Research Reveals: How Crypto Exchange Hacks Impact Global Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Research Reveals: How Crypto Exchange Hacks Impact Global Markets

The cryptocurrency market, known for its volatility, faces an additional layer of risk: exchange hacks. These breaches, resulting in the theft of millions, even billions, of dollars worth of digital assets, send shockwaves far beyond the immediate victims. New research reveals the surprisingly far-reaching consequences of these attacks on global markets and investor confidence.

The Ripple Effect of Crypto Exchange Hacks

The immediate impact of a major crypto exchange hack is, of course, devastating for the exchange itself and its users. However, the consequences extend far beyond individual losses. Studies show a clear correlation between large-scale hacks and:

-

Decreased Market Capitalization: Following a significant hack, the overall market capitalization of cryptocurrencies often experiences a sharp decline. This is driven by investor fear and uncertainty, leading to mass sell-offs. The recent hack of [insert name of recent significant exchange hack, if applicable, and cite source] serves as a stark example.

-

Price Volatility: The volatility inherent in crypto markets is amplified after a hack. Prices fluctuate wildly as traders react to the news, creating significant risk for both long-term and short-term investors. This instability can impact other financial markets indirectly.

-

Erosion of Trust: Perhaps the most significant long-term impact of exchange hacks is the erosion of trust in the cryptocurrency ecosystem. Potential investors, already hesitant due to the market's inherent risks, become even more wary after witnessing such breaches. This lack of trust hinders the wider adoption of cryptocurrencies.

-

Regulatory Scrutiny: Governments and regulatory bodies worldwide are increasingly paying attention to the security vulnerabilities of cryptocurrency exchanges. Major hacks often trigger calls for stricter regulations, which can stifle innovation and growth within the industry.

Beyond the Immediate Fallout: Long-Term Economic Impacts

The long-term economic implications of crypto exchange hacks are complex and multifaceted. Research suggests that:

-

Reduced Investment: The fear and uncertainty generated by hacks discourage investment in both cryptocurrencies and blockchain technology, hindering the development and growth of the sector.

-

Reputational Damage: The cryptocurrency industry as a whole suffers reputational damage after each major hack. This negative perception makes it harder for legitimate businesses to operate and attract investors.

-

Increased Security Costs: Exchanges are forced to invest heavily in improving their security infrastructure following hacks, increasing operating costs and potentially leading to higher fees for users.

Mitigating the Risk: Strengthening Security Measures

The cryptocurrency industry must prioritize security to maintain stability and attract investment. This includes:

-

Investing in advanced security technologies: Implementing robust multi-factor authentication, cold storage solutions, and advanced threat detection systems are crucial.

-

Regular security audits: Independent security audits should be conducted regularly to identify and address vulnerabilities.

-

Transparency and communication: Exchanges must be transparent about their security measures and promptly communicate any security incidents to users.

-

Collaboration and information sharing: Collaboration between exchanges and cybersecurity experts is essential to share best practices and address emerging threats.

Conclusion:

Crypto exchange hacks are not isolated incidents; they have far-reaching consequences for global markets and investor confidence. Addressing these challenges requires a multi-pronged approach involving stronger security measures, increased regulation, and a commitment to transparency and accountability within the cryptocurrency industry. The future of the cryptocurrency market depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Research Reveals: How Crypto Exchange Hacks Impact Global Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoins Future Ark Invest Forecasts 1 5 M Price With Global Collaboration

Apr 28, 2025

Bitcoins Future Ark Invest Forecasts 1 5 M Price With Global Collaboration

Apr 28, 2025 -

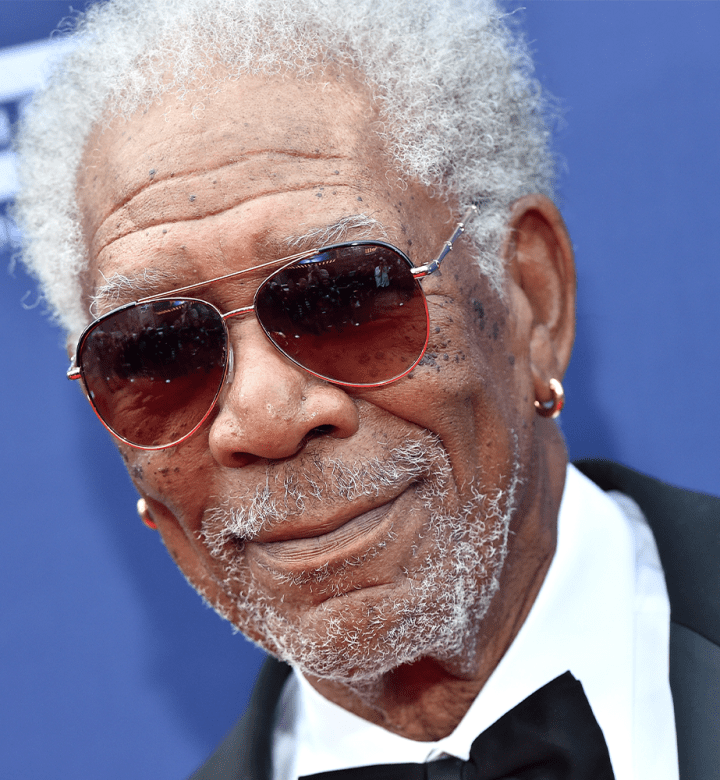

Goosebumps Guaranteed This Morgan Freeman Thriller On Netflix Is A Must Watch

Apr 28, 2025

Goosebumps Guaranteed This Morgan Freeman Thriller On Netflix Is A Must Watch

Apr 28, 2025 -

Whitby Goth Weekend 2024 A Celebration Of Gothic Culture

Apr 28, 2025

Whitby Goth Weekend 2024 A Celebration Of Gothic Culture

Apr 28, 2025 -

Full List Of Winners 2024 National Newspaper Awards In Montreal

Apr 28, 2025

Full List Of Winners 2024 National Newspaper Awards In Montreal

Apr 28, 2025 -

Pap Rally Key Takeaways From Pm Lawrence Wongs Ge 2025 Address

Apr 28, 2025

Pap Rally Key Takeaways From Pm Lawrence Wongs Ge 2025 Address

Apr 28, 2025

Latest Posts

-

Cardanos Ada Crucial Support Holds Implications For 1 Breakout Attempt

Apr 30, 2025

Cardanos Ada Crucial Support Holds Implications For 1 Breakout Attempt

Apr 30, 2025 -

Al Ahli And Al Hilal Analyzing The Decisive Battles In The Acl

Apr 30, 2025

Al Ahli And Al Hilal Analyzing The Decisive Battles In The Acl

Apr 30, 2025 -

Analyzing Kvaratskhelias Impact How Kvaradona Transformed Psg

Apr 30, 2025

Analyzing Kvaratskhelias Impact How Kvaradona Transformed Psg

Apr 30, 2025 -

Interview Khvicha Kvaratskhelia On Adapting To Psg Luis Enriques Coaching Style And Team Dynamics

Apr 30, 2025

Interview Khvicha Kvaratskhelia On Adapting To Psg Luis Enriques Coaching Style And Team Dynamics

Apr 30, 2025 -

Psps Poa Highlights Declining Public Confidence In Pap Ahead Of Ge 2025

Apr 30, 2025

Psps Poa Highlights Declining Public Confidence In Pap Ahead Of Ge 2025

Apr 30, 2025