Ripple's $1.5T Utility Case: Examining The Arguments Amidst Regulatory Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ripple's $1.5 Trillion Utility Case: Examining the Arguments Amidst Regulatory Uncertainty

The cryptocurrency world is buzzing with Ripple's ambitious claim of a $1.5 trillion utility case for XRP. This bold assertion, made amidst ongoing regulatory uncertainty surrounding the token, has sparked intense debate within the crypto community and beyond. But is this valuation realistic? Let's delve into the arguments and dissect the challenges Ripple faces in proving its case.

The Core Argument: XRP as a Bridge Currency for Global Payments

Ripple's central argument rests on XRP's utility within its On-Demand Liquidity (ODL) system. This system facilitates faster and cheaper cross-border payments for financial institutions by leveraging XRP as a bridge currency. Instead of relying on traditional correspondent banking relationships, which are slow and expensive, ODL uses XRP to instantly settle transactions, significantly reducing costs and processing times. This, Ripple argues, positions XRP for massive adoption within the global financial system, a market estimated to be worth trillions.

Evidence Presented by Ripple:

Ripple has presented various data points to support its $1.5 trillion valuation. This includes:

- Growing ODL Adoption: The company highlights the increasing number of financial institutions using ODL, showcasing its expanding global reach and network effects.

- Transaction Volume and Velocity: Data on XRP transaction volume and velocity are presented as indicators of growing demand and utility within the ODL system.

- Market Potential of Cross-Border Payments: Ripple emphasizes the enormous size of the global payments market, highlighting the potential for substantial XRP adoption and value appreciation.

Challenges and Counterarguments:

While Ripple's claims are ambitious, several factors cast doubt on the $1.5 trillion valuation:

- Regulatory Uncertainty: The ongoing SEC lawsuit against Ripple significantly impacts XRP's market value and future adoption. A negative outcome could severely cripple the project and its valuation. This regulatory uncertainty makes long-term projections highly speculative.

- Competition in the Cross-Border Payments Space: Ripple faces stiff competition from other players in the cross-border payments space, including established financial institutions, fintech companies, and other blockchain projects. This competition could limit XRP's market share.

- XRP's Decentralization: Critics question XRP's true decentralization, suggesting Ripple's significant control over the token's supply and distribution raises concerns about its long-term viability as a truly decentralized asset.

H2: The $1.5 Trillion Question: Is it Achievable?

The $1.5 trillion valuation for Ripple's utility case is undoubtedly ambitious and faces significant hurdles. While the potential of ODL for streamlining global payments is undeniable, the regulatory environment and intense competition present major challenges. The SEC lawsuit looms large, casting a long shadow over any future projections.

H3: What the Future Holds:

The ultimate success of Ripple's argument hinges on several factors:

- Resolution of the SEC Lawsuit: A favorable outcome could unlock significant growth for XRP and bolster its adoption.

- Continued ODL Adoption: Maintaining and accelerating the adoption rate of ODL by financial institutions is crucial for Ripple's success.

- Addressing Decentralization Concerns: Increasing XRP's decentralization could alleviate concerns about Ripple's influence and enhance its appeal to a wider audience.

Ultimately, whether Ripple's $1.5 trillion valuation will materialize remains to be seen. The future of XRP and its utility within the global payments landscape is inextricably linked to the resolution of regulatory challenges and the continued success of its ODL system in a highly competitive market. Only time will tell if this ambitious claim can become a reality.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ripple's $1.5T Utility Case: Examining The Arguments Amidst Regulatory Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Good News Aaron Gordon Expected To Play Monday Despite Calf Ankle Issue

Mar 18, 2025

Good News Aaron Gordon Expected To Play Monday Despite Calf Ankle Issue

Mar 18, 2025 -

Mars Exploration Mappings Crucial Role In Scientific Discovery

Mar 18, 2025

Mars Exploration Mappings Crucial Role In Scientific Discovery

Mar 18, 2025 -

Australian Entertainment Industry Shaken Analyzing The Village Roadshow Collapse

Mar 18, 2025

Australian Entertainment Industry Shaken Analyzing The Village Roadshow Collapse

Mar 18, 2025 -

Perusahaan Besar Pembagi Dividen Panduan Investasi Saham Menguntungkan

Mar 18, 2025

Perusahaan Besar Pembagi Dividen Panduan Investasi Saham Menguntungkan

Mar 18, 2025 -

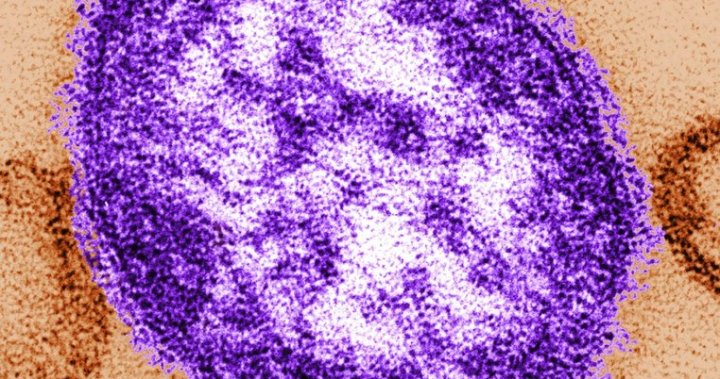

Calgary Measles Alert Public Health Issues Urgent Warning After Confirmed Case

Mar 18, 2025

Calgary Measles Alert Public Health Issues Urgent Warning After Confirmed Case

Mar 18, 2025

Latest Posts

-

Update Case Closed No Charges In Death Of Former Nhl Player Adam Johnson

Apr 30, 2025

Update Case Closed No Charges In Death Of Former Nhl Player Adam Johnson

Apr 30, 2025 -

Follow Dc Vs Kkr Live Cricket Score Ball By Ball Updates

Apr 30, 2025

Follow Dc Vs Kkr Live Cricket Score Ball By Ball Updates

Apr 30, 2025 -

The Smashing Machine Trailer Dwayne Johnson As Ufc Legend Mark Kerr

Apr 30, 2025

The Smashing Machine Trailer Dwayne Johnson As Ufc Legend Mark Kerr

Apr 30, 2025 -

Diana Shnaider Vs Iga Swiatek Madrid Open Odds And Predictions

Apr 30, 2025

Diana Shnaider Vs Iga Swiatek Madrid Open Odds And Predictions

Apr 30, 2025 -

11 Jump In Residential Bills Dte Rate Hike Request Sparks Outrage

Apr 30, 2025

11 Jump In Residential Bills Dte Rate Hike Request Sparks Outrage

Apr 30, 2025