Rate Cut Expected As Stock Market Volatility Intensifies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rate Cut Expected as Stock Market Volatility Intensifies

The global stock market is experiencing a period of heightened volatility, prompting widespread speculation that central banks, particularly the Federal Reserve, will implement a rate cut in the coming months. This dramatic shift comes amidst growing concerns about a potential recession and the lingering impact of inflation. Experts weigh in on the likelihood of this crucial monetary policy adjustment and its potential implications for investors.

Market Turmoil: A Perfect Storm?

The current market instability is a confluence of several significant factors. High inflation, while showing signs of cooling, remains a persistent threat. Geopolitical uncertainties, including the ongoing war in Ukraine and escalating tensions in other regions, contribute to investor anxiety. Furthermore, the recent banking sector turmoil has shaken confidence in the financial system, exacerbating the volatility. These combined pressures have led to significant market fluctuations, leaving investors on edge.

The Case for a Rate Cut:

Many economists and market analysts believe a rate cut is imminent. The argument centers on the need to stimulate economic growth and prevent a deeper recession. A rate cut would lower borrowing costs, making it cheaper for businesses to invest and for consumers to spend, potentially boosting economic activity. The slowing inflation rate also strengthens the case for a rate cut, as it reduces the risk of further fueling inflationary pressures. The recent banking crisis further emphasizes the need for supportive monetary policy to prevent a credit crunch.

Potential Downsides and Counterarguments:

While a rate cut appears likely to many, some argue against it. Concerns remain that a rate cut could reignite inflationary pressures, undermining the progress made in bringing inflation under control. Others suggest that the current market volatility is a temporary correction and that intervention is unnecessary. The effectiveness of a rate cut in addressing the root causes of the current market instability—namely, geopolitical uncertainty and lingering inflation—is also debated.

What Investors Should Do:

The current market volatility presents challenges for investors. A diversified investment portfolio is crucial to mitigate risk. Many experts advise against panic selling, emphasizing the importance of a long-term investment strategy. Careful monitoring of market trends and staying informed about economic developments is also vital. Seeking advice from a qualified financial advisor can provide personalized guidance tailored to individual circumstances and risk tolerance.

Looking Ahead:

The coming weeks and months will be crucial in determining the Federal Reserve's next move. Closely watching economic indicators, such as inflation data and employment figures, will be essential. Any announcement regarding a rate cut will undoubtedly have significant implications for global markets, impacting everything from borrowing costs to investment strategies. The situation remains fluid, demanding vigilance and informed decision-making from investors and policymakers alike. The extent of the rate cut, if implemented, and the timing of its announcement will be closely scrutinized by all stakeholders. The impact of this potential rate cut on various sectors, from technology to real estate, will be a key area of focus in the coming days. Stay tuned for further updates as this critical economic situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rate Cut Expected As Stock Market Volatility Intensifies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Last Of Us Season 2 Episode 2 That Death Changes Everything Recap And Discussion

Apr 22, 2025

The Last Of Us Season 2 Episode 2 That Death Changes Everything Recap And Discussion

Apr 22, 2025 -

Close Game Stars Win 4 3 Against Avalanche April 21 2025

Apr 22, 2025

Close Game Stars Win 4 3 Against Avalanche April 21 2025

Apr 22, 2025 -

Nomura Makes Biggest Post Lehman Acquisition Macquarie Asset Management Units

Apr 22, 2025

Nomura Makes Biggest Post Lehman Acquisition Macquarie Asset Management Units

Apr 22, 2025 -

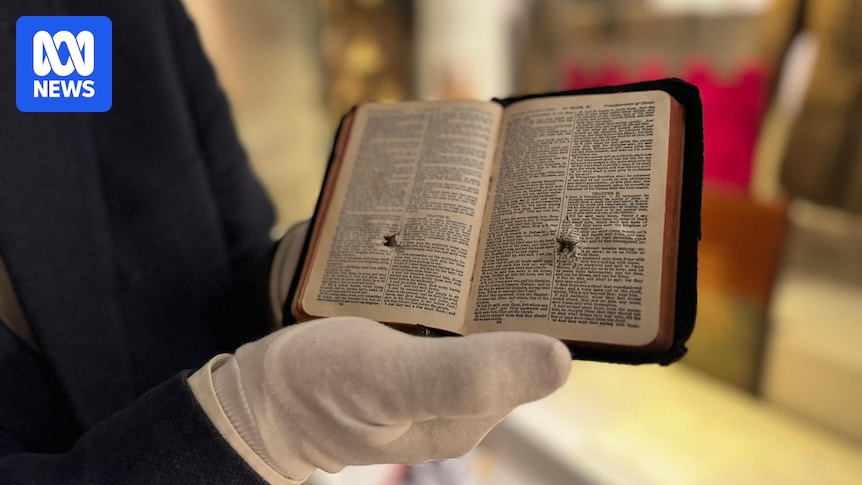

Exploring The Gallipoli Spirit A Sydney Exhibition

Apr 22, 2025

Exploring The Gallipoli Spirit A Sydney Exhibition

Apr 22, 2025 -

Ong Ye Kungs Sembawang Grc Team For Ge 2025 A Look At The Candidates

Apr 22, 2025

Ong Ye Kungs Sembawang Grc Team For Ge 2025 A Look At The Candidates

Apr 22, 2025