Retail Investor Fear Of Missing Out Ignites Bitcoin's Renewed Bull Run

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Retail Investor Fear of Missing Out Ignites Bitcoin's Renewed Bull Run

Bitcoin's price has surged in recent weeks, leaving many wondering about the driving force behind this renewed bull run. While several factors are at play, the palpable fear of missing out (FOMO) among retail investors is undeniably a significant contributor. This surge highlights the potent influence of market sentiment and the enduring appeal of Bitcoin as a volatile yet potentially lucrative investment.

The FOMO Factor: A Powerful Market Driver

The cryptocurrency market is inherently volatile, characterized by dramatic price swings. These fluctuations often trigger emotional responses from investors. When Bitcoin's price begins to climb, a sense of urgency – FOMO – can grip retail investors who fear being left behind. This collective rush to buy fuels further price increases, creating a self-reinforcing cycle. This recent surge is a prime example of this phenomenon in action. Social media platforms are buzzing with discussions about Bitcoin's potential, further amplifying the FOMO effect and driving more investment.

Beyond FOMO: Other Contributing Factors

While FOMO is a powerful catalyst, it's not the sole driver of Bitcoin's recent price increase. Several other factors are contributing to the bullish sentiment:

-

Institutional Adoption: Continued adoption of Bitcoin by major financial institutions lends credibility to the cryptocurrency and boosts investor confidence. This institutional interest helps to stabilize the market and attract a broader range of investors.

-

Macroeconomic Uncertainty: Global economic instability and inflation concerns are pushing investors towards alternative assets, including Bitcoin, which is often perceived as a hedge against inflation.

-

Technological Developments: Ongoing advancements in Bitcoin's underlying technology, such as the Lightning Network for faster and cheaper transactions, also contribute to positive sentiment.

-

Regulatory Clarity (in some regions): Increased regulatory clarity in certain jurisdictions is making Bitcoin more accessible and attractive to investors who previously hesitated due to uncertainty.

Understanding the Risks:

It's crucial to remember that investing in Bitcoin carries significant risks. The cryptocurrency market is notoriously volatile, and prices can plummet as quickly as they rise. FOMO-driven investments, particularly without thorough research and risk assessment, can lead to substantial financial losses. Before investing in Bitcoin or any other cryptocurrency, it's vital to:

- Conduct thorough research: Understand the technology, market dynamics, and inherent risks associated with Bitcoin.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversify your investments to mitigate risk.

- Only invest what you can afford to lose: Never invest money you cannot afford to lose completely.

The Future of Bitcoin:

Predicting the future price of Bitcoin is impossible. While the current bull run is fueled by FOMO and other factors, the long-term trajectory of Bitcoin remains uncertain. Continued institutional adoption, technological advancements, and regulatory developments will likely play a significant role in shaping Bitcoin's future. However, investors should always approach the market with caution and a realistic understanding of the inherent volatility.

Keywords: Bitcoin, Bitcoin price, bull run, cryptocurrency, FOMO, fear of missing out, retail investors, institutional adoption, macroeconomic uncertainty, regulatory clarity, investment risk, cryptocurrency investment, volatile market, Bitcoin price surge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Retail Investor Fear Of Missing Out Ignites Bitcoin's Renewed Bull Run. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solve The Wordle Answer And Hints For May 13 2025

May 16, 2025

Solve The Wordle Answer And Hints For May 13 2025

May 16, 2025 -

Confirmed Lineups And Injury Report Chelsea Vs Manchester United

May 16, 2025

Confirmed Lineups And Injury Report Chelsea Vs Manchester United

May 16, 2025 -

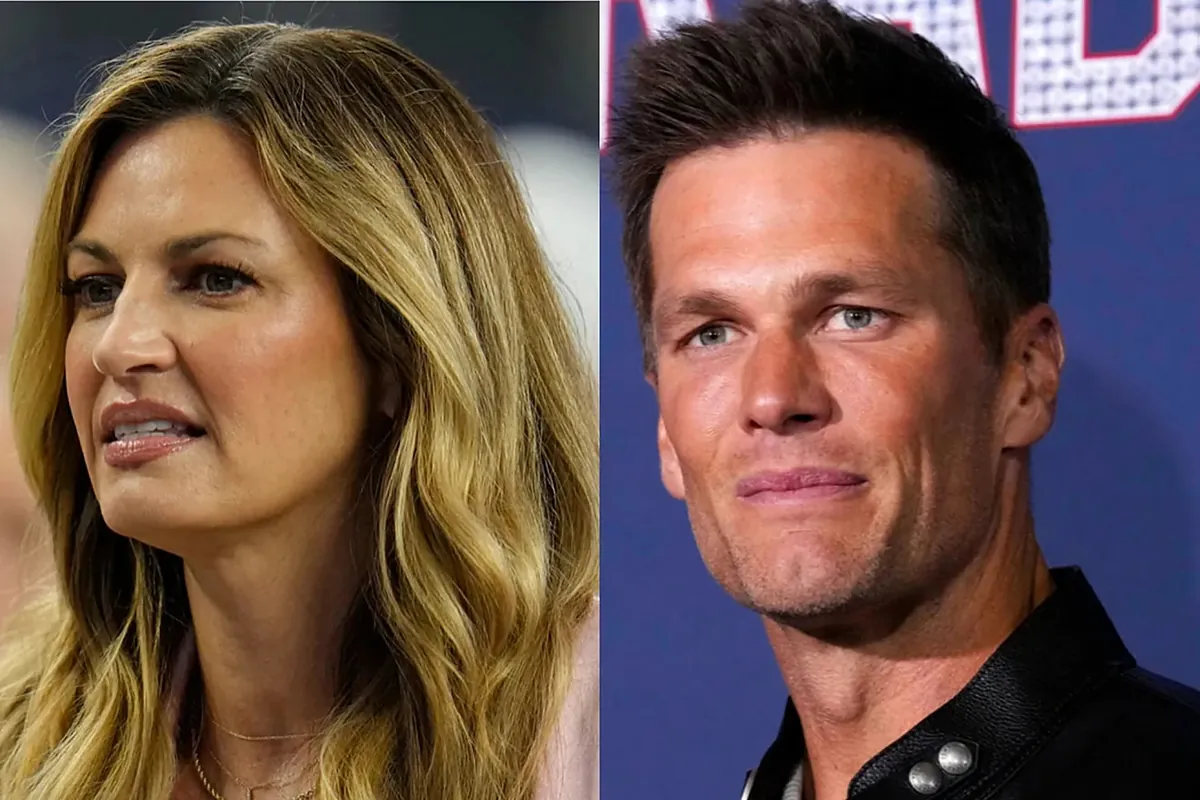

Surprise Erin Andrews Post Fox Career Takes An Interesting Turn With Tom Brady

May 16, 2025

Surprise Erin Andrews Post Fox Career Takes An Interesting Turn With Tom Brady

May 16, 2025 -

2025 Price Prediction For The Artificial Superintelligence Alliance Breakout Or Bust

May 16, 2025

2025 Price Prediction For The Artificial Superintelligence Alliance Breakout Or Bust

May 16, 2025 -

Ryan Foxs Myrtle Beach Classic Victory A Pga Championship Win For New Zealand

May 16, 2025

Ryan Foxs Myrtle Beach Classic Victory A Pga Championship Win For New Zealand

May 16, 2025