QUBT Stock: Earnings Report And Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

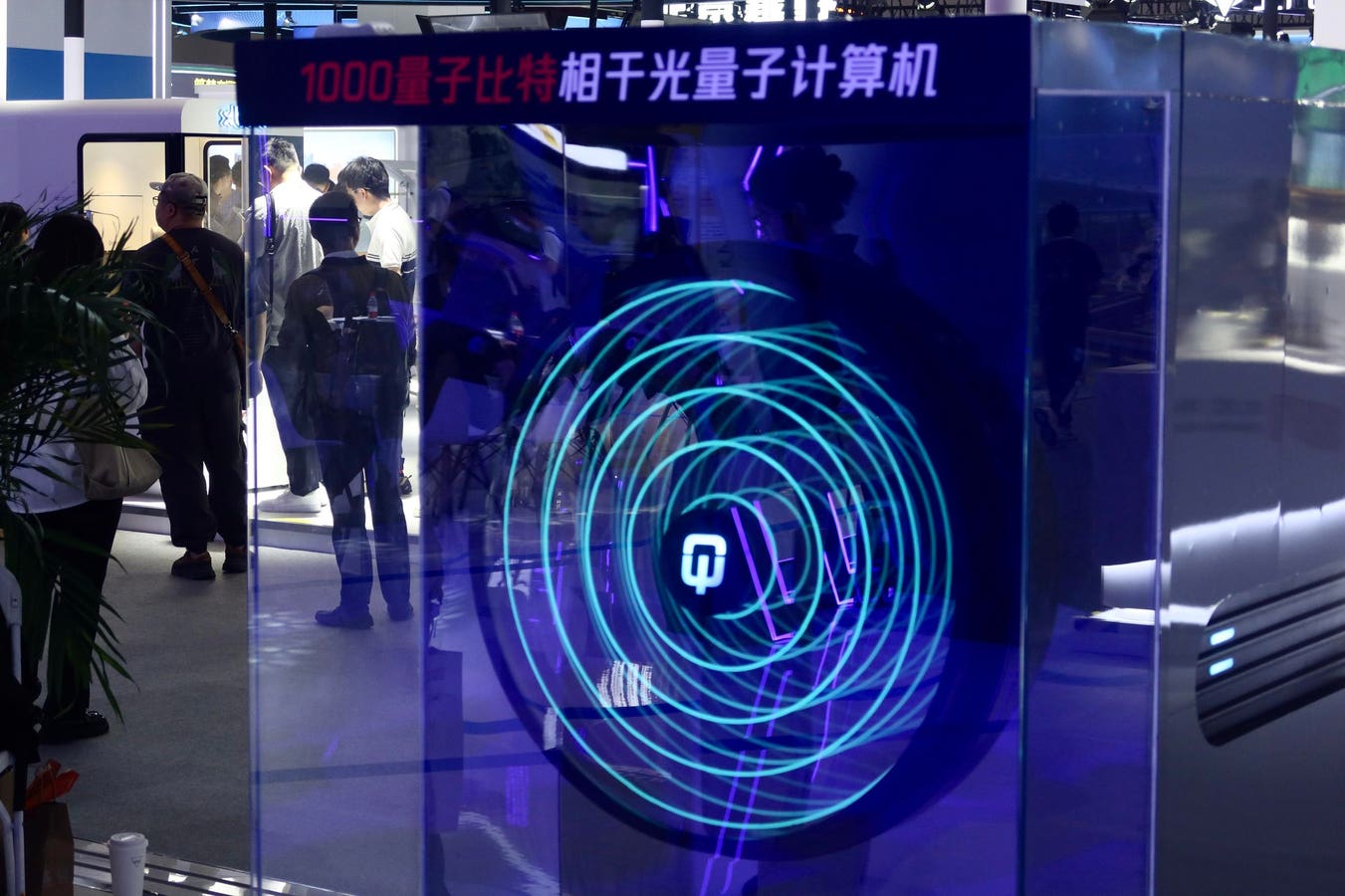

QUBT Stock: Diving Deep into the Earnings Report and Charting an Investment Strategy

QUBT stock has been making waves recently, prompting many investors to ask: is now the time to buy, sell, or hold? Understanding the company's recent earnings report is crucial for formulating a sound investment strategy. This in-depth analysis explores QUBT's financial performance, assesses its future prospects, and offers insights for navigating the complexities of this intriguing investment.

QUBT's Latest Earnings Report: A Detailed Look

QUBT's most recent earnings report revealed [Insert Key Financial Data Here: e.g., revenue figures, EPS, net income, etc.]. While [mention positive aspects, e.g., exceeding analyst expectations or significant growth in a specific sector], the report also highlighted [mention challenges or areas needing improvement, e.g., increased operating costs or a dip in a particular market segment]. A key takeaway from the report is [mention a significant finding or trend, e.g., the company's successful expansion into a new market or a strategic shift in its business model].

Analyzing Key Performance Indicators (KPIs)

Several key performance indicators (KPIs) provide crucial context for evaluating QUBT's performance and forecasting future trends. These include:

- Revenue Growth: [Analyze revenue growth trends, comparing year-over-year and quarter-over-quarter performance. Highlight any significant changes and explain the underlying factors.]

- Earnings Per Share (EPS): [Analyze EPS trends, highlighting any significant increases or decreases and explaining their causes.]

- Debt-to-Equity Ratio: [Assess the company's financial leverage and its potential impact on future performance.]

- Profit Margins: [Analyze profit margins to gauge the company's profitability and efficiency.]

Future Outlook and Investment Strategy Considerations

Predicting the future performance of any stock involves inherent uncertainty. However, based on QUBT's recent earnings report and broader market trends, we can outline several potential scenarios and investment strategies:

Scenario 1: Continued Growth

If QUBT successfully executes its current strategy and capitalizes on emerging market opportunities, we could see [mention potential positive outcomes, e.g., sustained revenue growth, increased market share, higher stock price]. In this scenario, a long-term buy-and-hold strategy might be appropriate, with potential for significant returns.

Scenario 2: Stagnation or Decline

If QUBT faces unforeseen challenges or fails to adapt to changing market dynamics, we could see [mention potential negative outcomes, e.g., slower revenue growth, decreased profitability, lower stock price]. In this scenario, a more cautious approach might be warranted, possibly involving diversification or partial divestment.

Scenario 3: Strategic Shift

QUBT might undertake a significant strategic shift, such as a merger, acquisition, or expansion into a new market. This could lead to [mention potential outcomes, both positive and negative, depending on the nature of the strategic shift]. Thorough due diligence and analysis of the strategic shift will be critical in determining the appropriate investment strategy.

Risk Assessment:

Investing in QUBT, like any stock, carries inherent risks. These include [mention specific risks, e.g., market volatility, competition, regulatory changes, technological disruptions]. A thorough risk assessment is essential before making any investment decisions.

Conclusion: Making Informed Decisions

The QUBT earnings report offers valuable insights into the company's financial health and future prospects. However, it's crucial to consider broader market trends and conduct thorough due diligence before making any investment decisions. Remember that this analysis is for informational purposes only and is not financial advice. Always consult with a qualified financial advisor before making any investment choices. By carefully considering the information presented here and conducting your own research, you can develop a well-informed and effective investment strategy for QUBT stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on QUBT Stock: Earnings Report And Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jason Puncheon The Crystal Palace Fa Cup Final Goal That Defined A Generation

May 17, 2025

Jason Puncheon The Crystal Palace Fa Cup Final Goal That Defined A Generation

May 17, 2025 -

Queen Latifahs Multifaceted Career From Music To Film And Beyond

May 17, 2025

Queen Latifahs Multifaceted Career From Music To Film And Beyond

May 17, 2025 -

Decisoes Finais Resultados E Classificacao Da Liga Europeia

May 17, 2025

Decisoes Finais Resultados E Classificacao Da Liga Europeia

May 17, 2025 -

Chelsea Vs United Team News And Predicted Lineups

May 17, 2025

Chelsea Vs United Team News And Predicted Lineups

May 17, 2025 -

So Fis Cma Fest Fan Fair X The Artists You Need To See

May 17, 2025

So Fis Cma Fest Fan Fair X The Artists You Need To See

May 17, 2025