Recession Risk Rises As Wall Street Tanks Under Trump's Shadow

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Recession Risk Rises as Wall Street Tanks Under Trump's Shadow

The specter of a recession is looming large over the US economy, fueled by a volatile stock market and lingering uncertainty surrounding the Trump administration's economic policies. Wall Street's recent downturn has ignited widespread concerns, prompting experts to reassess the risk of an impending economic downturn. The question on everyone's mind: is a recession inevitable?

Trump's Economic Legacy Under Scrutiny:

Donald Trump's presidency was marked by significant tax cuts and deregulation, policies aimed at boosting economic growth. While initial results showed positive growth, the long-term effects are now being questioned, particularly in light of the current market volatility. His trade wars, specifically the ongoing tensions with China, have significantly impacted global trade and contributed to supply chain disruptions, further exacerbating economic anxieties. The uncertainty surrounding his post-presidency influence also adds to the instability.

Wall Street's Tumultuous Ride:

The Dow Jones Industrial Average and the S&P 500 have experienced significant dips recently, reflecting investor anxieties about inflation, interest rate hikes by the Federal Reserve, and the ongoing geopolitical instability. This market downturn isn't just a blip; it's a sustained period of volatility that is sending shockwaves through the financial sector and impacting consumer confidence. The fear is that this instability will trigger a domino effect, leading to job losses and a contraction in economic activity.

Key Indicators Pointing Towards Recessionary Risks:

Several key economic indicators are flashing warning signs:

- Inverted Yield Curve: The inversion of the yield curve, where short-term Treasury yields exceed long-term yields, is a historically reliable predictor of recessions. This anomaly suggests investors are anticipating future economic slowdown.

- High Inflation: Persistent inflation is eroding consumer purchasing power and forcing the Federal Reserve to implement aggressive interest rate hikes, which can stifle economic growth and potentially trigger a recession.

- Weakening Consumer Confidence: Consumer spending is a major driver of the US economy. Declining consumer confidence suggests reduced spending, impacting businesses and potentially leading to further job losses.

- Global Uncertainty: Geopolitical tensions, particularly the war in Ukraine and ongoing trade disputes, are adding to the global economic uncertainty, creating a ripple effect that impacts the US economy.

What Experts Are Saying:

Economists are divided on the likelihood of an immediate recession. Some argue that the current economic slowdown is a necessary correction after a period of rapid growth, while others warn of a more significant downturn. The consensus, however, seems to be that the risk of a recession is significantly higher than it was a year ago. The Federal Reserve's actions will play a crucial role in determining the future trajectory of the economy.

Preparing for Potential Economic Downturn:

While the future remains uncertain, individuals and businesses can take steps to prepare for a potential recession:

- Diversify Investments: Reducing exposure to risk by diversifying investments is crucial.

- Build an Emergency Fund: Having a substantial emergency fund can provide a safety net during periods of economic uncertainty.

- Manage Debt: Reducing debt levels can improve financial resilience.

- Monitor Economic Indicators: Staying informed about key economic indicators can help individuals and businesses make informed decisions.

Conclusion:

The combination of Wall Street's decline, rising inflation, and lingering uncertainty surrounding global events has increased the risk of a recession in the United States. While it's impossible to predict with certainty when or if a recession will occur, the current economic climate demands vigilance and proactive planning. The legacy of the Trump administration's economic policies continues to be debated, with its impact on the current situation remaining a central point of discussion. The coming months will be crucial in determining the future trajectory of the US economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Recession Risk Rises As Wall Street Tanks Under Trump's Shadow. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pc Gamers Prioritize User Generated Content Microtransactions Dominate With 58 Market Share

Apr 22, 2025

Pc Gamers Prioritize User Generated Content Microtransactions Dominate With 58 Market Share

Apr 22, 2025 -

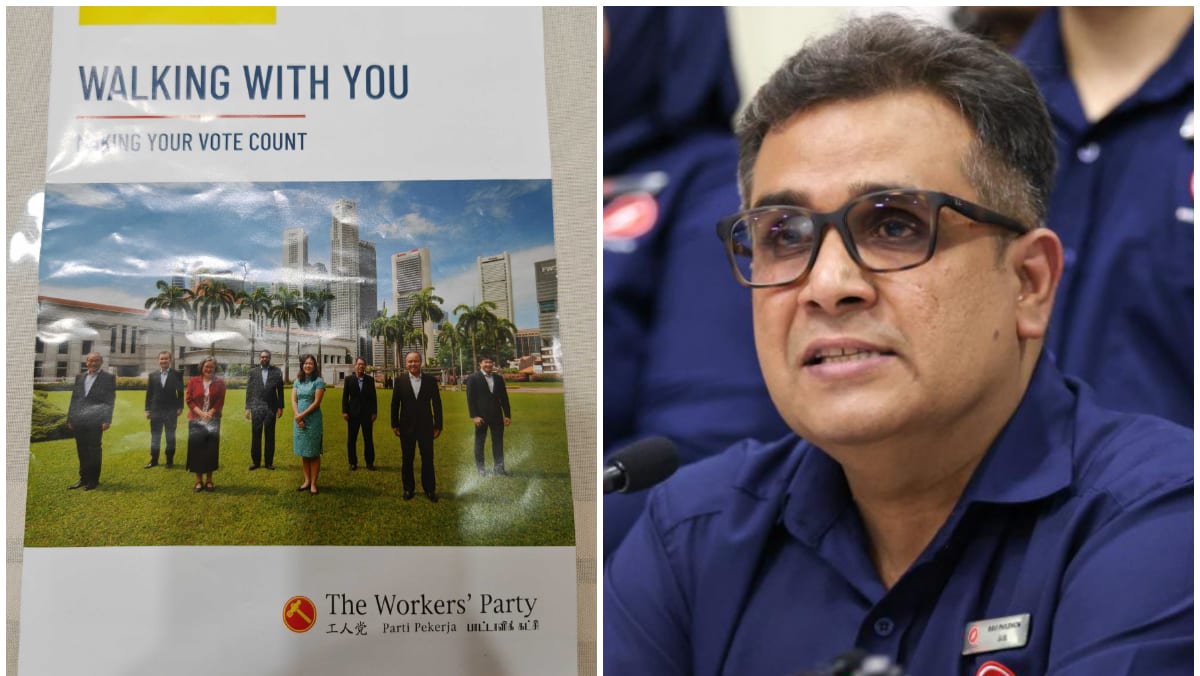

Workers Party To Contest Jalan Kayu Smc In Ge 2025 After Red Dot Uniteds Concession

Apr 22, 2025

Workers Party To Contest Jalan Kayu Smc In Ge 2025 After Red Dot Uniteds Concession

Apr 22, 2025 -

Experience St Georges Day In Hinckley A Community Celebration

Apr 22, 2025

Experience St Georges Day In Hinckley A Community Celebration

Apr 22, 2025 -

Nuggets Fall To Clippers 102 105 In Hard Fought Playoff Game April 21 2025

Apr 22, 2025

Nuggets Fall To Clippers 102 105 In Hard Fought Playoff Game April 21 2025

Apr 22, 2025 -

Ge 2025 Implications Inside The Negotiations To Keep Louis Ng In The Pap

Apr 22, 2025

Ge 2025 Implications Inside The Negotiations To Keep Louis Ng In The Pap

Apr 22, 2025