Rising Treasury Yields Signal Investor Concerns Over US Fiscal Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Treasury Yields Signal Investor Concerns Over US Fiscal Future

The escalating yields on US Treasury bonds are sending a clear message: investors are increasingly worried about the nation's fiscal health. This upward trend, a significant development in the financial markets, reflects growing anxieties surrounding the ballooning national debt, persistent inflation, and the potential for future interest rate hikes by the Federal Reserve. Understanding the implications of this trend is crucial for anyone invested in the US economy.

The yield on a Treasury bond represents the return an investor receives. A rising yield indicates that investors demand a higher return to compensate for perceived increased risk. This risk, in the current context, is primarily linked to the US government's fiscal trajectory.

H2: The Looming Debt Ceiling and Its Impact

The recent debt ceiling standoff in Congress dramatically highlighted the fragility of the US fiscal position. While a temporary solution was reached, the near-miss underscored the potential for future political gridlock and the risk of a US default, a scenario that would have catastrophic global consequences. This uncertainty is a major driver behind the rise in Treasury yields. Investors are pricing in the increased risk associated with holding US debt under these conditions.

H2: Inflation's Persistent Grip and the Fed's Response

Stubbornly high inflation continues to plague the US economy. While the Federal Reserve has implemented aggressive interest rate hikes to combat inflation, the effectiveness of these measures remains uncertain. Further rate increases, aimed at curbing inflation, would directly impact Treasury yields, pushing them even higher. This creates a challenging environment for investors, who must weigh the risks of inflation against the potential returns from Treasury bonds.

H3: What Rising Yields Mean for Investors

- Increased borrowing costs: Higher Treasury yields translate to increased borrowing costs for businesses and consumers, potentially slowing economic growth.

- Impact on the stock market: Rising yields can put downward pressure on the stock market, as investors may shift their investments from equities to the perceived safety of bonds.

- Dollar strength: Higher yields can attract foreign investment, leading to a stronger US dollar, which can impact international trade and competitiveness.

H2: The Road Ahead: Uncertainty and Potential Solutions

The future trajectory of Treasury yields remains uncertain. Several factors will influence their movement, including:

- The Fed's monetary policy: The Fed's future decisions on interest rates will play a pivotal role in shaping Treasury yields.

- Fiscal policy decisions: Addressing the long-term fiscal challenges facing the US will be critical in restoring investor confidence. This includes controlling spending and finding sustainable solutions for the national debt.

- Global economic conditions: Global economic growth and geopolitical events will also impact investor sentiment and Treasury yields.

H2: Conclusion: Navigating the Uncertain Terrain

The rising yields on US Treasury bonds reflect a growing unease among investors regarding the US fiscal future. While the situation presents challenges, it also underscores the importance of prudent fiscal management and proactive policy decisions. For investors, carefully monitoring the evolving situation and diversifying their portfolios are crucial strategies to navigate this period of uncertainty. The future path of US Treasury yields will be closely watched by investors and economists worldwide, as it provides a vital barometer of the health of the US economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Treasury Yields Signal Investor Concerns Over US Fiscal Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hanover Board Member Stipend Increase A 7 000 Decision

May 22, 2025

Hanover Board Member Stipend Increase A 7 000 Decision

May 22, 2025 -

Shai Gilgeous Alexander Leads Thunder To Game 1 Win Against Timberwolves In Conference Finals

May 22, 2025

Shai Gilgeous Alexander Leads Thunder To Game 1 Win Against Timberwolves In Conference Finals

May 22, 2025 -

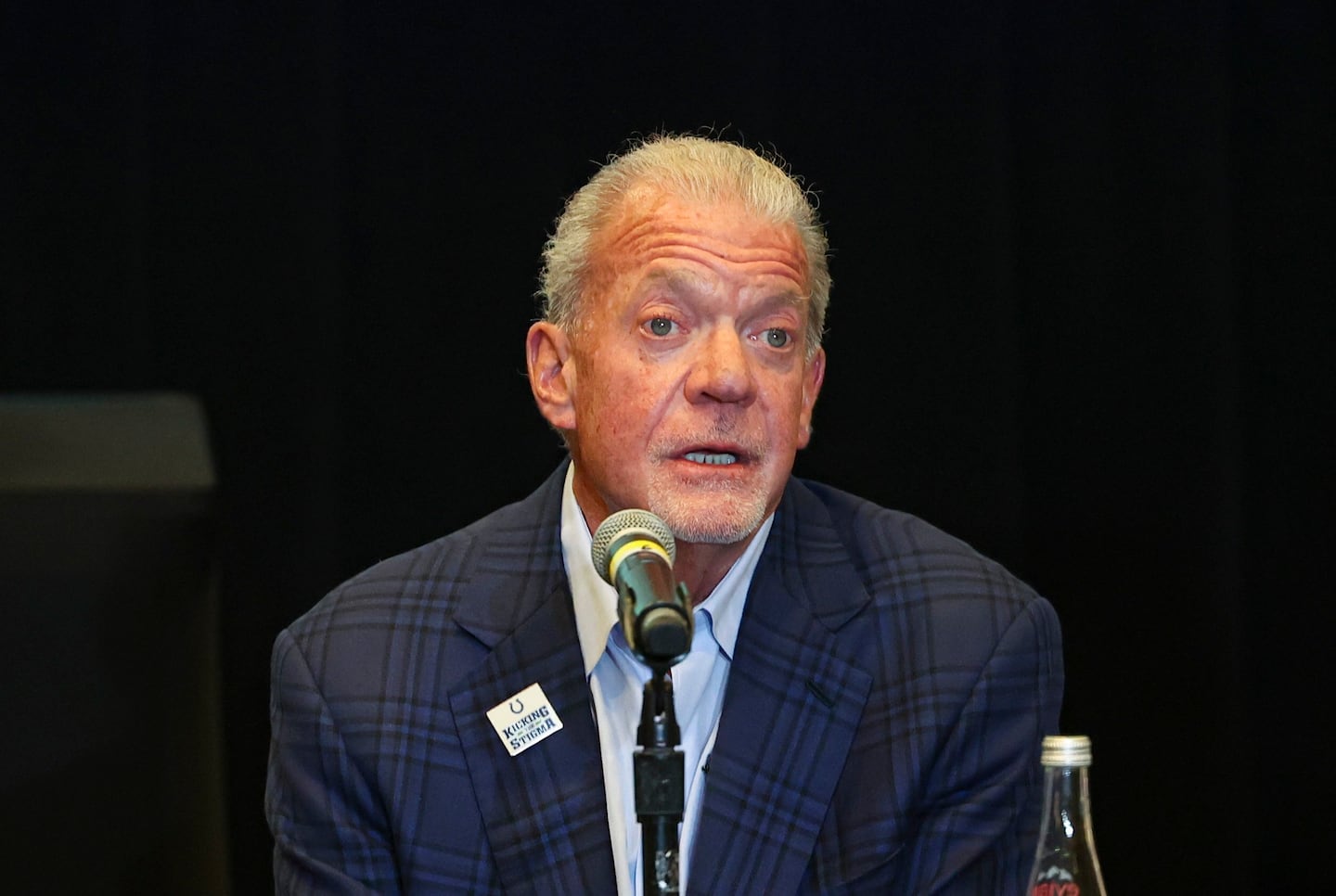

End Of An Era Indianapolis Colts Mourn The Loss Of Jim Irsay

May 22, 2025

End Of An Era Indianapolis Colts Mourn The Loss Of Jim Irsay

May 22, 2025 -

Following Cannes Incident Denzel Washingtons Publicist Offers Clarification

May 22, 2025

Following Cannes Incident Denzel Washingtons Publicist Offers Clarification

May 22, 2025 -

Live Coverage Google I O 2025 What To Expect From Android And Ai

May 22, 2025

Live Coverage Google I O 2025 What To Expect From Android And Ai

May 22, 2025