Retail Sector Slump Forces RBA To Consider Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Retail Sector Slump Forces RBA to Consider Rate Cut

Australia's struggling retail sector is pushing the Reserve Bank of Australia (RBA) to seriously consider a rate cut, potentially as early as the next meeting. The recent slump in retail sales figures has sparked widespread concern, signaling a potential slowdown in the broader economy. This unexpected downturn is forcing the RBA to re-evaluate its monetary policy stance, raising questions about the future direction of interest rates.

The Australian Bureau of Statistics (ABS) released worrying data last week showing a significant decline in retail sales for [Month, Year]. This follows a [Number]% drop in [Previous Month], painting a bleak picture for the sector. Economists are now scrambling to understand the underlying causes of this sharp decline, with several factors contributing to the slowdown.

Factors Contributing to the Retail Slump

Several key factors are believed to be driving the retail sector's downturn:

- High Inflation: Persistent high inflation continues to erode consumer spending power. Rising costs for essential goods and services leave less disposable income for discretionary purchases, impacting retail sales significantly. This is particularly impacting lower-income households.

- Increased Interest Rates: The RBA's previous interest rate hikes, aimed at curbing inflation, have increased borrowing costs for consumers and businesses. This has led to reduced consumer confidence and a reluctance to take on new debt, further dampening retail spending.

- Cost of Living Crisis: The combined effect of high inflation and increased interest rates has created a significant cost of living crisis for many Australians. This forces households to prioritize essential spending, leaving little room for non-essential retail purchases.

- Global Economic Uncertainty: Global economic headwinds, including geopolitical instability and concerns about a potential recession, are also contributing to uncertainty in the Australian market, impacting consumer confidence and spending habits.

RBA's Dilemma: Rate Cut or Further Observation?

The RBA now faces a critical decision. While previous rate hikes aimed to control inflation, the sharp decline in retail sales suggests the economy may be more vulnerable than initially anticipated. A rate cut could stimulate the economy by making borrowing cheaper and boosting consumer spending. However, reducing rates too soon could fuel inflation further, exacerbating the existing economic challenges.

The RBA Governor, Philip Lowe, has indicated that the central bank is closely monitoring the situation and will assess all available data before making any decisions. The upcoming RBA meeting in [Month, Date] will be crucial, with market analysts closely watching for any indication of a potential rate cut.

What Does This Mean for Consumers and Businesses?

The current situation creates uncertainty for both consumers and businesses. Consumers may see some relief if interest rates are cut, potentially boosting spending power. However, the long-term impact will depend on the effectiveness of the RBA's policy response and the broader global economic outlook. Businesses, particularly in the retail sector, face a challenging period, needing to adapt to changing consumer spending habits and potentially prepare for further economic slowdown.

Looking Ahead: Uncertainty Remains

The future remains uncertain. While a rate cut is a possibility, the RBA's decision will depend on a careful weighing of the risks. The ongoing impact of inflation, the strength of the labor market, and global economic conditions will all play a significant role in shaping the RBA's monetary policy decisions in the coming months. The situation will require close monitoring from consumers, businesses, and economists alike. Further updates will follow as the RBA makes its announcement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Retail Sector Slump Forces RBA To Consider Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Behind The Scenes Of Final Destination Bloodlines The Controversial Oldest Person On Fire Scene

May 08, 2025

Behind The Scenes Of Final Destination Bloodlines The Controversial Oldest Person On Fire Scene

May 08, 2025 -

Denver Nuggets Shock Oklahoma City Thunder Jokics 42 Point Masterclass

May 08, 2025

Denver Nuggets Shock Oklahoma City Thunder Jokics 42 Point Masterclass

May 08, 2025 -

Australian Households Bear Brunt Reserve Banks April Interest Rate Decision Analyzed

May 08, 2025

Australian Households Bear Brunt Reserve Banks April Interest Rate Decision Analyzed

May 08, 2025 -

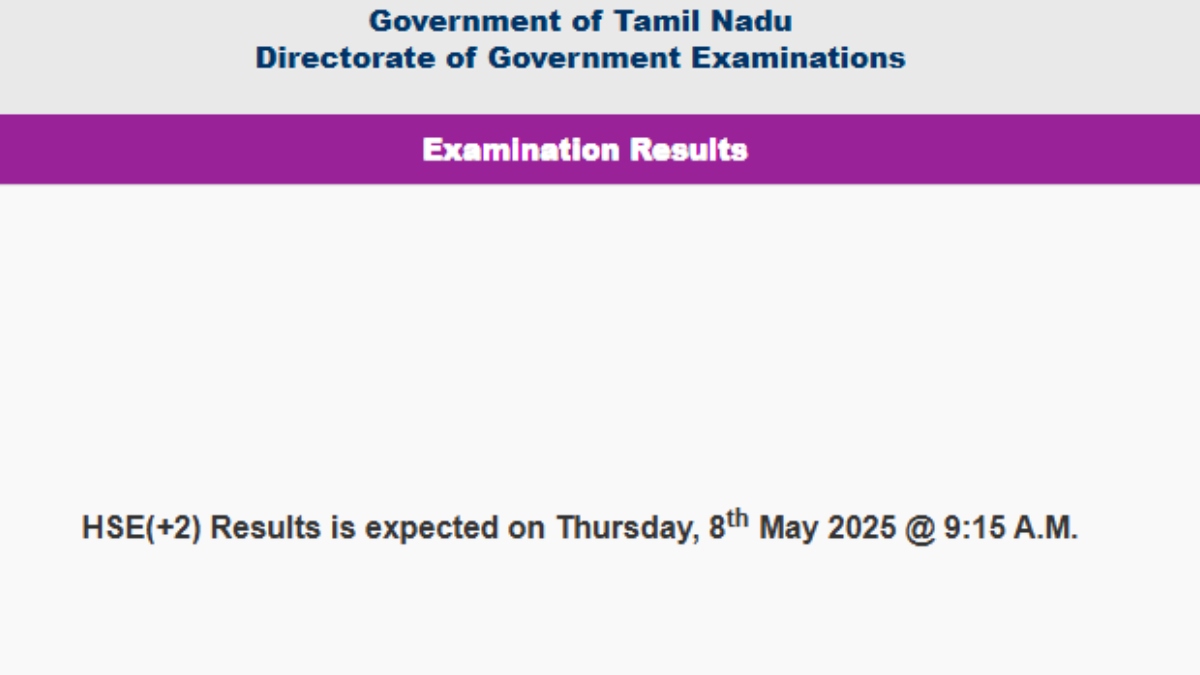

Tn 12th 2 Results 2025 Live Updates Dge Tn Gov In And Tnresults Nic In

May 08, 2025

Tn 12th 2 Results 2025 Live Updates Dge Tn Gov In And Tnresults Nic In

May 08, 2025 -

Oklahoma City Thunder Jaylin Williams Performance And Future Role

May 08, 2025

Oklahoma City Thunder Jaylin Williams Performance And Future Role

May 08, 2025

Latest Posts

-

Knicks Vs Celtics May 7 2025 Game Recap And Box Score

May 08, 2025

Knicks Vs Celtics May 7 2025 Game Recap And Box Score

May 08, 2025 -

Final Destination Bloodlines A New Level Of Gore In The Horror Sequel

May 08, 2025

Final Destination Bloodlines A New Level Of Gore In The Horror Sequel

May 08, 2025 -

Is This Modular Mini Pc A Bad Investment A Detailed Analysis

May 08, 2025

Is This Modular Mini Pc A Bad Investment A Detailed Analysis

May 08, 2025 -

Houthi Group Ceases Fire In Yemen Trumps Announcement

May 08, 2025

Houthi Group Ceases Fire In Yemen Trumps Announcement

May 08, 2025 -

May 7 2025 Knicks Celtics Game Box Score Playoff Showdown

May 08, 2025

May 7 2025 Knicks Celtics Game Box Score Playoff Showdown

May 08, 2025