Rising Trade Tensions: Impact On US Stocks, Dollar, And Government Bond Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Trade Tensions: Impact on US Stocks, Dollar, and Government Bond Yields

Global trade tensions are escalating, sending ripples through the US economy, impacting everything from stock markets and the dollar to government bond yields. The uncertainty created by these rising tensions is causing significant volatility and prompting investors to reassess their strategies. This article delves into the complex interplay between trade disputes and key economic indicators, providing insights into the current market landscape and potential future scenarios.

The Impact on US Stocks:

The escalating trade war has already had a noticeable impact on US stock markets. Increased tariffs and retaliatory measures create uncertainty for businesses, leading to:

- Reduced corporate earnings: Higher import costs eat into profit margins, forcing companies to adjust pricing strategies or absorb the increased expenses, impacting their bottom line. This is particularly true for sectors heavily reliant on international trade.

- Increased investment hesitancy: Investors become wary of committing capital in an environment characterized by unpredictable trade policies. This uncertainty can lead to decreased investment and slower economic growth.

- Market Volatility: Fluctuations in trade policy announcements directly correlate with increased volatility in the stock market. Investors react swiftly to news impacting international trade, creating short-term price swings.

Specific sectors like technology, manufacturing, and agriculture are particularly vulnerable to the effects of trade disputes, as they are heavily involved in global supply chains.

The Dollar's Response to Trade Uncertainty:

The US dollar's strength relative to other currencies is also influenced by trade tensions. While initially, a strong dollar might seem beneficial to US consumers due to cheaper imports, the long-term implications are more nuanced:

- Reduced US exports: A strong dollar makes US goods more expensive for foreign buyers, potentially reducing demand and impacting export-oriented businesses.

- Increased capital inflows: During times of uncertainty, investors might seek the perceived safety of the US dollar, leading to increased capital inflows and further strengthening the currency. However, this effect isn't always consistent.

- Inflationary pressures: While a strong dollar can curb inflation by lowering import prices, tariffs counteract this effect, leading to potential inflationary pressures.

Government Bond Yields and Safe-Haven Demand:

Government bond yields, reflecting the return on investment in government debt, are also sensitive to trade disputes. Increased uncertainty often leads to:

- Increased demand for safe-haven assets: Investors seek stability during times of economic uncertainty, driving up demand for US Treasury bonds, which are considered a safe-haven asset. This increased demand pushes bond prices up and yields down.

- Flight to quality: Investors move away from riskier assets like stocks and into safer government bonds, further impacting yields.

- Impact on monetary policy: The Federal Reserve (Fed) closely monitors the impact of trade tensions on the economy. If the situation worsens, the Fed may adjust its monetary policy, potentially influencing bond yields further.

Looking Ahead: Navigating the Uncertain Terrain

The ongoing trade disputes present significant challenges for the US economy. The ultimate impact will depend on several factors, including the duration and intensity of the disputes, the responses of other countries, and the actions taken by the US government and the Federal Reserve. Investors and businesses need to closely monitor developments and adapt their strategies accordingly, carefully weighing the risks and potential opportunities presented by this volatile environment. Diversification and a long-term investment horizon are crucial during these times of economic uncertainty. Further analysis and expert commentary will be vital in understanding the evolving situation and its ramifications on the US economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Trade Tensions: Impact On US Stocks, Dollar, And Government Bond Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

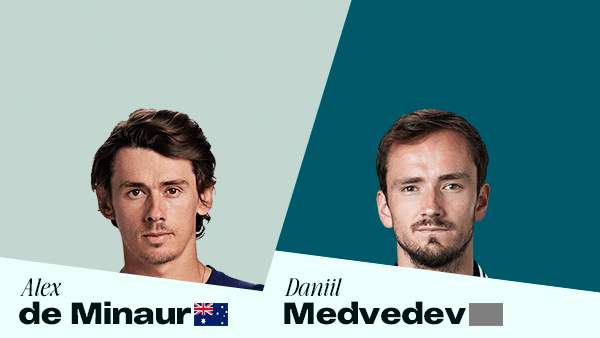

Watch Medvedev Vs De Minaur Monte Carlo Preview Live Streaming And Betting Predictions

Apr 11, 2025

Watch Medvedev Vs De Minaur Monte Carlo Preview Live Streaming And Betting Predictions

Apr 11, 2025 -

Alcaraz Triumphs In Monte Carlo Overcoming Cerundolo For Maiden Title

Apr 11, 2025

Alcaraz Triumphs In Monte Carlo Overcoming Cerundolo For Maiden Title

Apr 11, 2025 -

Aday Mara Transfer Michigan Basketballs Top Target

Apr 11, 2025

Aday Mara Transfer Michigan Basketballs Top Target

Apr 11, 2025 -

Black Mirrors Seventh Season Back To Its Sci Fi Roots

Apr 11, 2025

Black Mirrors Seventh Season Back To Its Sci Fi Roots

Apr 11, 2025 -

Why Aaron Rai Uses Two Gloves And Iron Covers A Pros Approach

Apr 11, 2025

Why Aaron Rai Uses Two Gloves And Iron Covers A Pros Approach

Apr 11, 2025