Ripple's $1.5 Trillion Utility: A Deeper Dive Into The US Reserve Debate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ripple's $1.5 Trillion Utility: A Deeper Dive into the US Reserve Debate

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has cast a long shadow over the cryptocurrency market, but it's also shone a spotlight on the potential utility of Ripple's XRP token. While the SEC argues XRP is an unregistered security, Ripple maintains it's a functional cryptocurrency with a significant role in global financial transactions, potentially worth trillions. This article delves into the core arguments surrounding Ripple's claimed $1.5 trillion utility and its relevance to the ongoing US reserve debate.

The $1.5 Trillion Claim: Fact or Fiction?

The figure of $1.5 trillion, often cited in discussions surrounding Ripple's potential, represents the estimated value of global daily cross-border payments. Ripple advocates argue that their technology, utilizing XRP, offers a significantly faster, cheaper, and more efficient alternative to traditional methods like SWIFT. By facilitating these transactions, they believe XRP could capture a substantial portion of this massive market, potentially unlocking trillions in value.

However, this calculation hinges on several key assumptions:

- Market Adoption: Widespread adoption of Ripple's technology is crucial. While Ripple boasts numerous partnerships with financial institutions, mass adoption remains uncertain. Competition from other blockchain solutions and regulatory hurdles could significantly impact its market share.

- XRP's Role: The success of this model depends entirely on XRP's continued use as a bridge currency within RippleNet. Any legal rulings that limit XRP's functionality would drastically reduce its value proposition.

- Price Volatility: The volatile nature of cryptocurrencies poses a significant risk. Even if RippleNet achieves widespread adoption, the fluctuating price of XRP could drastically alter its overall market valuation.

The US Reserve Debate and Ripple's Place

The debate around Ripple's potential also intersects with the broader discussion regarding the future of global reserve currencies. The dominance of the US dollar is increasingly being challenged, and some argue that blockchain-based solutions like RippleNet could offer a decentralized alternative. However, this remains a long-term proposition.

Several factors influence this debate:

- Decentralization vs. Centralization: While RippleNet offers a more decentralized approach than traditional banking systems, it's still a centralized company controlling a significant portion of XRP's supply. This contrasts with the decentralized ethos of many other cryptocurrencies.

- Regulatory Uncertainty: The SEC lawsuit and the broader regulatory landscape for cryptocurrencies remain significant obstacles. Clearer regulatory frameworks are needed for blockchain technology to thrive and compete with established financial systems.

- Technological Scalability: To handle the volume of global transactions, RippleNet's technology needs to demonstrate scalability and resilience. Current limitations in transaction speed and network capacity could hinder its ability to compete effectively.

Conclusion: A Waiting Game

The potential of Ripple and its $1.5 trillion valuation remain highly speculative. The outcome of the SEC lawsuit will significantly influence its future, impacting not only Ripple's market position but also the broader cryptocurrency landscape and the global reserve currency debate. While the technology behind RippleNet holds promise, significant hurdles regarding adoption, regulation, and technological scalability need to be overcome before its full potential can be realized. The coming months and years will be crucial in determining whether Ripple's ambitious vision becomes a reality. Investors should proceed with caution and carefully consider the inherent risks associated with the cryptocurrency market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ripple's $1.5 Trillion Utility: A Deeper Dive Into The US Reserve Debate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Icc Sanctions Pakistan Player For Misconduct During New Zealand Series

Mar 18, 2025

Icc Sanctions Pakistan Player For Misconduct During New Zealand Series

Mar 18, 2025 -

Political Fallout Netanyahu Targets Israels Internal Security Service

Mar 18, 2025

Political Fallout Netanyahu Targets Israels Internal Security Service

Mar 18, 2025 -

High Stakes Draw Kellaways Gamble Impacts Both Teams Season Prospects

Mar 18, 2025

High Stakes Draw Kellaways Gamble Impacts Both Teams Season Prospects

Mar 18, 2025 -

Innovator Lady Gaga Urges Artists To Break The Mold Key Career Advice

Mar 18, 2025

Innovator Lady Gaga Urges Artists To Break The Mold Key Career Advice

Mar 18, 2025 -

Another Selection Fiasco Pcb Under Fire For Questionable Team Choice

Mar 18, 2025

Another Selection Fiasco Pcb Under Fire For Questionable Team Choice

Mar 18, 2025

Latest Posts

-

Trumps Reported Call To Bezos A Dispute Over Amazons Public Image

Apr 30, 2025

Trumps Reported Call To Bezos A Dispute Over Amazons Public Image

Apr 30, 2025 -

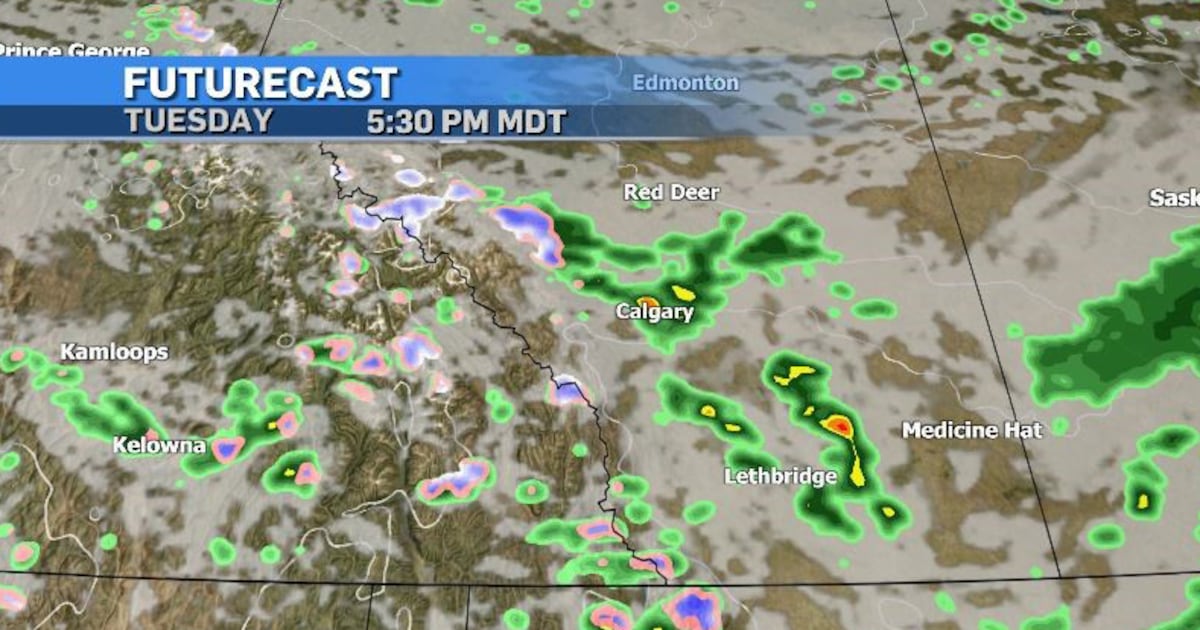

Expect Wind And Clouds In Calgary Tuesday Chance Of Thunderstorms

Apr 30, 2025

Expect Wind And Clouds In Calgary Tuesday Chance Of Thunderstorms

Apr 30, 2025 -

Decisoes De Investimento Da Berkshire Greg Abel Assume O Leme Apos Buffett

Apr 30, 2025

Decisoes De Investimento Da Berkshire Greg Abel Assume O Leme Apos Buffett

Apr 30, 2025 -

Has Epics Mobile Games Store Achieved Its Goals A Data Driven Look

Apr 30, 2025

Has Epics Mobile Games Store Achieved Its Goals A Data Driven Look

Apr 30, 2025 -

Singapore Students Penknife Assault On Teacher Leads To Arrest

Apr 30, 2025

Singapore Students Penknife Assault On Teacher Leads To Arrest

Apr 30, 2025