Rising Oil Prices: Positive Trade Signals Between U.S. And China

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Oil Prices: A Unexpected Catalyst for US-China Trade Cooperation?

The recent surge in global oil prices, driven by a confluence of factors including geopolitical instability and increased demand, has unexpectedly created a potential opening for improved trade relations between the United States and China. While seemingly disparate, the rising cost of crude oil presents a shared challenge that could foster unprecedented cooperation between the world's two largest economies. This development offers a glimmer of hope amidst ongoing trade tensions and geopolitical uncertainty.

The Shared Challenge of Energy Security

Both the US and China are significant consumers of oil, making them highly vulnerable to price fluctuations. The current price hikes are impacting inflation rates, impacting businesses and consumers alike. This shared economic vulnerability transcends political differences, creating a powerful incentive for collaboration. Both nations have a vested interest in stabilizing the global oil market and ensuring a reliable and affordable energy supply. This shared interest could pave the way for renewed dialogue and potentially even joint initiatives to address the root causes of oil price volatility.

Potential Avenues for Cooperation:

Several avenues for US-China cooperation on oil and energy are emerging:

-

Joint investment in renewable energy: The need to diversify energy sources and reduce reliance on volatile fossil fuels could lead to joint investments in renewable energy technologies and infrastructure. This could include collaborative research and development, shared technological advancements, and potentially even joint projects in emerging markets.

-

Strategic oil reserves: Discussions could revolve around coordinating the release of strategic oil reserves to alleviate price pressures. This would require a level of trust and transparency that has been lacking in recent years, but the urgency of the situation could incentivize such cooperation.

-

Enhanced communication and information sharing: Improved communication channels related to oil market trends, production forecasts, and geopolitical risks could help both nations better anticipate and mitigate future price shocks. Open dialogue could contribute to a more stable and predictable energy market.

-

Infrastructure development: Collaborating on infrastructure projects related to oil transportation, refining, and storage could enhance energy security for both nations. This could involve joint investments in pipelines, ports, and other critical infrastructure.

Beyond Oil: A Broader Trade Agenda?

While the focus is currently on oil, this potential for cooperation could signal a broader thaw in US-China trade relations. Successfully navigating the shared challenge of rising oil prices could build trust and lay the groundwork for addressing other pressing trade issues. The success of such cooperation would depend on both nations' willingness to compromise and prioritize mutual benefit over short-term political gains.

Challenges and Uncertainties:

Despite the potential for cooperation, significant challenges remain. Deep-seated geopolitical tensions and mistrust continue to cast a shadow over any potential breakthroughs. The success of any cooperative ventures will depend on overcoming these obstacles and fostering a climate of mutual respect and understanding.

Conclusion:

The unexpected link between rising oil prices and potential US-China trade cooperation presents a unique opportunity. While the path ahead is fraught with challenges, the shared vulnerability to volatile oil markets offers a compelling impetus for dialogue and potential collaboration. The coming months will be crucial in determining whether this opportunity leads to meaningful improvements in bilateral relations or remains a fleeting possibility. The global community will be watching closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Oil Prices: Positive Trade Signals Between U.S. And China. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

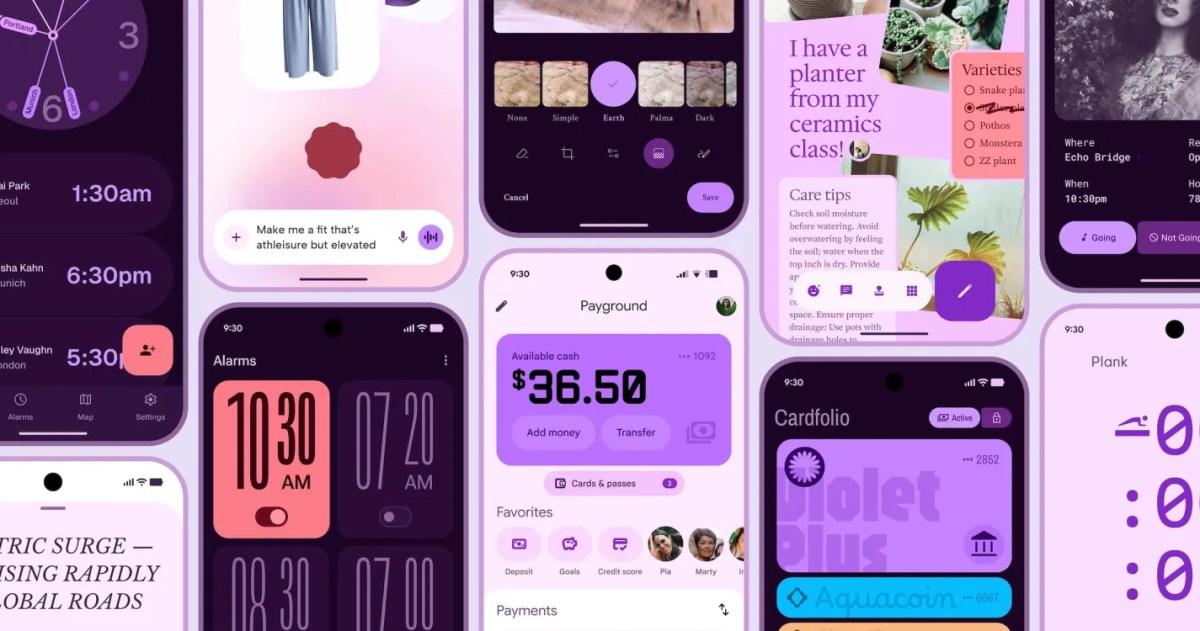

I Phone Vs Android Will A New Look Sway Young Consumers

May 09, 2025

I Phone Vs Android Will A New Look Sway Young Consumers

May 09, 2025 -

Check Your Facts Uk Anchor Exposes Pak Minister On Live Television

May 09, 2025

Check Your Facts Uk Anchor Exposes Pak Minister On Live Television

May 09, 2025 -

Twitter Vs India 8 000 Account Blocking Request Met With Resistance From Elon Musk

May 09, 2025

Twitter Vs India 8 000 Account Blocking Request Met With Resistance From Elon Musk

May 09, 2025 -

2025 Nba Playoffs Game 2 Recap Warriors Vs Wolves Key Plays And Final Score

May 09, 2025

2025 Nba Playoffs Game 2 Recap Warriors Vs Wolves Key Plays And Final Score

May 09, 2025 -

Will Xrp Rise Price Prediction For May 7 2024

May 09, 2025

Will Xrp Rise Price Prediction For May 7 2024

May 09, 2025