Reserve Bank Holds Interest Rates: April Decision Leaves Households Struggling

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Reserve Bank Holds Interest Rates: April Decision Leaves Households Struggling

The Reserve Bank of Australia (RBA) has once again opted to hold the official cash rate steady at 3.6 percent, a decision announced this April that has left many Australian households grappling with the ongoing cost of living crisis. While the pause offers a temporary reprieve from further rate hikes, the lingering high interest rates continue to place significant pressure on mortgage holders and renters alike.

This decision, while seemingly offering stability, marks a complex economic landscape. The RBA's statement highlighted a need to assess the impact of previous increases, suggesting a cautious approach to future monetary policy. However, for many Australians, the current rate remains a substantial burden.

The Impact on Households:

The sustained high interest rates are impacting Australians in several key ways:

- Mortgage Stress: Homeowners with variable-rate mortgages are facing significantly increased monthly repayments, leaving less disposable income for essential expenses. Many are forced to cut back on discretionary spending, impacting local businesses and the wider economy. Mortgage stress is becoming a significant social and economic concern.

- Rental Crisis Exacerbated: Higher interest rates often translate to increased rental costs, as landlords pass on their increased borrowing expenses to tenants. This further intensifies the already dire rental market across Australia, leaving many vulnerable to housing insecurity.

- Reduced Consumer Spending: With less money available after meeting essential expenses, consumer spending is slowing down. This impacts businesses' revenue and could potentially lead to job losses in some sectors.

Expert Opinions and Market Reactions:

Economists offer varied perspectives on the RBA's decision. Some argue that the pause is necessary to assess the lagging effects of previous rate hikes on inflation and the broader economy. Others believe that further reductions are needed to stimulate economic growth and alleviate the pressure on struggling households. The market's reaction has been mixed, with some analysts predicting further rate cuts in the coming months while others remain cautious.

Looking Ahead: What's Next for Interest Rates?

The RBA's future moves remain uncertain. The upcoming months will be crucial in assessing the effectiveness of the current rate and the trajectory of inflation. Key factors to watch include:

- Inflation data: The rate of inflation will be a key determinant in the RBA's future decisions. Any signs of persistent inflation could lead to further rate hikes.

- Wage growth: Strong wage growth could fuel inflationary pressures, potentially prompting the RBA to act.

- Unemployment figures: Rising unemployment could indicate a weakening economy, potentially leading to rate cuts.

The RBA's April decision to hold interest rates steady provides temporary relief, but the ongoing challenges faced by Australian households remain significant. The coming months will be critical in determining the next steps in monetary policy and their impact on the Australian economy and its citizens. The situation requires careful monitoring and proactive strategies from both the government and financial institutions to support those most vulnerable to the current economic climate. The struggle is real, and the future remains uncertain for many Australian families.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Reserve Bank Holds Interest Rates: April Decision Leaves Households Struggling. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nuggets Vs Thunder Live Score Update May 7 2025

May 08, 2025

Nuggets Vs Thunder Live Score Update May 7 2025

May 08, 2025 -

Okc Thunders Jaylin Williams Performance And Potential For The Future

May 08, 2025

Okc Thunders Jaylin Williams Performance And Potential For The Future

May 08, 2025 -

Russell Westbrook Trade Will The Nuggets Gamble Pay Off Against The Thunder

May 08, 2025

Russell Westbrook Trade Will The Nuggets Gamble Pay Off Against The Thunder

May 08, 2025 -

Final Destination Bloodlines Shatters Gore Record With Unprecedented Body Count

May 08, 2025

Final Destination Bloodlines Shatters Gore Record With Unprecedented Body Count

May 08, 2025 -

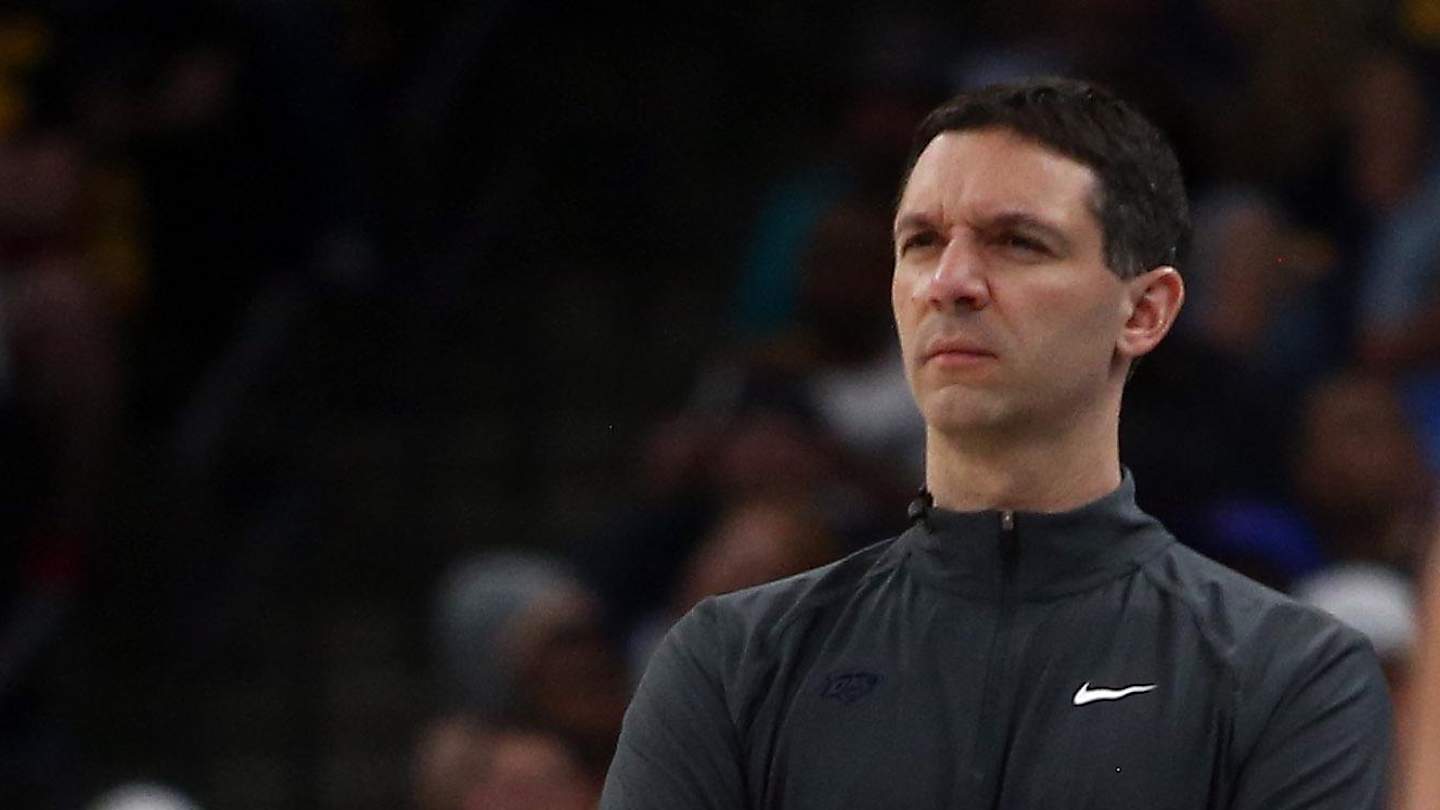

Mark Daigneault Discusses Strategic Fouling And 3 Point Shooting Probabilities

May 08, 2025

Mark Daigneault Discusses Strategic Fouling And 3 Point Shooting Probabilities

May 08, 2025

Latest Posts

-

2025 Nba Season Nuggets Thunder Game Summary May 5th

May 08, 2025

2025 Nba Season Nuggets Thunder Game Summary May 5th

May 08, 2025 -

Digital Taste The Technology Of Recording And Replicating Flavor

May 08, 2025

Digital Taste The Technology Of Recording And Replicating Flavor

May 08, 2025 -

Wordle May 7 1418 Nyt Game Solution And Helpful Hints

May 08, 2025

Wordle May 7 1418 Nyt Game Solution And Helpful Hints

May 08, 2025 -

Final Destination Bloodlines Shatters Gory World Record

May 08, 2025

Final Destination Bloodlines Shatters Gory World Record

May 08, 2025 -

Celtics Fall To Knicks In Game 2 20 Point Comeback Seals 2 0 Series Deficit

May 08, 2025

Celtics Fall To Knicks In Game 2 20 Point Comeback Seals 2 0 Series Deficit

May 08, 2025