Rising Delistings On The SGX: Understanding The Market Trends Of 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Delistings on the SGX: Understanding the Market Trends of 2024

The Singapore Exchange (SGX) has witnessed a concerning surge in delistings in 2024, prompting investors and market analysts to scrutinize the underlying trends shaping the Singaporean stock market. This isn't just a minor fluctuation; it's a significant shift potentially indicative of broader economic forces at play. Understanding these trends is crucial for anyone invested in or considering investment in the SGX.

What Constitutes a Delisting?

Before delving into the reasons behind the rising delistings, it's essential to clarify what a delisting actually means. A delisting occurs when a company's shares are removed from the official listing of a stock exchange, such as the SGX. This can happen for various reasons, some voluntary and others involuntary. The result, however, is the same: investors can no longer buy or sell the company's shares on the exchange.

The Surge in Delistings: Key Factors in 2024

Several contributing factors explain the increase in SGX delistings observed this year:

1. Increased Regulatory Scrutiny: The Singaporean government has tightened regulatory oversight of listed companies, leading to increased compliance costs and stricter enforcement. Companies struggling to meet these new standards may find delisting a more viable option than facing potential penalties.

2. Global Economic Uncertainty: The global economic landscape remains volatile, impacting businesses across various sectors. Many companies, particularly smaller ones, are finding it challenging to maintain profitability and sustain their listing requirements amidst inflation, rising interest rates, and geopolitical instability. This has led to a wave of voluntary delistings, allowing companies to restructure privately.

3. Acquisition and Private Equity Activity: A significant number of delistings stem from acquisitions by private equity firms or larger corporations. These acquisitions often result in the target company being delisted as it transitions to private ownership. This is a common occurrence, especially in sectors experiencing consolidation.

4. Poor Financial Performance: Simply put, some companies are delisted due to consistently poor financial performance. Failure to meet listing requirements, such as minimum profit levels or market capitalization thresholds, often leads to mandatory delisting. This highlights the importance of due diligence for investors.

Impact on Investors and the Market:

The rising delisting trend carries implications for both investors and the overall health of the SGX. For investors, it means a reduced pool of investable securities and potential losses if they hold shares in delisted companies. For the SGX, it could signal a need for adjustments to listing rules and regulations to foster a more vibrant and sustainable market.

Looking Ahead: Navigating the Shifting Landscape

The increase in SGX delistings in 2024 highlights the dynamic nature of the market and the need for investors to remain vigilant. Conducting thorough due diligence, diversifying portfolios, and staying informed about regulatory changes are crucial strategies for navigating this evolving landscape. The SGX, too, will likely need to adapt its strategies to attract and retain companies, ensuring the continued growth and stability of the Singaporean stock market. The future will undoubtedly require a careful balancing act between stricter regulation and fostering a conducive environment for business growth.

Keywords: SGX delistings, Singapore Exchange, stock market trends, 2024 market trends, delisting reasons, Singapore stock market, market volatility, investment strategies, regulatory changes, financial performance, acquisitions, private equity.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Delistings On The SGX: Understanding The Market Trends Of 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Warren Buffett Vende Acciones De Apple Analisis De La Reduccion Del 13 De Su Participacion

May 13, 2025

Warren Buffett Vende Acciones De Apple Analisis De La Reduccion Del 13 De Su Participacion

May 13, 2025 -

David Beckham Defends Inter Miami After Minnesota Uniteds Social Media Attack

May 13, 2025

David Beckham Defends Inter Miami After Minnesota Uniteds Social Media Attack

May 13, 2025 -

Controversy At Cannes Film Festival Cracks Down On Barely There Dresses

May 13, 2025

Controversy At Cannes Film Festival Cracks Down On Barely There Dresses

May 13, 2025 -

Helldivers 2 Super Earth Invasion New Enemies And Challenges Await

May 13, 2025

Helldivers 2 Super Earth Invasion New Enemies And Challenges Await

May 13, 2025 -

White South African Refugees Denied Resettlement Help By Episcopal Church

May 13, 2025

White South African Refugees Denied Resettlement Help By Episcopal Church

May 13, 2025

Latest Posts

-

Chinese Breakthrough Silicon Free Transistor Promises Unprecedented Speed And Efficiency

May 13, 2025

Chinese Breakthrough Silicon Free Transistor Promises Unprecedented Speed And Efficiency

May 13, 2025 -

Hot Wheels Unleashes Metal Mario This Summers Must Have Collectible

May 13, 2025

Hot Wheels Unleashes Metal Mario This Summers Must Have Collectible

May 13, 2025 -

Two Future Stars Shine In Obscure 1945 Wwii Drama

May 13, 2025

Two Future Stars Shine In Obscure 1945 Wwii Drama

May 13, 2025 -

Public Health Emergency Texass Massive Measles Outbreak

May 13, 2025

Public Health Emergency Texass Massive Measles Outbreak

May 13, 2025 -

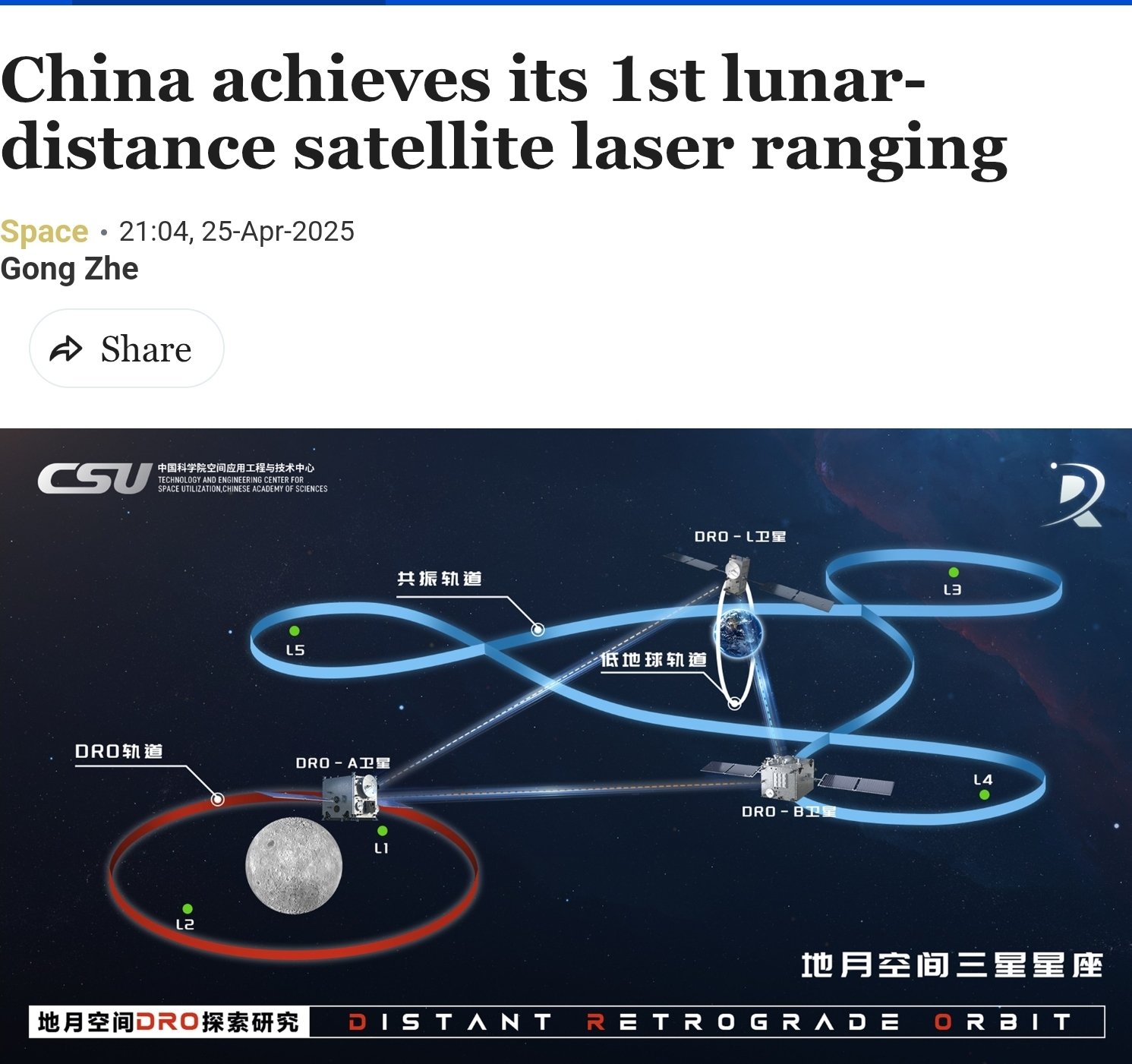

China Expands Space Capabilities With Lunar Orbit Laser Ranging

May 13, 2025

China Expands Space Capabilities With Lunar Orbit Laser Ranging

May 13, 2025