnings might be a viable strategy – particularly if you believe the market has undervalued the company.

- Sell: If you're concerned about QUBT's short-term prospects or need to reduce risk in your portfolio, selling before earnings might be prudent. This limits potential losses if the earnings report disappoints.

- Hold: If you're already invested in QUBT and are comfortable with your current position, holding might be the most suitable approach, allowing you to weather short-term fluctuations.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The information provided here reflects the current market conditions and may change.

Keywords: QUBT stock, quantum computing, earnings report, investment guide, buy or sell, stock market, technology stocks, investment strategy, risk tolerance, financial analysis, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on QUBT Stock: Buy Or Sell Before Earnings? Your Quantum Computing Investment Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Fa Cup Final Live Stream Teams And Predictions

May 17, 2025

2025 Fa Cup Final Live Stream Teams And Predictions

May 17, 2025 -

Analyzing Teslas Terawatt Target Implications Of Master Plan 4

May 17, 2025

Analyzing Teslas Terawatt Target Implications Of Master Plan 4

May 17, 2025 -

Strengthening Ine Security The Importance Of Proactive Cve Management

May 17, 2025

Strengthening Ine Security The Importance Of Proactive Cve Management

May 17, 2025 -

Chelsea Fans Dream Lineup Vs Man Utd Jacksons Replacement Debated

May 17, 2025

Chelsea Fans Dream Lineup Vs Man Utd Jacksons Replacement Debated

May 17, 2025 -

Ipl Return Marred By Rain Kohli Tribute Dampened

May 17, 2025

Ipl Return Marred By Rain Kohli Tribute Dampened

May 17, 2025