Reforming The US Tax System: A Strategy For Reducing Debt And Deficits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Reforming the US Tax System: A Strategy for Reducing Debt and Deficits

The United States faces a looming fiscal crisis, burdened by a massive national debt and persistent budget deficits. Experts agree that comprehensive tax reform is crucial to address this challenge, but finding a politically palatable and economically sound solution is proving incredibly difficult. This article explores potential strategies for reforming the US tax system to reduce debt and deficits, examining both the challenges and opportunities involved.

The Current State of US National Debt and Deficits:

The national debt, currently exceeding $31 trillion, represents a significant threat to long-term economic stability. Persistent budget deficits, the annual shortfall between government spending and revenue, contribute directly to this escalating debt. These deficits are driven by a complex interplay of factors, including rising healthcare costs, an aging population, and insufficient tax revenue.

Potential Strategies for Tax Reform:

Several strategies are being debated to reform the US tax system and improve the nation's fiscal health. These include:

1. Broadening the Tax Base: Currently, many high-income individuals and corporations utilize loopholes and deductions to minimize their tax burden. Closing these loopholes and broadening the tax base could significantly increase revenue. This could involve:

- Limiting itemized deductions: Restricting deductions for state and local taxes (SALT) and other high-value deductions could generate substantial revenue.

- Addressing corporate tax avoidance: Strengthening regulations to prevent corporate tax avoidance through strategies like inversions and transfer pricing is vital.

- Raising taxes on capital gains and dividends: Increasing tax rates on capital gains and dividends, which disproportionately benefit high-income earners, could also bolster revenue.

2. Tax Simplification: The current US tax code is notoriously complex, leading to increased compliance costs and opportunities for tax avoidance. Simplifying the tax code through measures like:

- Consolidating tax brackets: Reducing the number of tax brackets could make the system easier to understand and administer.

- Standardizing deductions: Simplifying the itemized deduction system could reduce complexity and improve fairness.

- Implementing a simpler tax form: A more user-friendly tax form could reduce the need for costly tax preparation services.

could improve compliance and reduce administrative burdens.

3. Reforming Healthcare Financing: Healthcare costs are a significant driver of the national debt. Addressing this through reforms like:

- Negotiating drug prices: Allowing Medicare to negotiate drug prices could significantly reduce healthcare spending.

- Expanding coverage: Expanding access to affordable healthcare could reduce the financial burden on individuals and the government.

- Improving efficiency: Implementing measures to reduce administrative costs and improve efficiency within the healthcare system is crucial.

could free up substantial resources for debt reduction.

4. Investing in Infrastructure: While seemingly counterintuitive, strategic investments in infrastructure can boost long-term economic growth, leading to increased tax revenue and ultimately reducing the debt-to-GDP ratio. This requires careful planning and prioritization of projects with high economic returns.

Challenges and Political Considerations:

Implementing significant tax reform faces significant political hurdles. Balancing the need for revenue generation with concerns about fairness and economic competitiveness is a delicate task. Reaching bipartisan consensus on any major tax reform proposal will require considerable political compromise and negotiation.

Conclusion:

Reforming the US tax system is not a simple undertaking. However, addressing the nation's fiscal challenges requires bold action. A combination of strategies, including broadening the tax base, simplifying the tax code, reforming healthcare financing, and strategic infrastructure investment, offers a path toward reducing debt and deficits. The success of any reform will depend on a commitment to finding common ground and prioritizing long-term fiscal sustainability over short-term political gains. The ongoing debate and the eventual legislative outcome will be crucial for the future economic health of the United States.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Reforming The US Tax System: A Strategy For Reducing Debt And Deficits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Small Town Dreams Big Stage Reality Kakinada Boy In Ipl

Mar 30, 2025

Small Town Dreams Big Stage Reality Kakinada Boy In Ipl

Mar 30, 2025 -

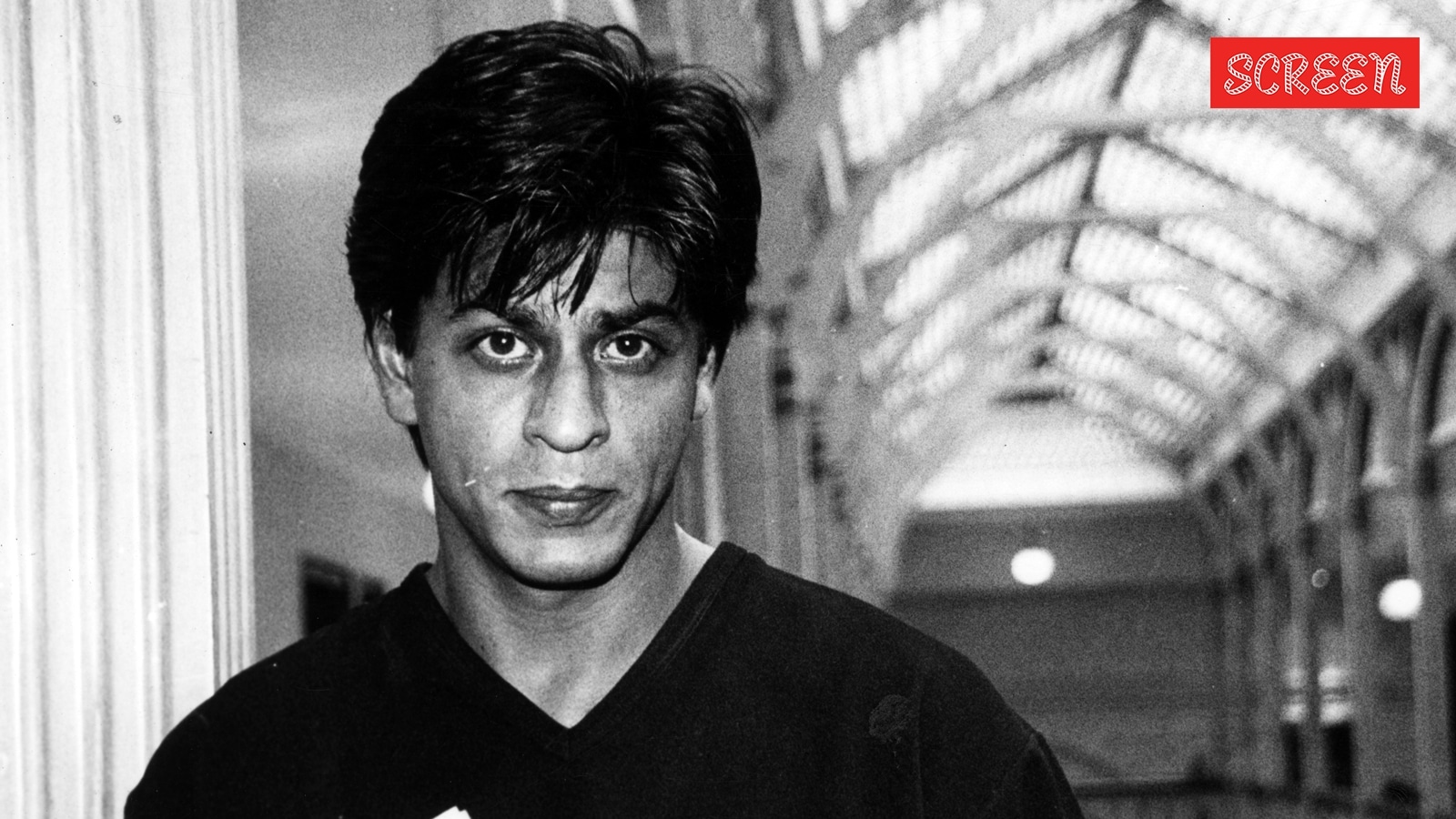

The Mumbai Booing How Shah Rukh Khan Handled Post Kkr Loss Criticism

Mar 30, 2025

The Mumbai Booing How Shah Rukh Khan Handled Post Kkr Loss Criticism

Mar 30, 2025 -

Eintracht Frankfurt Und Marmoush Eine Erfolgreiche Partnerschaft

Mar 30, 2025

Eintracht Frankfurt Und Marmoush Eine Erfolgreiche Partnerschaft

Mar 30, 2025 -

Hope For Yankees Fans Important Relief Pitcher Set For Return

Mar 30, 2025

Hope For Yankees Fans Important Relief Pitcher Set For Return

Mar 30, 2025 -

Upbits 2024 Success Tripled Shareholder Payouts Explained

Mar 30, 2025

Upbits 2024 Success Tripled Shareholder Payouts Explained

Mar 30, 2025