RDU's Philemon Demands GST Reduction: "Daily Tax, Twice-Yearly Refund Is Unfair"

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RDU's Philemon Demands GST Reduction: "Daily Tax, Twice-Yearly Refund is Unfair"

Raleigh-Durham International Airport (RDU) CEO, Philemon, has launched a scathing attack on the current Goods and Services Tax (GST) system, calling the current structure unfair and demanding immediate reduction. The outspoken CEO argues that the current system, which requires businesses to pay GST daily, only to receive a refund biannually, places an undue burden on already stretched airport resources. This bold statement has sent ripples through the aviation industry and sparked a debate about the fairness and efficiency of the GST system for large businesses.

Philemon's frustration stems from the significant capital investment RDU requires to maintain its operations and accommodate growing passenger numbers. He argues that the current GST system acts as a substantial, ongoing drain on these resources, forcing the airport to effectively finance the government's tax revenue for extended periods. "It's simply unsustainable," Philemon stated in a press conference earlier today. "We're paying tax daily, effectively acting as a short-term lender to the government, without adequate compensation for the associated financial risks."

The Core Issue: Cash Flow and Operational Efficiency

The heart of Philemon's argument centers around the impact of the current GST system on RDU's cash flow. The six-month delay between tax payment and refund creates significant liquidity challenges. These challenges, Philemon explains, directly impact the airport's ability to:

- Invest in infrastructure improvements: From runway maintenance to terminal expansions, RDU requires significant capital investment to remain competitive. The current GST system hinders this process.

- Maintain operational efficiency: The constant need to manage the fluctuating cash flow caused by the GST system diverts resources and manpower away from core operational functions.

- Attract new businesses and airlines: A financially strained airport is less attractive to potential partners. The current GST system, according to Philemon, puts RDU at a disadvantage in attracting lucrative partnerships.

Calls for Reform and Potential Solutions

Philemon's call for GST reduction isn't simply a complaint; it's a proposal for reform. He suggests several potential solutions, including:

- More frequent GST refunds: Moving to quarterly or even monthly refunds would significantly alleviate the cash flow burden.

- A tiered GST system: A system that adjusts GST rates based on the size and operational requirements of a business could provide a more equitable approach.

- Tax credits for infrastructure investment: Providing tax credits specifically for airports investing in critical infrastructure projects could offset the impact of GST payments.

Industry Response and Future Outlook

The aviation industry is closely watching the situation unfold. While some support Philemon's stance, others remain hesitant, emphasizing the complexities of reforming the GST system. The government has yet to respond officially, but the pressure is mounting for a review of the current system's impact on large businesses like RDU. This debate highlights the urgent need for a more streamlined and equitable GST system for all businesses, but especially those crucial to national infrastructure. The coming weeks will be critical in determining the future of GST regulations and their impact on RDU and other similarly affected businesses across the nation. This is a developing story, and we will continue to provide updates as they become available. Stay tuned for further developments in this ongoing saga.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RDU's Philemon Demands GST Reduction: "Daily Tax, Twice-Yearly Refund Is Unfair". We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

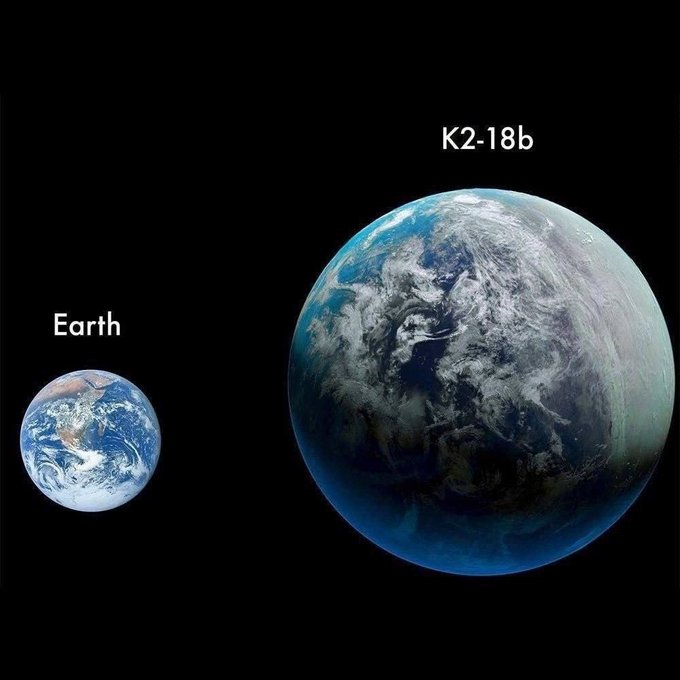

New Research High Probability Of Life On Ocean Exoplanet K2 18b

Apr 28, 2025

New Research High Probability Of Life On Ocean Exoplanet K2 18b

Apr 28, 2025 -

Scott Mills Quirky Radio 2 Gift For Ellie Taylor Revealed

Apr 28, 2025

Scott Mills Quirky Radio 2 Gift For Ellie Taylor Revealed

Apr 28, 2025 -

Venezia Vs Ac Milan And More Football Tracker Provides In Depth Match Analysis

Apr 28, 2025

Venezia Vs Ac Milan And More Football Tracker Provides In Depth Match Analysis

Apr 28, 2025 -

Vera Series 14 Episode 1 Where To Watch And Discussion

Apr 28, 2025

Vera Series 14 Episode 1 Where To Watch And Discussion

Apr 28, 2025 -

Whats App Defends Controversial Meta Ai Circle Feature Amidst Criticism

Apr 28, 2025

Whats App Defends Controversial Meta Ai Circle Feature Amidst Criticism

Apr 28, 2025

Latest Posts

-

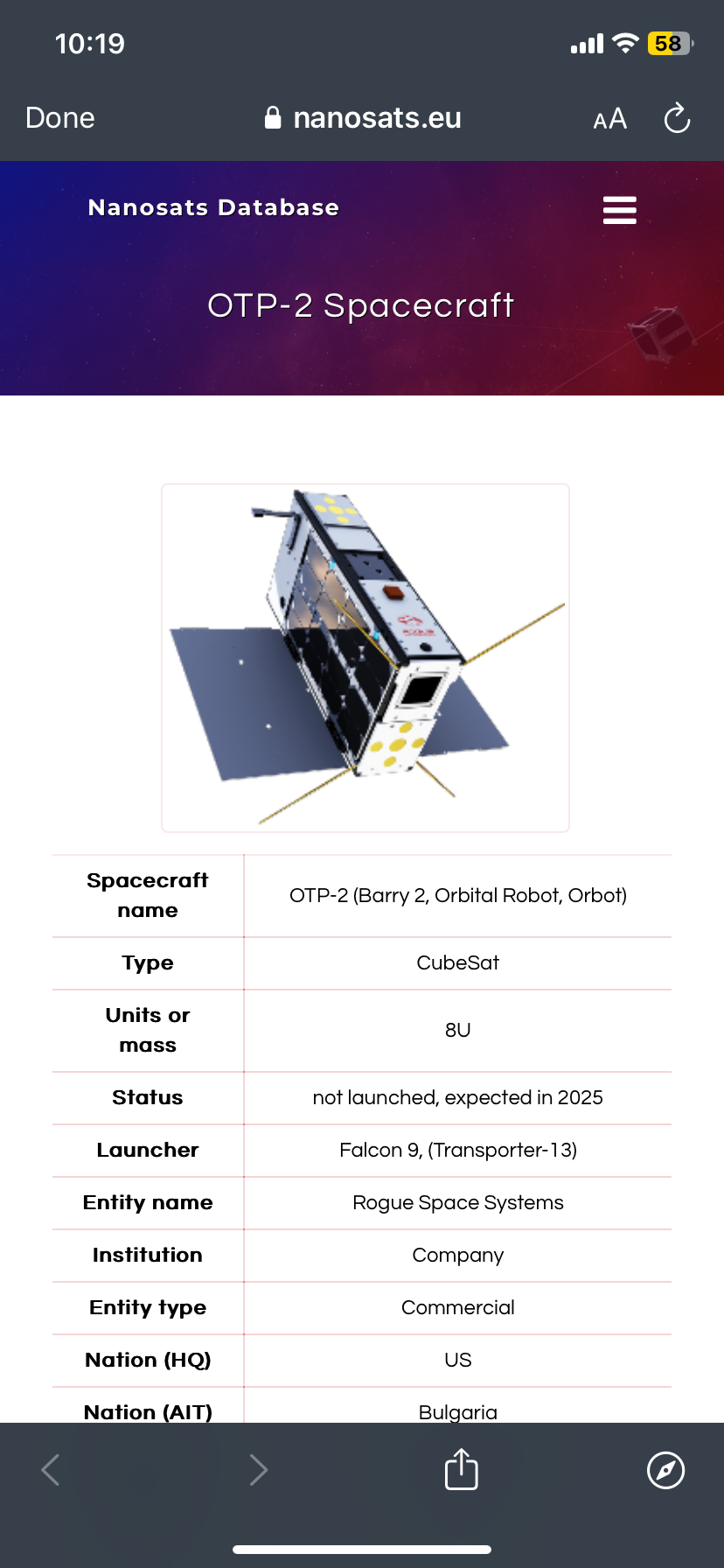

Next Big Future Com Details On Two Novel Otp 2 Propulsion Experiments

Apr 30, 2025

Next Big Future Com Details On Two Novel Otp 2 Propulsion Experiments

Apr 30, 2025 -

Champions League Semi Finals Arsenal Psg And Barcelona Inter Match Previews

Apr 30, 2025

Champions League Semi Finals Arsenal Psg And Barcelona Inter Match Previews

Apr 30, 2025 -

Boeing Resumes Flights Of 737 Max Planes Rejected By Chinese Authorities

Apr 30, 2025

Boeing Resumes Flights Of 737 Max Planes Rejected By Chinese Authorities

Apr 30, 2025 -

Otp 2 Update Results From Two Crucial Propulsion Experiments Revealed

Apr 30, 2025

Otp 2 Update Results From Two Crucial Propulsion Experiments Revealed

Apr 30, 2025 -

Psg Star The Key Obstacle To Arsenals Champions League Dream

Apr 30, 2025

Psg Star The Key Obstacle To Arsenals Champions League Dream

Apr 30, 2025