RBA Expected To Cut Rates Amidst Retail Slump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBA Expected to Cut Rates Amidst Retail Slump: Is a Recession on the Horizon?

Australia's struggling retail sector has economists and market analysts buzzing, with many predicting the Reserve Bank of Australia (RBA) will cut interest rates at its upcoming meeting. The recent slump in consumer spending, coupled with weakening inflation figures, has intensified calls for monetary easing to stimulate economic growth. But will a rate cut be enough to avert a potential recession?

Retail Sales Plummet: A Sign of Deeper Economic Woes?

Recent retail sales figures have painted a bleak picture of the Australian economy. Data released last week showed a significant decline in consumer spending, marking the third consecutive month of contraction. This downturn isn't isolated to specific sectors; it's a broad-based weakness indicating a potential loss of consumer confidence. Experts point to several contributing factors, including:

- High inflation: Persistent inflation has eroded purchasing power, leaving consumers with less disposable income.

- Rising interest rates: Previous RBA rate hikes, aimed at curbing inflation, have increased borrowing costs, impacting both businesses and households.

- Cost of living pressures: Soaring energy and grocery prices are putting immense strain on household budgets.

RBA Under Pressure to Act: Rate Cut on the Cards?

The RBA is facing mounting pressure to respond to the deteriorating economic situation. Many economists believe a rate cut is now inevitable, arguing that the current monetary policy stance is too restrictive for the current economic climate. A rate cut would aim to:

- Stimulate borrowing and spending: Lower interest rates would make borrowing cheaper, encouraging businesses to invest and consumers to spend.

- Boost economic growth: Increased investment and spending would help to lift economic activity and create jobs.

- Support the struggling retail sector: Lower interest rates could help to revitalize the retail sector by boosting consumer confidence and demand.

Will a Rate Cut Be Enough? The Recession Risk

While a rate cut could provide a much-needed boost to the economy, some experts warn it may not be sufficient to prevent a recession. The severity and persistence of the retail slump, coupled with global economic uncertainty, pose significant challenges. The effectiveness of a rate cut also depends on other factors, such as consumer sentiment and global economic conditions.

What to Expect from the RBA's Next Meeting

The RBA's next monetary policy meeting is scheduled for [Insert Date of Next Meeting]. While the market largely anticipates a rate cut, the magnitude of the cut remains uncertain. Analysts predict a reduction of [Insert Predicted Rate Cut Percentage], but this could be adjusted depending on the latest economic data and RBA assessment. Investors and consumers alike will be closely watching the RBA's announcement for clues about the future direction of monetary policy.

Looking Ahead: Navigating Economic Uncertainty

The current economic climate presents significant challenges for Australia. The retail slump, coupled with global uncertainty, underscores the need for a carefully calibrated policy response from the RBA. While a rate cut is widely anticipated, its effectiveness in preventing a recession remains to be seen. The coming months will be crucial in determining the trajectory of the Australian economy and the RBA's future policy decisions. Stay tuned for further updates.

Keywords: RBA, Reserve Bank of Australia, interest rates, rate cut, retail sales, consumer spending, inflation, recession, economic growth, monetary policy, Australian economy, cost of living, borrowing costs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBA Expected To Cut Rates Amidst Retail Slump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Maple Leafs Vs Panthers Game 2 Post Game Report And Series Outlook

May 08, 2025

Maple Leafs Vs Panthers Game 2 Post Game Report And Series Outlook

May 08, 2025 -

Josh Hartnetts Unexpected Return Analyzing His Most Gonzo Project

May 08, 2025

Josh Hartnetts Unexpected Return Analyzing His Most Gonzo Project

May 08, 2025 -

Lekkerimaeki Expected Back For Abbotsford Canucks Crucial Game 3

May 08, 2025

Lekkerimaeki Expected Back For Abbotsford Canucks Crucial Game 3

May 08, 2025 -

Pennsylvania Stimulus Check Update Am I Too Late To Claim My Money

May 08, 2025

Pennsylvania Stimulus Check Update Am I Too Late To Claim My Money

May 08, 2025 -

Chuwi Minibook X A 10 5 Inch Netbook Revival

May 08, 2025

Chuwi Minibook X A 10 5 Inch Netbook Revival

May 08, 2025

Latest Posts

-

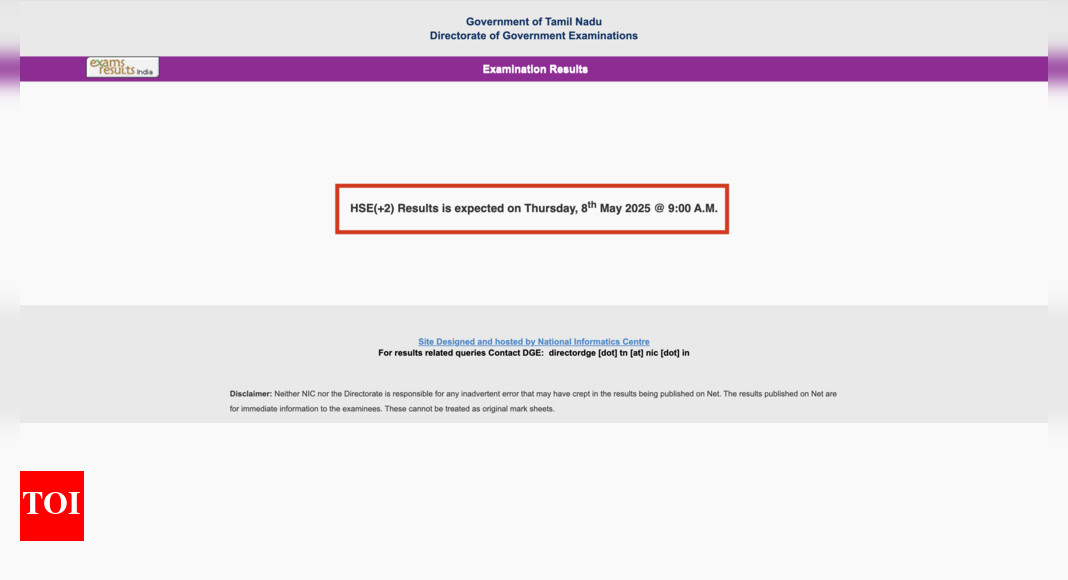

Dge Tn Announces Tamil Nadu Class 12th Result 2024 95 03 Pass Percentage

May 08, 2025

Dge Tn Announces Tamil Nadu Class 12th Result 2024 95 03 Pass Percentage

May 08, 2025 -

Ai Agents Connecting To All Saa S Applications Today

May 08, 2025

Ai Agents Connecting To All Saa S Applications Today

May 08, 2025 -

Kamino Kmno 100 Growth In 30 Days Binance Listing Impact Analyzed

May 08, 2025

Kamino Kmno 100 Growth In 30 Days Binance Listing Impact Analyzed

May 08, 2025 -

Saudi Pro League Shock Al Ittihad Stuns Al Nassr Despite Ronaldos Presence

May 08, 2025

Saudi Pro League Shock Al Ittihad Stuns Al Nassr Despite Ronaldos Presence

May 08, 2025 -

Ice Detention Of Georgetown Peace Scholar Badar Khan Suri Sparks Outrage

May 08, 2025

Ice Detention Of Georgetown Peace Scholar Badar Khan Suri Sparks Outrage

May 08, 2025