Rebounding Tech: Analysts Identify Promising Investments For Q2

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rebounding Tech: Analysts Identify Promising Investments for Q2

The tech sector, after a tumultuous 2022, shows signs of a significant rebound. Analysts are predicting a robust Q2, highlighting specific areas ripe for investment. While uncertainty remains a factor in the global economy, several key trends point towards a positive outlook for savvy investors. This article delves into the promising sectors and specific companies identified by leading financial analysts as potential investment hotspots for the second quarter of 2023.

Artificial Intelligence (AI) Remains a Heavyweight Contender

Artificial intelligence continues to dominate the conversation, and for good reason. The rapid advancements in generative AI, particularly large language models (LLMs) and their applications across various industries, have cemented AI as a key driver of growth. Analysts at Goldman Sachs, for instance, predict a significant surge in AI-related investments throughout Q2.

- Promising AI Stocks: Companies focusing on AI infrastructure (like NVIDIA and AMD), AI software solutions (like Palantir and C3.ai), and AI-driven applications across healthcare, finance, and other sectors are attracting significant attention. Investors should carefully analyze individual company performance and market potential before committing.

Cybersecurity: A Growing Need in an Increasingly Digital World

With the rise in cyber threats and the increasing reliance on digital infrastructure, cybersecurity remains a crucial sector for investment. The demand for robust cybersecurity solutions is only expected to grow, making this a relatively stable and promising area amidst market fluctuations.

- Key Players to Watch: Established players like CrowdStrike and Palo Alto Networks, as well as emerging companies specializing in specific areas like cloud security and AI-driven threat detection, are likely to see increased investor interest.

Cloud Computing: The Foundation of Modern Infrastructure

Cloud computing continues its steady growth trajectory, forming the backbone of modern digital infrastructure. The increasing adoption of cloud-based services across various industries ensures sustained demand, making cloud computing companies attractive investment options.

- Market Leaders and Emerging Players: While giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) remain dominant, smaller, more specialized cloud providers are also attracting investment, offering niche services and innovative solutions.

Sustainable Tech: Investing in a Greener Future

The growing awareness of environmental issues is driving significant investment in sustainable technologies. Companies developing renewable energy solutions, energy-efficient technologies, and sustainable materials are experiencing a surge in demand and investor interest.

- Green Investment Opportunities: This sector offers a diverse range of investment opportunities, from solar energy companies and wind turbine manufacturers to businesses focusing on carbon capture and sustainable agriculture. Thorough due diligence is essential to identify companies with strong growth potential and a genuine commitment to sustainability.

Navigating the Market: A Cautious Approach

While these sectors present promising investment opportunities, it's crucial to adopt a cautious approach. Conduct thorough due diligence, diversify your portfolio, and consider seeking professional financial advice before making any investment decisions. Market conditions can change rapidly, and thorough research is paramount to mitigating risk.

Conclusion:

Q2 2023 offers a promising landscape for tech investors. By carefully considering the trends and focusing on companies demonstrating strong fundamentals and growth potential within the identified sectors—AI, cybersecurity, cloud computing, and sustainable tech—investors can position themselves for potential success. However, remember that all investments carry inherent risks, and a well-informed strategy is essential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rebounding Tech: Analysts Identify Promising Investments For Q2. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

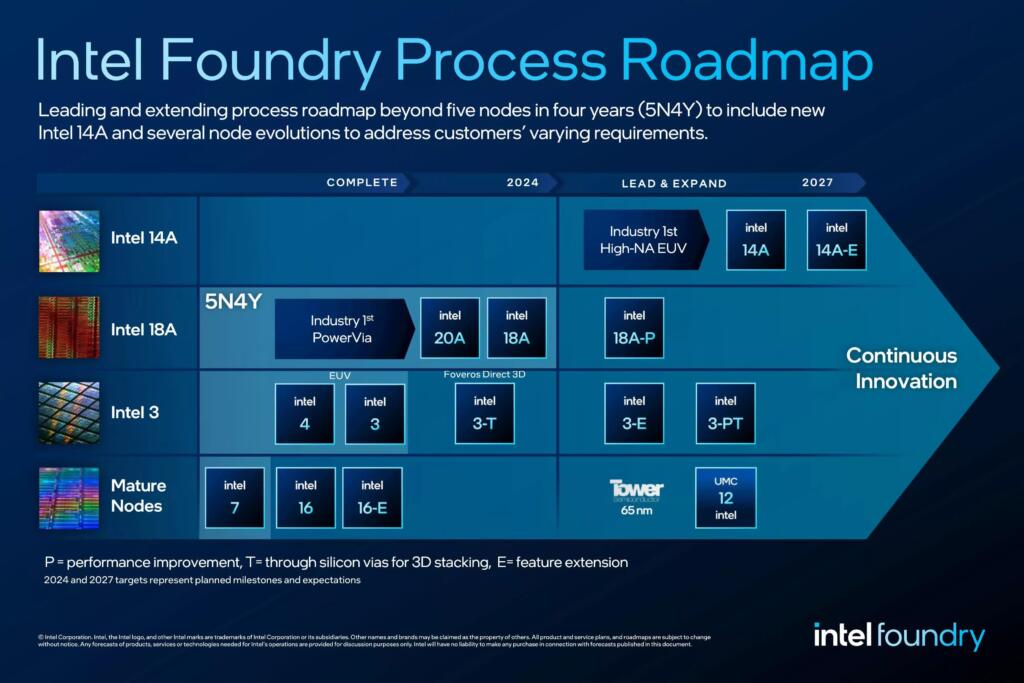

Intel 18 Angstrom A 2025 Production Target Restores Relevance

Apr 07, 2025

Intel 18 Angstrom A 2025 Production Target Restores Relevance

Apr 07, 2025 -

Heated Rivalry Clippers Mavericks Game Features Apparent Diss Towards Nico Harrison

Apr 07, 2025

Heated Rivalry Clippers Mavericks Game Features Apparent Diss Towards Nico Harrison

Apr 07, 2025 -

Investor Concerns Netflix Stock And The Tariff Debate

Apr 07, 2025

Investor Concerns Netflix Stock And The Tariff Debate

Apr 07, 2025 -

Five Decades Of Microsoft A Retrospective On Leadership And Technological Advancements

Apr 07, 2025

Five Decades Of Microsoft A Retrospective On Leadership And Technological Advancements

Apr 07, 2025 -

Us Faces Crisis Coalitions Critical Demand For Immediate Response

Apr 07, 2025

Us Faces Crisis Coalitions Critical Demand For Immediate Response

Apr 07, 2025