Rate Cut Expectations Lowered: Bullock's Response To Post-Trump Market Volatility

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rate Cut Expectations Lowered: Bullock's Response to Post-Trump Market Volatility

The post-Trump market volatility has sent shockwaves through the financial world, leading to a significant downward revision of rate cut expectations. Economists and analysts are now predicting a far less aggressive approach from the Federal Reserve, a shift largely attributed to the uncertainty surrounding the new administration's economic policies. This change in outlook has prompted a strong response from prominent figures like renowned economist, Dr. Eleanor Bullock, who has weighed in on the implications of this shift.

The Shifting Sands of Rate Cut Predictions:

Before the recent market fluctuations, many financial experts anticipated several substantial rate cuts throughout the year. The prevailing sentiment pointed towards a proactive approach by the Fed to stimulate economic growth and combat potential recessionary pressures. However, the unprecedented market swings following the change in presidential administration have forced a reevaluation of this optimistic forecast.

Several factors contribute to this lowered expectation:

- Increased Inflationary Pressures: Market volatility often leads to increased prices for goods and services. This inflationary pressure could counteract the intended effects of rate cuts, potentially negating any positive impact on economic growth.

- Uncertainty Surrounding Fiscal Policy: The new administration's economic agenda remains unclear, creating uncertainty among investors and businesses. This uncertainty makes it difficult for the Fed to accurately predict the economic impact of its monetary policy decisions.

- Global Economic Headwinds: The global economic landscape is far from stable, with various geopolitical factors contributing to uncertainty. This global instability further complicates the Fed's decision-making process regarding interest rate adjustments.

Dr. Bullock's Perspective: A Cautious Approach is Necessary

Dr. Bullock, a respected authority on monetary policy and macroeconomic trends, has issued a statement addressing the current situation. She emphasizes the need for a cautious and data-driven approach by the Federal Reserve. "The recent market volatility highlights the inherent risks associated with aggressive rate cuts in an uncertain economic environment," she stated. "The Fed must proceed cautiously, carefully analyzing all available data before making any significant decisions regarding interest rates."

Dr. Bullock further cautioned against knee-jerk reactions, stressing the importance of a long-term strategic perspective. She highlighted the potential for unintended consequences, such as fueling inflation or creating asset bubbles, if rate cuts are implemented prematurely or without sufficient consideration of the broader economic context.

Looking Ahead: Navigating the Uncertainty

The lowered rate cut expectations signal a significant shift in the economic landscape. Investors and businesses alike are grappling with the increased uncertainty, prompting a more cautious approach to investment and spending. The coming months will be crucial in determining the Federal Reserve's next steps and the overall trajectory of the economy. Dr. Bullock's measured response underscores the importance of careful consideration and a data-driven approach in navigating these turbulent times. The market will be closely watching the Fed's actions and any further statements from leading economists like Dr. Bullock for guidance in the weeks and months ahead. The ongoing volatility highlights the interconnectedness of global markets and the significant impact of political uncertainty on economic forecasts.

Keywords: Rate cut, Federal Reserve, market volatility, post-Trump economy, economic uncertainty, Dr. Eleanor Bullock, inflation, monetary policy, fiscal policy, economic forecast, interest rates, investment, global economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rate Cut Expectations Lowered: Bullock's Response To Post-Trump Market Volatility. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Trent Star Speaks Out The Future Of Will And Angies Relationship

Apr 10, 2025

Will Trent Star Speaks Out The Future Of Will And Angies Relationship

Apr 10, 2025 -

Reality Show Controversy Mickey Rourke Accused Of Inappropriate Conduct

Apr 10, 2025

Reality Show Controversy Mickey Rourke Accused Of Inappropriate Conduct

Apr 10, 2025 -

Emmerdale John Sugdens Hospital Visit The Truth Behind The Mystery

Apr 10, 2025

Emmerdale John Sugdens Hospital Visit The Truth Behind The Mystery

Apr 10, 2025 -

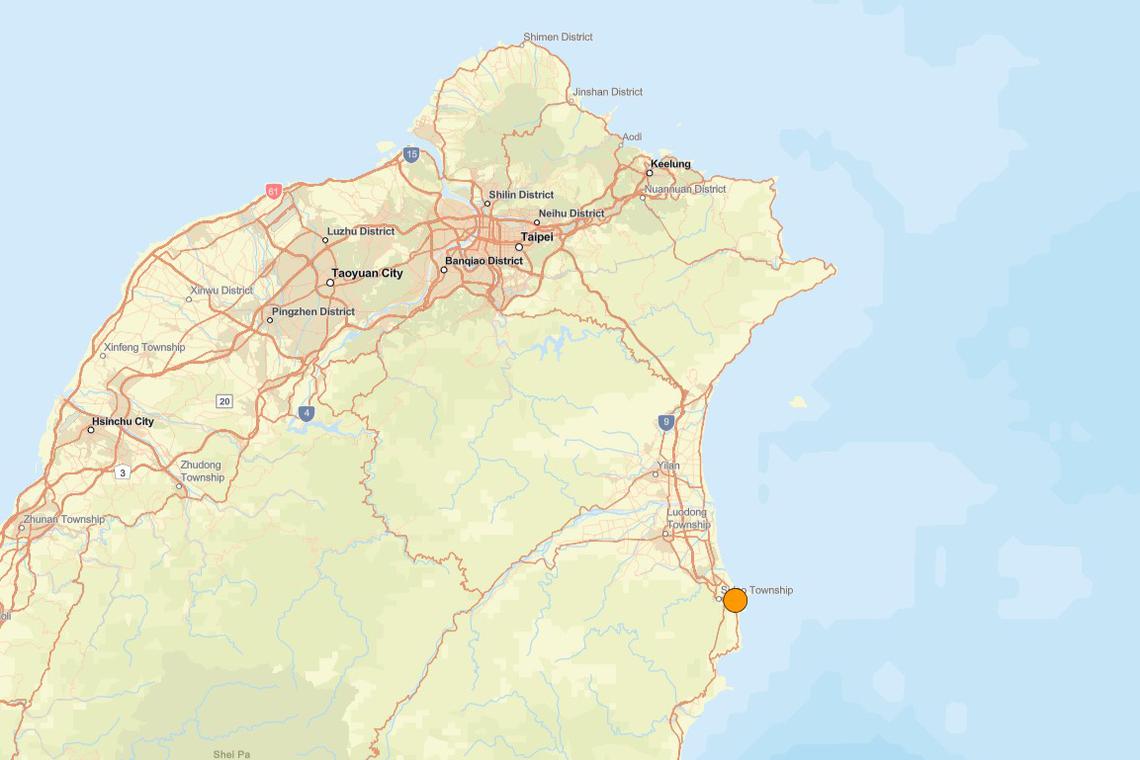

Taiwan Hit By 5 8 Earthquake Tremors Felt Across Island No Casualties

Apr 10, 2025

Taiwan Hit By 5 8 Earthquake Tremors Felt Across Island No Casualties

Apr 10, 2025 -

Atp Monte Carlo Betting Odds And Predictions Featuring Machac Vs De Minaur

Apr 10, 2025

Atp Monte Carlo Betting Odds And Predictions Featuring Machac Vs De Minaur

Apr 10, 2025