Rising India-Pakistan Tensions: Impact On Global Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising India-Pakistan Tensions: A Looming Threat to Global Markets?

The recent escalation of tensions between India and Pakistan has sent ripples of concern throughout global financial markets. While the immediate impact may seem limited, the potential for wider consequences is significant, impacting everything from energy prices to investor confidence. This volatile situation demands close monitoring by economists, policymakers, and investors alike.

A History of Volatility: The relationship between India and Pakistan has long been characterized by periods of heightened tension and conflict, often stemming from disputes over the Kashmir region. These flare-ups historically have had a limited, localized impact on global markets. However, the interconnected nature of the modern global economy means that even regional conflicts can have far-reaching consequences.

Potential Economic Impacts:

- Energy Markets: Both India and Pakistan are significant consumers of energy. Any disruption to trade routes or supply chains in the region could lead to increased energy prices globally, impacting industries and consumers worldwide. The potential for conflict to affect oil and gas transit through the region is a major concern.

- Trade and Investment: Increased tensions can lead to reduced trade between India and Pakistan, as well as decreased foreign direct investment (FDI) in both countries. This slowdown in economic activity can have knock-on effects on global supply chains and economic growth.

- Investor Sentiment: Uncertainty and instability are detrimental to investor confidence. The current situation could trigger a sell-off in emerging market equities, impacting investor portfolios and potentially slowing down global capital flows.

- Geopolitical Risk Premium: Increased geopolitical risk often leads to a higher risk premium demanded by investors, resulting in higher borrowing costs for governments and corporations in affected regions, and potentially globally. This can stifle economic growth and development.

H2: Specific Sectors at Risk:

Beyond the broader market impacts, specific sectors are particularly vulnerable to escalating India-Pakistan tensions:

- Technology: Both countries have burgeoning technology sectors. Disruption in cross-border collaborations and supply chains could hinder growth in this crucial industry.

- Textiles and Apparel: The textile and apparel industry in both countries is significant. Trade disruptions could lead to shortages and price increases.

- Tourism: The tourism sector is highly susceptible to geopolitical instability. Any escalation of conflict could lead to a significant drop in tourist arrivals, harming local economies.

H3: Mitigating the Risks:

While the situation is concerning, there are factors that could mitigate the potential negative impacts:

- Diplomatic Engagement: Continued diplomatic efforts to de-escalate tensions are crucial. International mediation could play a significant role in preventing a wider conflict.

- Economic Interdependence: The economic interdependence between India and Pakistan creates an incentive for both countries to avoid all-out conflict, as such a conflict would have devastating economic consequences for both.

- Global Response: A strong and unified response from the international community could help to contain the situation and prevent further escalation.

Conclusion:

The rising tensions between India and Pakistan present a significant risk to global markets. While the immediate impact may be limited, the potential for broader consequences is substantial. Close monitoring of the situation, alongside proactive diplomatic efforts, is crucial to minimizing the potential disruption to the global economy. Investors and policymakers should be prepared for potential market volatility and implement strategies to mitigate the risks associated with this evolving geopolitical situation. The coming weeks will be critical in determining the long-term economic fallout.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising India-Pakistan Tensions: Impact On Global Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sigue Vigente El Proyecto Schuman Analisis A 75 Anos De Su Declaracion

May 10, 2025

Sigue Vigente El Proyecto Schuman Analisis A 75 Anos De Su Declaracion

May 10, 2025 -

Cheapest Ryzen 9 Mini Pc With O Cu Link And Windows 11 Pro A Deep Dive

May 10, 2025

Cheapest Ryzen 9 Mini Pc With O Cu Link And Windows 11 Pro A Deep Dive

May 10, 2025 -

Cameron Brink Basketball Skills And The Si Swimsuit Photoshoot

May 10, 2025

Cameron Brink Basketball Skills And The Si Swimsuit Photoshoot

May 10, 2025 -

Crucial Team Shift Ahead Of Bombers Crucial Clash

May 10, 2025

Crucial Team Shift Ahead Of Bombers Crucial Clash

May 10, 2025 -

Live Set For Life Results Full Winning Numbers For May 8

May 10, 2025

Live Set For Life Results Full Winning Numbers For May 8

May 10, 2025

Latest Posts

-

Black Families Lead Travel Boom Economic And Social Impacts

May 10, 2025

Black Families Lead Travel Boom Economic And Social Impacts

May 10, 2025 -

Lifetime Isa Myths Busted Unlocking Your Savings Potential

May 10, 2025

Lifetime Isa Myths Busted Unlocking Your Savings Potential

May 10, 2025 -

Gates Issues Stark Warning Musks Dogecoin Actions Threaten Millions

May 10, 2025

Gates Issues Stark Warning Musks Dogecoin Actions Threaten Millions

May 10, 2025 -

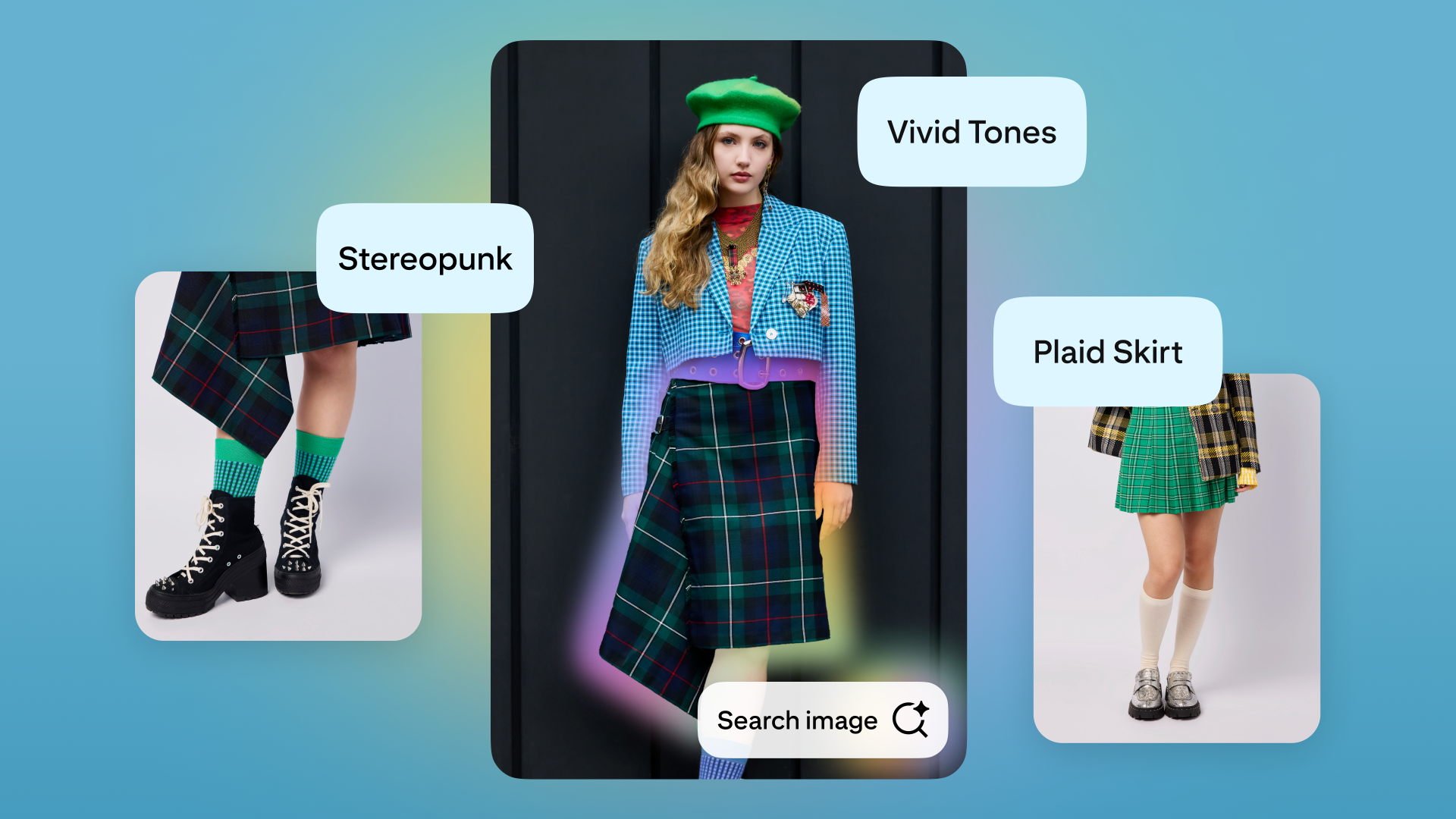

Shop Your Style Pinterests New Ai Powered Visual Search

May 10, 2025

Shop Your Style Pinterests New Ai Powered Visual Search

May 10, 2025 -

Nba Star Ben Simmons And The Reality Of A Significant Salary Reduction

May 10, 2025

Nba Star Ben Simmons And The Reality Of A Significant Salary Reduction

May 10, 2025