RUNE Crash: 60% Liquidity Drop On THORChain Impacts Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RUNE Crash: 60% Liquidity Drop on THORChain Shakes Crypto Market

The cryptocurrency market experienced a significant shockwave today as the price of RUNE, the native token of the THORChain decentralized exchange (DEX), plummeted. A dramatic 60% drop in liquidity across THORChain's various pools sent ripples through the crypto community, leaving many investors wondering about the future of this innovative cross-chain protocol. The sudden crash raises serious questions about the stability and resilience of decentralized finance (DeFi) protocols, particularly those operating in the volatile landscape of cross-chain transactions.

What Happened to THORChain and RUNE?

THORChain, lauded for its ambition to create a truly decentralized and permissionless cross-chain exchange, suffered a massive liquidity crisis. Reports suggest a significant withdrawal of liquidity from various pools, resulting in a staggering 60% reduction. This liquidity crunch directly impacted the price of RUNE, its governance and utility token. The price plunged, wiping out a substantial portion of investor holdings.

While the exact cause remains under investigation, several factors are being speculated upon:

-

Potential Exploit or Vulnerability: The possibility of a previously unknown exploit or vulnerability in THORChain's smart contracts is a leading theory. Security experts are currently scrutinizing the codebase to identify any potential weaknesses that could have been exploited.

-

Market Manipulation: Some analysts suspect a coordinated market manipulation attempt, aiming to artificially depress the price of RUNE and capitalize on the ensuing panic selling. However, conclusive evidence of such activity is currently lacking.

-

Loss of Confidence: The significant liquidity drain might also stem from a loss of confidence among users and liquidity providers. Negative news or perceived risks associated with THORChain could trigger a cascade effect, leading to mass withdrawals.

Impact on the Wider Crypto Market:

The RUNE crash has sent shockwaves beyond just THORChain. The incident underscores the inherent risks associated with DeFi protocols, reminding investors of the volatility and potential for unforeseen events. The broader crypto market experienced a slight dip following the news, highlighting the interconnectedness of different projects and assets. The event serves as a stark reminder of the need for robust security measures and transparent governance within the DeFi ecosystem.

What's Next for THORChain and RUNE?

The THORChain team has acknowledged the situation and is working diligently to address the liquidity crisis. However, the extent of the damage and the timeframe for recovery remain uncertain. The community is eagerly awaiting a detailed explanation from the developers, shedding light on the root cause of the event and outlining the recovery plan.

The future price of RUNE depends heavily on the outcome of the ongoing investigations and the effectiveness of the implemented recovery measures. Investors are advised to exercise caution and conduct thorough due diligence before making any investment decisions. The situation highlights the importance of risk management and diversification within any cryptocurrency portfolio.

Keywords: RUNE, THORChain, Liquidity Crisis, Crypto Crash, DeFi, Decentralized Exchange, Cross-Chain, Cryptocurrency, Market Volatility, Price Drop, Security, Smart Contracts, Token, Governance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RUNE Crash: 60% Liquidity Drop On THORChain Impacts Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fils Awaits Alcaraz After Upsets Rock Monte Carlo Masters

Apr 11, 2025

Fils Awaits Alcaraz After Upsets Rock Monte Carlo Masters

Apr 11, 2025 -

Europa League Lyon Vs Manchester United Live Updates Score And Match Analysis

Apr 11, 2025

Europa League Lyon Vs Manchester United Live Updates Score And Match Analysis

Apr 11, 2025 -

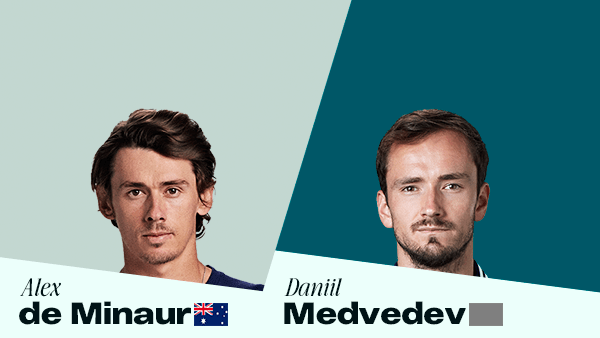

Monte Carlo Masters Medvedev Vs De Minaur Live Stream Tv Guide And Betting Tips

Apr 11, 2025

Monte Carlo Masters Medvedev Vs De Minaur Live Stream Tv Guide And Betting Tips

Apr 11, 2025 -

Martin Kemps Marriage In Jeopardy Son Roman Reacts To Confession

Apr 11, 2025

Martin Kemps Marriage In Jeopardy Son Roman Reacts To Confession

Apr 11, 2025 -

Legia Warsaw Vs Chelsea Europa Conference League Match Updates

Apr 11, 2025

Legia Warsaw Vs Chelsea Europa Conference League Match Updates

Apr 11, 2025