Ripple's Circle Acquisition: Analyzing The $5 Billion Price Tag And Its Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ripple's Circle Acquisition: A $5 Billion Gamble or Strategic Masterstroke?

The cryptocurrency world is buzzing with the news of Ripple's rumored $5 billion acquisition of Circle, a major player in the stablecoin market. While neither company has officially confirmed the deal, the whispers are persistent, and the potential implications are vast. This unprecedented move, if confirmed, would reshape the crypto landscape, sparking debates about market dominance, regulatory hurdles, and the future of stablecoins. This article delves into the details of this potential mega-deal, analyzing the hefty price tag and its far-reaching consequences.

The $5 Billion Question: Is it Worth It?

A $5 Billion price tag for Circle is staggering, even in the volatile world of cryptocurrency. This valuation raises several questions. Is Circle truly worth this much? What are the underlying assets and future growth projections justifying such a substantial investment? Analysts are divided. Some argue the price reflects Circle's significant market share in the USD Coin (USDC) stablecoin market, its robust infrastructure, and its potential for future growth in areas like payments and DeFi. Others suggest the price is inflated, reflecting the current hype surrounding the crypto market rather than Circle's intrinsic value.

Analyzing Circle's Strengths and Strategic Importance for Ripple:

Circle boasts several key advantages that make it an attractive acquisition target for Ripple:

- Dominant Stablecoin Market Share: USDC is a leading stablecoin, offering stability and low volatility compared to other cryptocurrencies. This stability is crucial for widespread adoption and institutional investment.

- Robust Infrastructure and Technology: Circle has invested heavily in its infrastructure, providing a secure and reliable platform for transactions. This established infrastructure would significantly benefit Ripple's existing operations.

- Strategic Partnerships and Regulatory Compliance: Circle has forged partnerships with major financial institutions and has a strong focus on regulatory compliance, a critical factor in navigating the complex legal landscape of cryptocurrencies. This could help Ripple mitigate regulatory risks.

- Synergy with Ripple's XRP Ledger: Integrating Circle's infrastructure with Ripple's XRP Ledger could create a more efficient and scalable payment system, potentially attracting a larger user base.

Implications of the Potential Acquisition:

The potential acquisition of Circle by Ripple has several significant implications:

- Increased Market Dominance: The combined entity would command a substantial share of the stablecoin market and payment processing infrastructure.

- Enhanced Regulatory Scrutiny: A deal of this magnitude would undoubtedly attract increased scrutiny from regulators worldwide, potentially leading to stricter regulations on stablecoins and cryptocurrencies.

- Impact on XRP: The acquisition could indirectly impact the price and adoption of XRP, Ripple's native cryptocurrency. A strengthened ecosystem could boost XRP's value and utility.

- Competition within the Crypto Space: Other major players in the crypto space might respond to this consolidation, potentially leading to further mergers and acquisitions.

Conclusion: A Bold Move with Uncertain Outcomes

The potential acquisition of Circle by Ripple for $5 billion is a bold strategic move that carries both significant risks and substantial rewards. While the high price tag raises questions, the potential synergies and increased market dominance are undeniable. The coming weeks and months will be critical in determining whether this gamble pays off, ultimately shaping the future of the cryptocurrency landscape. The deal’s ultimate success will depend heavily on regulatory approvals, the integration of both companies' systems, and the overall market conditions. Only time will tell if this proves to be a masterstroke or a costly mistake. We will continue to update this article as more information becomes available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ripple's Circle Acquisition: Analyzing The $5 Billion Price Tag And Its Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Post Game Fallout Le Bron James Shaquille O Neal Spar Over Lakers Defeat

May 19, 2025

Post Game Fallout Le Bron James Shaquille O Neal Spar Over Lakers Defeat

May 19, 2025 -

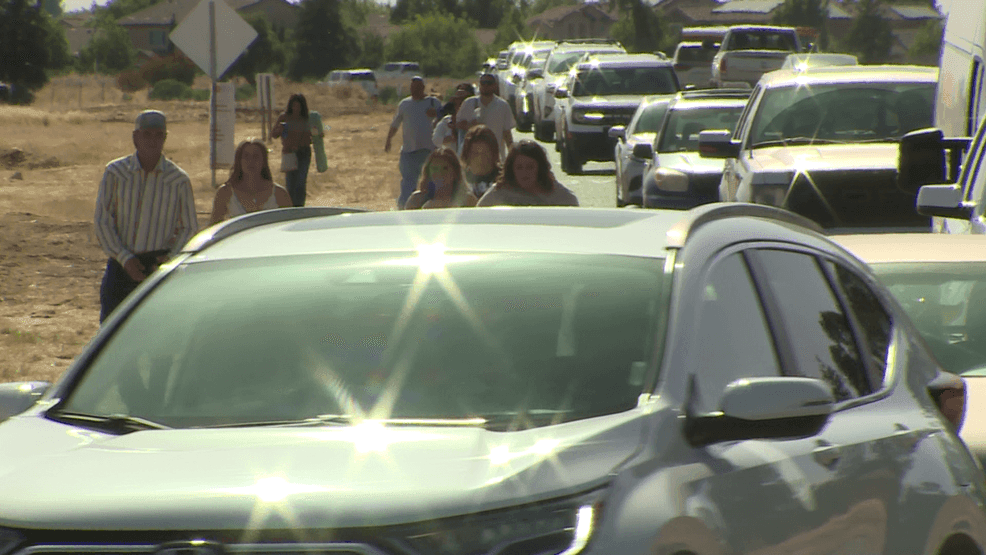

Shafter Chp Issues Traffic Warning For Luke Bryan Concert

May 19, 2025

Shafter Chp Issues Traffic Warning For Luke Bryan Concert

May 19, 2025 -

Epic Games Seeks Court Order To Restore Fortnite To Us App Store

May 19, 2025

Epic Games Seeks Court Order To Restore Fortnite To Us App Store

May 19, 2025 -

Aews Darby Allin Conquers Everest A Triumphant Summit

May 19, 2025

Aews Darby Allin Conquers Everest A Triumphant Summit

May 19, 2025 -

Are Ai Ads The Death Knell For Affordable Streaming Services

May 19, 2025

Are Ai Ads The Death Knell For Affordable Streaming Services

May 19, 2025