S$7 Million Misappropriated: Ex-Company Director's China Property Fraud Unveiled

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S$7 Million Misappropriated: Ex-Company Director's China Property Fraud Unveiled

Singapore is reeling after the shocking revelation of a multi-million dollar fraud involving a former company director and misappropriated funds used to purchase property in China. The case, which has sent shockwaves through the business community, highlights the increasing sophistication of financial crimes and the vulnerabilities of corporate governance. The details, unveiled in a recent court hearing, paint a picture of elaborate deceit and potential systemic weaknesses.

A Web of Deceit: How the Fraud Unfolded

The accused, [Insert Name if available, otherwise use "the former director"], a former director of [Insert Company Name], allegedly misappropriated a staggering S$7 million from the company's coffers. Investigations reveal a carefully orchestrated scheme spanning several years. The funds, initially disguised as legitimate business transactions, were secretly channeled into offshore accounts before being used to purchase several high-value properties in various Chinese cities.

Sophisticated Scheme Exploits Loopholes:

The complexity of the scheme highlights the challenges faced by businesses in detecting and preventing such sophisticated financial crimes. Investigators believe the former director exploited loopholes in the company's internal financial controls, leveraging their position of trust to mask their illicit activities. This underlines the critical need for robust internal audit systems and stringent oversight mechanisms within companies, especially those operating internationally.

The Role of Offshore Accounts and Cross-Border Transactions:

The use of offshore accounts and cross-border transactions played a significant role in concealing the fraudulent activities. The opaque nature of these transactions makes it difficult to trace the flow of funds, requiring extensive investigations by both local and international authorities. This case underscores the urgency for greater transparency and regulatory cooperation in combating cross-border financial crime.

Implications for Corporate Governance in Singapore:

This case has significant implications for corporate governance in Singapore. It serves as a stark reminder of the importance of:

- Strengthening internal controls: Companies need to implement robust internal audit procedures and regularly review their financial processes to detect anomalies and prevent fraud.

- Enhancing transparency: Open communication and clear reporting mechanisms are essential for maintaining accountability and preventing financial misconduct.

- Improving employee vetting: Thorough background checks and due diligence are crucial when hiring individuals in positions of trust.

- Regular external audits: Independent audits can provide an objective assessment of a company's financial health and identify potential red flags.

The Ongoing Investigation and Legal Proceedings:

The authorities are currently conducting a thorough investigation into the matter, aiming to recover the misappropriated funds and bring the perpetrators to justice. The case is expected to go to trial soon, with the former director facing serious charges, including breach of trust and money laundering. The outcome will have significant implications for future corporate fraud cases and the enforcement of related legislation in Singapore.

Keywords: Singapore, fraud, China, property, misappropriation, corporate governance, financial crime, offshore accounts, money laundering, internal controls, investigation, legal proceedings, S$7 million, [Insert Company Name if available], [Insert Name of Accused if available].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S$7 Million Misappropriated: Ex-Company Director's China Property Fraud Unveiled. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

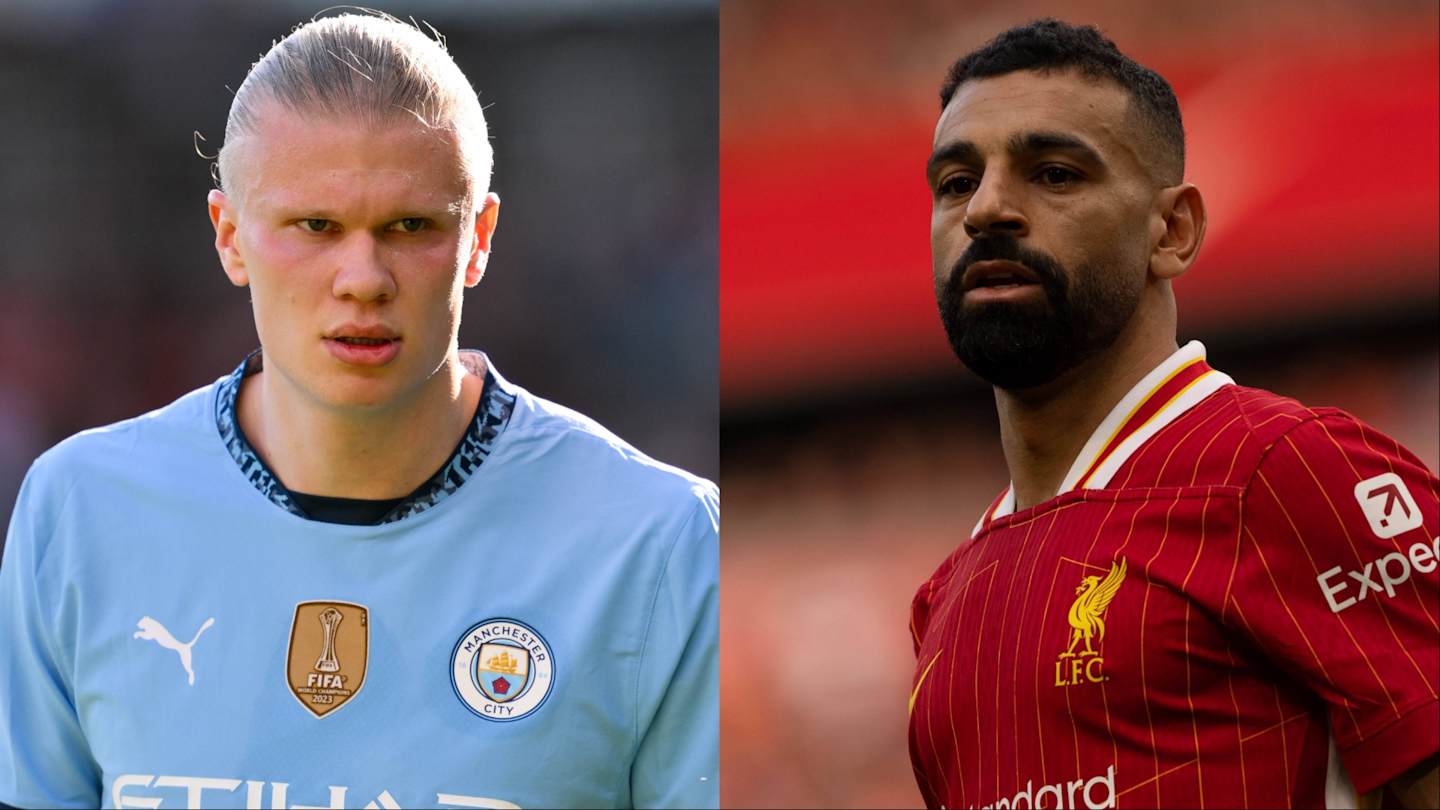

Premier League Golden Boot Standings Latest Updates And Top Contenders

May 21, 2025

Premier League Golden Boot Standings Latest Updates And Top Contenders

May 21, 2025 -

Facing Windows 10s Sunset Dells Vision For The Next Generation Of Pcs

May 21, 2025

Facing Windows 10s Sunset Dells Vision For The Next Generation Of Pcs

May 21, 2025 -

Capitals Beat Wings Jarvis Empty Netter Seals Victory

May 21, 2025

Capitals Beat Wings Jarvis Empty Netter Seals Victory

May 21, 2025 -

Analysis The Implications Of Trumps Take It Down Act

May 21, 2025

Analysis The Implications Of Trumps Take It Down Act

May 21, 2025 -

Times Internets Strategic Acquisition Cricbuzz And The Dream11 Partnership

May 21, 2025

Times Internets Strategic Acquisition Cricbuzz And The Dream11 Partnership

May 21, 2025