Rising Wedge Pattern In Hedera (HBAR): What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rising Wedge Pattern in Hedera (HBAR): What it Means for Investors

The cryptocurrency market is notoriously volatile, and even seasoned investors can find themselves caught off guard. Currently, Hedera Hashgraph (HBAR), a promising enterprise-grade blockchain platform, is showing a concerning chart pattern: the rising wedge. This bearish signal has many investors wondering what the future holds for HBAR and how they should adjust their portfolios. Let's delve into what a rising wedge pattern signifies and what it might mean for your HBAR investments.

Understanding the Rising Wedge Pattern

A rising wedge is a technical chart pattern characterized by converging upward-sloping trendlines. The pattern forms as the price fluctuates within increasingly narrower highs and lows, creating a wedge shape resembling a rising triangle. While initially appearing bullish due to the upward trend, rising wedges are typically considered bearish reversal patterns. This means they often precede a significant price decline. The narrowing price action suggests a weakening of the bullish momentum, hinting at an impending reversal.

Why is the Rising Wedge Bearish?

The bearish interpretation of the rising wedge stems from the imbalance between buyers and sellers. As the price moves higher within the wedge, buying pressure weakens. Sellers are becoming increasingly dominant, as evidenced by the inability of buyers to push the price significantly beyond the upper trendline. Eventually, the selling pressure overcomes the buying pressure, leading to a breakdown below the lower trendline and a potential price drop.

The Rising Wedge in HBAR: A Closer Look

Hedera (HBAR) has recently displayed characteristics consistent with a rising wedge pattern. While past performance is not indicative of future results, this pattern warrants careful consideration for HBAR investors. Several factors could be contributing to this pattern, including:

- Overall Market Sentiment: The broader cryptocurrency market's performance significantly impacts individual altcoins like HBAR. A bearish market sentiment could contribute to the weakening buying pressure observed in the rising wedge.

- Profit-Taking: After periods of significant price appreciation, investors often engage in profit-taking, leading to a sell-off that contributes to the downward pressure seen in a rising wedge.

- Lack of Catalysts: The absence of major catalysts or positive news events for Hedera could also contribute to a lack of buying enthusiasm, strengthening the bearish sentiment reflected in the pattern.

What Should HBAR Investors Do?

The appearance of a rising wedge pattern is not a guaranteed prediction of a price crash. However, it serves as a cautionary signal. Investors should:

- Monitor the Breakout: Closely watch the price action at the lower trendline of the wedge. A decisive break below this support level confirms the bearish signal and suggests a potential price drop.

- Consider Risk Management: Implement appropriate risk management strategies, such as setting stop-loss orders to limit potential losses if the price breaks down.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your investments across different cryptocurrencies and asset classes can help mitigate risk.

- Stay Informed: Keep abreast of news and developments related to Hedera. Positive news or announcements could potentially reverse the bearish trend.

Conclusion:

The rising wedge pattern in Hedera (HBAR) presents a concerning signal for investors. While not a definitive prediction of a price decline, it warrants careful monitoring and prudent risk management. Investors should closely observe the price action, implement appropriate risk management techniques, and stay informed about Hedera's developments. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions. The information provided here is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rising Wedge Pattern In Hedera (HBAR): What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Psg Vs Arsenal Rematch Luis Enrique Demands A Historic Victory

Apr 30, 2025

Psg Vs Arsenal Rematch Luis Enrique Demands A Historic Victory

Apr 30, 2025 -

The Uks Web3 Future Animoca Brands Coinbase And Fabric Ventures Strategic Investments

Apr 30, 2025

The Uks Web3 Future Animoca Brands Coinbase And Fabric Ventures Strategic Investments

Apr 30, 2025 -

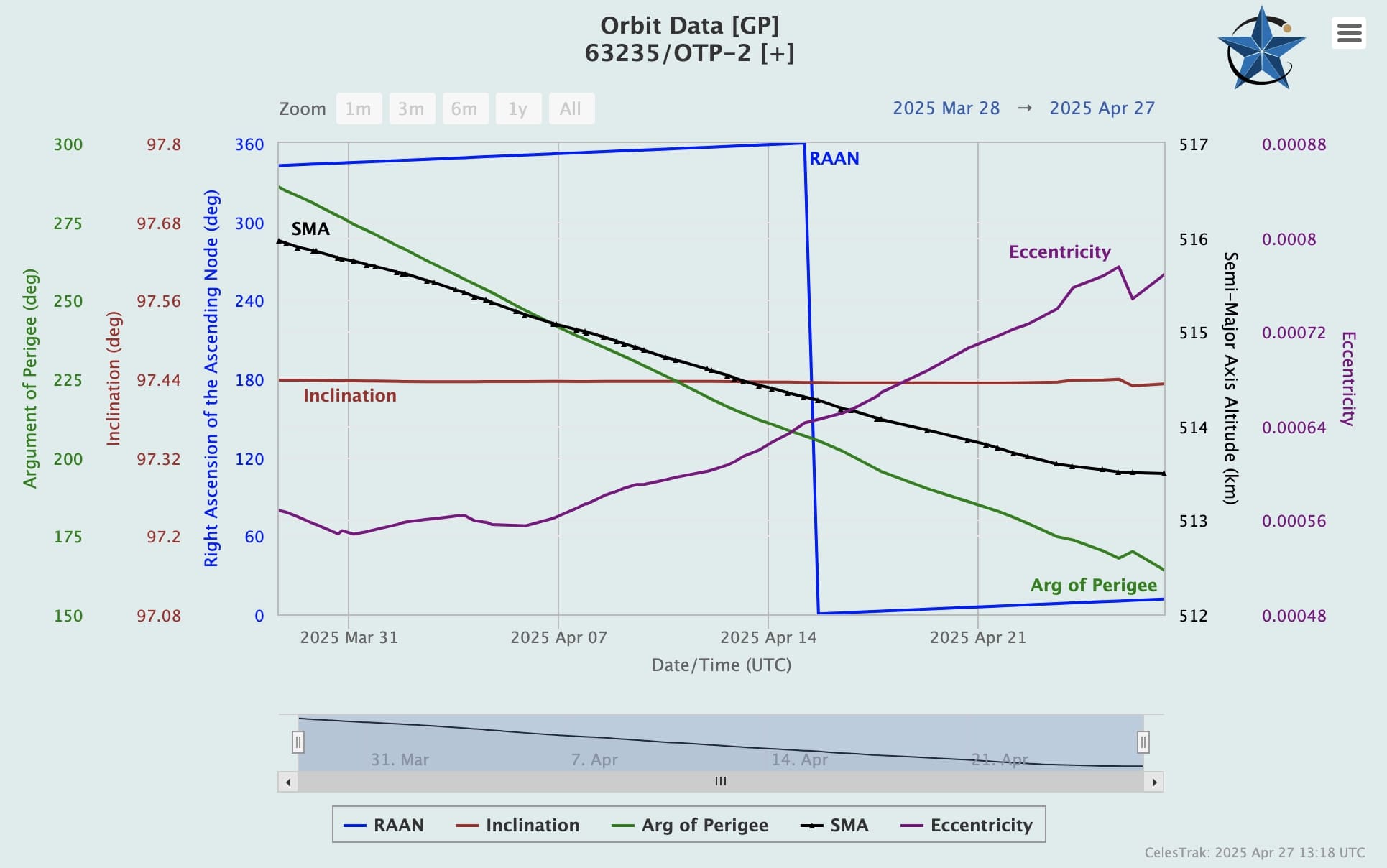

Otp 2 Significant Slowdown Observed In Propellantless Satellites Orbital Decay

Apr 30, 2025

Otp 2 Significant Slowdown Observed In Propellantless Satellites Orbital Decay

Apr 30, 2025 -

Epic Games On Android Why Apple Needs To Embrace Third Party App Stores

Apr 30, 2025

Epic Games On Android Why Apple Needs To Embrace Third Party App Stores

Apr 30, 2025 -

How Stablecoins Can Increase Bank Liquidity And Attract More Deposits

Apr 30, 2025

How Stablecoins Can Increase Bank Liquidity And Attract More Deposits

Apr 30, 2025

Latest Posts

-

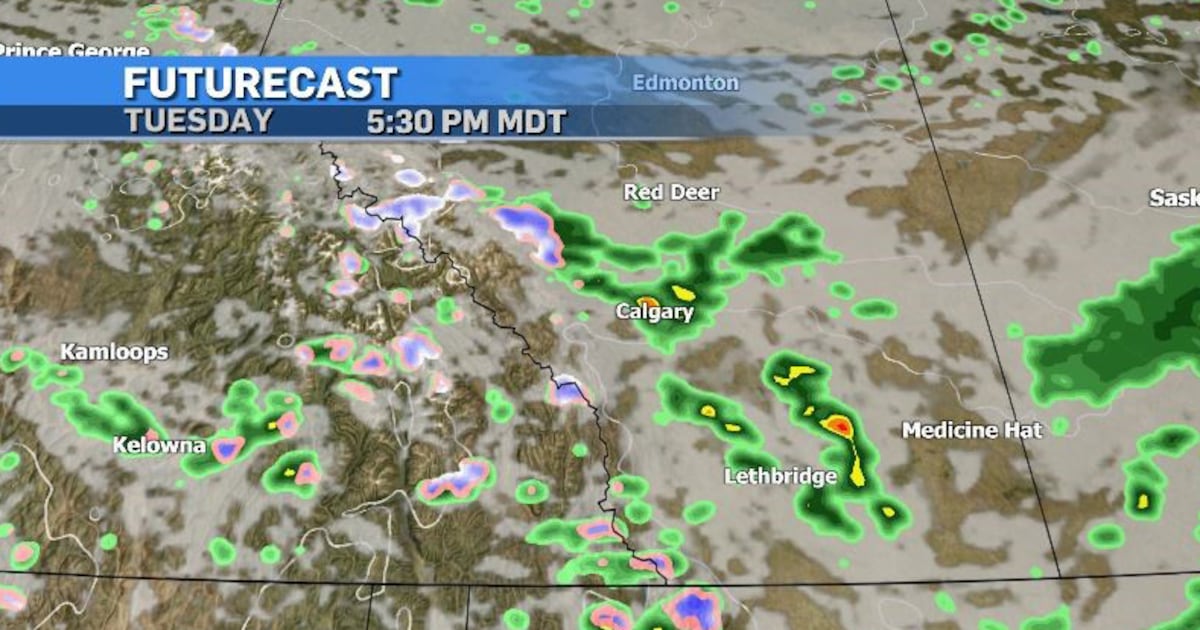

Thunderstorm Watch For Calgary Cloudy Windy Conditions Expected Tuesday

Apr 30, 2025

Thunderstorm Watch For Calgary Cloudy Windy Conditions Expected Tuesday

Apr 30, 2025 -

Disability Rights Battle Heats Up At Supreme Court What To Expect

Apr 30, 2025

Disability Rights Battle Heats Up At Supreme Court What To Expect

Apr 30, 2025 -

Rare Supreme Court Clashes Justice Gorsuchs Heated Exchange

Apr 30, 2025

Rare Supreme Court Clashes Justice Gorsuchs Heated Exchange

Apr 30, 2025 -

Latest On Trump Tariffs Uk Prime Minister Faces Crucial Trade Decision

Apr 30, 2025

Latest On Trump Tariffs Uk Prime Minister Faces Crucial Trade Decision

Apr 30, 2025 -

Kolkatas Ipl Victory Over Delhi Narines Front Line Leadership Proves Decisive

Apr 30, 2025

Kolkatas Ipl Victory Over Delhi Narines Front Line Leadership Proves Decisive

Apr 30, 2025