Retail Slump Forces RBA's Hand: Interest Rate Cut Imminent?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Retail Slump Forces RBA's Hand: Interest Rate Cut Imminent?

Australia's struggling retail sector is putting immense pressure on the Reserve Bank of Australia (RBA) to deliver an interest rate cut, with economists and analysts increasingly predicting a move in the coming months. The recent spate of disappointing retail sales figures paints a concerning picture of consumer spending, a key driver of the Australian economy. Could a rate cut be the lifeline the economy needs, or is it a risky gamble with potentially unforeseen consequences?

Weak Retail Sales Fuel Speculation

The latest retail sales data has been significantly weaker than anticipated, revealing a concerning slowdown in consumer spending. This downturn isn't just a blip; it reflects a broader trend of cautious consumer behaviour, influenced by factors including high inflation, rising cost of living, and subdued wage growth. This prolonged period of sluggish retail performance is raising alarm bells within the RBA, highlighting the need for decisive action.

RBA's Tightrope Walk: Inflation vs. Growth

The RBA faces a difficult balancing act. While inflation remains stubbornly high, necessitating a cautious approach to monetary policy, the persistent weakness in retail sales signals a significant risk to economic growth. Cutting interest rates could stimulate spending and boost economic activity, but it also risks further fueling inflation. The central bank must carefully weigh these competing concerns before making a decision.

Expert Opinions Divided: Rate Cut or Hold?

Economists are divided on the likelihood and timing of a rate cut. Some argue that a rate cut is essential to prevent a more significant economic slowdown, emphasizing the importance of supporting consumer spending. They highlight the potential for a vicious cycle: weak retail sales leading to business closures, job losses, and further dampening consumer confidence. Others maintain that inflation remains the primary concern and advocate for a wait-and-see approach, suggesting that further rate cuts could exacerbate inflationary pressures.

- Arguments for a Rate Cut: Stimulate consumer spending, boost economic growth, prevent a deeper recession.

- Arguments Against a Rate Cut: Risk of further inflation, potential for asset price bubbles.

Impact of a Potential Rate Cut on Consumers and Businesses

A rate cut would likely provide some relief to borrowers, reducing monthly mortgage repayments and potentially freeing up disposable income for spending. Businesses, particularly those in the retail sector, could see an increase in consumer demand. However, the benefits might be limited if inflation remains high, eroding the real value of any gains.

Looking Ahead: What to Expect

The RBA's next meeting will be keenly watched by markets and the public alike. While a rate cut is not guaranteed, the deteriorating retail sales figures significantly increase the probability. The central bank will need to carefully consider all the factors at play before making a decision that could have far-reaching consequences for the Australian economy. The coming weeks and months will be crucial in determining the direction of monetary policy and the future trajectory of the Australian economy. Stay tuned for further updates as the situation unfolds.

Keywords: RBA, Reserve Bank of Australia, interest rate cut, interest rates Australia, retail sales, Australian economy, inflation, consumer spending, economic growth, monetary policy, economic slowdown, recession, mortgage repayments, borrowing costs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Retail Slump Forces RBA's Hand: Interest Rate Cut Imminent?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

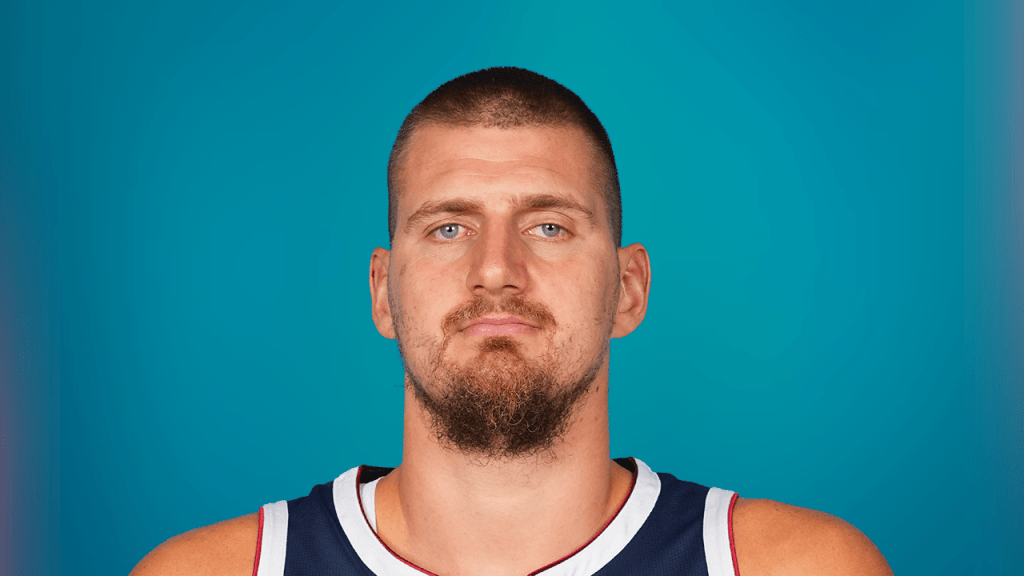

Jokics 42 Points Lead Nuggets To Upset Victory Over Thunder In Nba Playoffs

May 08, 2025

Jokics 42 Points Lead Nuggets To Upset Victory Over Thunder In Nba Playoffs

May 08, 2025 -

Us Campaign Intensifies Pressure Mounts For Release Of Detained Georgetown Scholar

May 08, 2025

Us Campaign Intensifies Pressure Mounts For Release Of Detained Georgetown Scholar

May 08, 2025 -

Tatums Game 1 Performance A Turning Point For The Boston Celtics

May 08, 2025

Tatums Game 1 Performance A Turning Point For The Boston Celtics

May 08, 2025 -

Indias Op Sindoor Pakistan Ministers On Air Denial Of Terrorist Training Camps Met With Sharp Rebuttal

May 08, 2025

Indias Op Sindoor Pakistan Ministers On Air Denial Of Terrorist Training Camps Met With Sharp Rebuttal

May 08, 2025 -

International Pressure Mounts Release Of Detained Georgetown Scholar Urged

May 08, 2025

International Pressure Mounts Release Of Detained Georgetown Scholar Urged

May 08, 2025

Latest Posts

-

Jokic Laughs Off Free Throw Merchant Taunts From Opposing Fans

May 09, 2025

Jokic Laughs Off Free Throw Merchant Taunts From Opposing Fans

May 09, 2025 -

Bluey And The Battle Against Trumps Tariffs Rudds Stand For Australian Film

May 09, 2025

Bluey And The Battle Against Trumps Tariffs Rudds Stand For Australian Film

May 09, 2025 -

Josh Hartnetts Fight Or Flight A 40 Year Olds Return To Action Stunts

May 09, 2025

Josh Hartnetts Fight Or Flight A 40 Year Olds Return To Action Stunts

May 09, 2025 -

Political Commentary In Andor The Impact Of Naming The Genocide

May 09, 2025

Political Commentary In Andor The Impact Of Naming The Genocide

May 09, 2025 -

Black Rock Bitcoin Etf Dominates 530 Million Inflows Eth Funds Steady

May 09, 2025

Black Rock Bitcoin Etf Dominates 530 Million Inflows Eth Funds Steady

May 09, 2025