Ripple's $1.5T Utility: A Deep Dive Into The Ongoing Legal And Market Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ripple's $1.5T Utility: A Deep Dive into the Ongoing Legal and Market Implications

Ripple Labs, the company behind the XRP cryptocurrency, finds itself at the center of a multifaceted storm. The ongoing SEC lawsuit, while dominating headlines, overshadows a crucial aspect of Ripple's potential: its claimed $1.5 trillion utility within the global financial system. This article delves into the complexities of this claim, exploring the legal battles and their profound implications for the XRP market and the broader cryptocurrency landscape.

The SEC Lawsuit: A Defining Moment

The Securities and Exchange Commission (SEC) lawsuit against Ripple alleges that XRP is an unregistered security. This legal battle is far from over, and its outcome will significantly impact the future of XRP and how other cryptocurrencies are regulated. A favorable ruling for Ripple could set a precedent, potentially opening the door for wider cryptocurrency adoption. Conversely, an unfavorable ruling could stifle innovation and lead to stricter regulations across the board.

Ripple's $1.5 Trillion Claim: Fact or Fiction?

Ripple often highlights the potential of its technology to revolutionize cross-border payments. They point to XRP's speed, efficiency, and low transaction costs as key advantages over traditional systems. The $1.5 trillion figure represents the estimated total addressable market for cross-border payments, suggesting Ripple's ambition to capture a significant portion of this massive sector.

However, critics argue that this figure is overly optimistic and doesn't account for the intense competition from other players in the fintech space, including established financial institutions and other cryptocurrency projects. The actual market share Ripple can capture remains a subject of debate.

Market Implications: Volatility and Uncertainty

The legal uncertainty surrounding XRP has created significant volatility in its price. Investors remain hesitant, with price movements often mirroring developments in the lawsuit. This volatility underscores the risk associated with investing in cryptocurrencies, particularly those embroiled in regulatory battles.

Beyond the Lawsuit: Ripple's Technological Advancements

Despite the legal challenges, Ripple continues to innovate. Their focus on enterprise solutions and partnerships with financial institutions demonstrates a commitment to building a sustainable ecosystem. Their technology's potential to streamline international transactions remains a key driver of interest, even amidst the ongoing legal uncertainty.

Potential Outcomes and Future Predictions:

Several scenarios could unfold:

- SEC Victory: A ruling in favor of the SEC could severely impact XRP's price and potentially lead to stricter regulations on other cryptocurrencies. This could dampen innovation and limit the growth of the crypto market.

- Ripple Victory: A win for Ripple could boost XRP's price dramatically and potentially lead to increased adoption. This could positively influence the entire cryptocurrency market, fostering greater trust and investment.

- Settlement: A negotiated settlement could offer a middle ground, potentially involving certain restrictions on XRP's use or a commitment to stricter compliance measures. This outcome would likely cause some market fluctuations but potentially less dramatic than a definitive win or loss.

Conclusion: Navigating the Uncharted Waters

The future of XRP and its potential $1.5 trillion utility remains uncertain, heavily reliant on the outcome of the SEC lawsuit. While the legal battle dominates the narrative, it's crucial to consider Ripple's technological advancements and their potential to disrupt the global financial landscape. Investors and industry observers must navigate this uncertainty carefully, weighing the potential rewards against the considerable risks involved. The ongoing saga serves as a stark reminder of the regulatory challenges facing the cryptocurrency industry and the need for clearer, more consistent regulatory frameworks globally.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ripple's $1.5T Utility: A Deep Dive Into The Ongoing Legal And Market Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rajasthan Royals Bolstered Sanju Samson Recovers Joins Squad For Ipl 2025

Mar 18, 2025

Rajasthan Royals Bolstered Sanju Samson Recovers Joins Squad For Ipl 2025

Mar 18, 2025 -

Mel Taylor Reports Ticketmasters Buy One Get One Concert Deal

Mar 18, 2025

Mel Taylor Reports Ticketmasters Buy One Get One Concert Deal

Mar 18, 2025 -

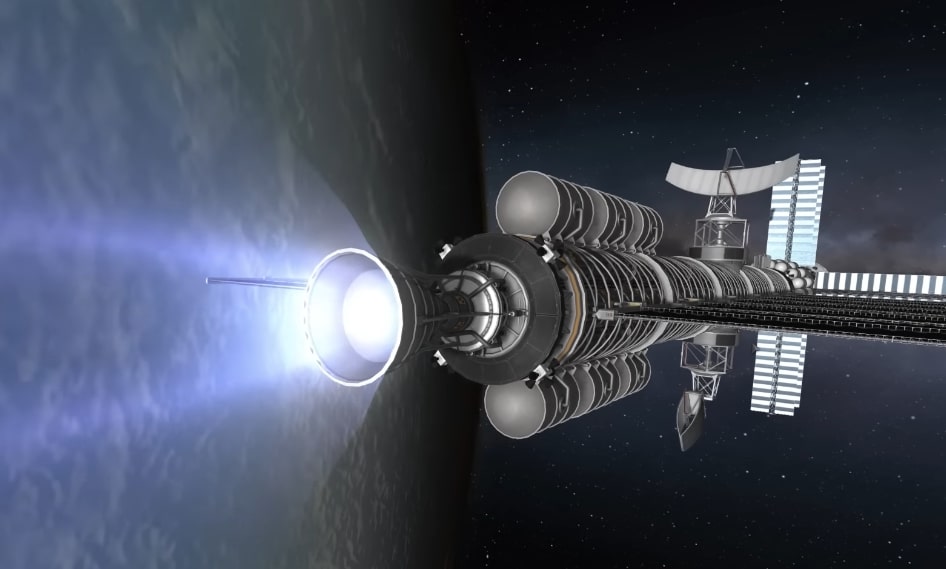

Nuclear Saltwater Rocket Propulsion A Realistic Path To Faster Than Ever Space Travel

Mar 18, 2025

Nuclear Saltwater Rocket Propulsion A Realistic Path To Faster Than Ever Space Travel

Mar 18, 2025 -

Atalanta Coach Gasperini On Inter Match Edersons Red Card A Decisive Factor

Mar 18, 2025

Atalanta Coach Gasperini On Inter Match Edersons Red Card A Decisive Factor

Mar 18, 2025 -

Fear And Snow White Actor Comments On Disneys Premiere Pivot

Mar 18, 2025

Fear And Snow White Actor Comments On Disneys Premiere Pivot

Mar 18, 2025

Latest Posts

-

Ms Vs Qg Live Score Todays Psl Match Updates Playing Xi And Toss Result

Apr 30, 2025

Ms Vs Qg Live Score Todays Psl Match Updates Playing Xi And Toss Result

Apr 30, 2025 -

Criminal Ips Threat Intelligence Platform A Spotlight At Rsac 2025

Apr 30, 2025

Criminal Ips Threat Intelligence Platform A Spotlight At Rsac 2025

Apr 30, 2025 -

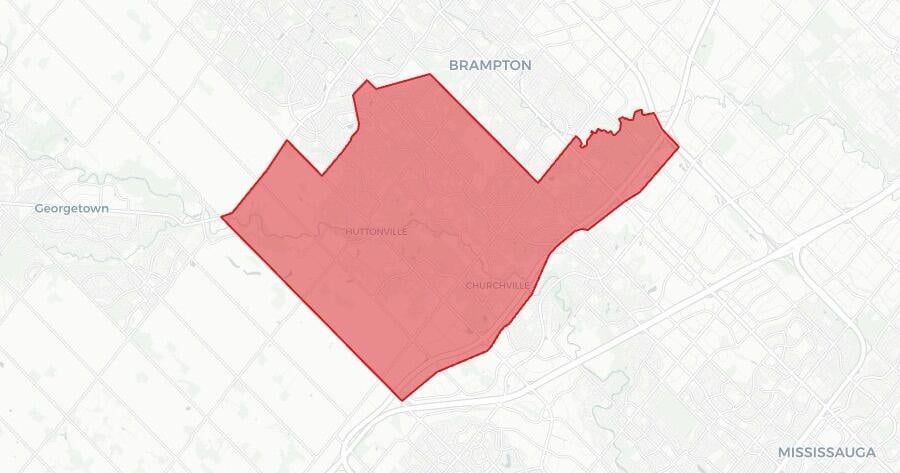

Federal Election Results Brampton South Constituency Breakdown And Analysis

Apr 30, 2025

Federal Election Results Brampton South Constituency Breakdown And Analysis

Apr 30, 2025 -

Tucson Area Evacuated As Wind Driven Wildfire Rapidly Spreads

Apr 30, 2025

Tucson Area Evacuated As Wind Driven Wildfire Rapidly Spreads

Apr 30, 2025 -

Web3 Gaming Evolution Engines Of Fury And Treeverses Latest Developments

Apr 30, 2025

Web3 Gaming Evolution Engines Of Fury And Treeverses Latest Developments

Apr 30, 2025