Safe-Haven Crypto: Investors Flee Dollar, Embrace Digital Assets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Safe-Haven Crypto: Investors Flee Dollar, Embrace Digital Assets

The US dollar's recent volatility is pushing investors into the perceived safety of cryptocurrencies, marking a significant shift in the traditional safe-haven asset landscape. As inflation concerns persist and geopolitical uncertainty looms, Bitcoin and other digital assets are increasingly seen as a hedge against economic turmoil. This flight from the dollar isn't just a trend; it's a potential paradigm shift in how investors view risk and diversification.

The Dollar's Diminishing Appeal

The US dollar, long considered the world's reserve currency and a safe haven during times of crisis, is facing unprecedented challenges. High inflation rates, coupled with aggressive interest rate hikes by the Federal Reserve, have eroded investor confidence. The dollar's decline against other major currencies further fuels the search for alternative, more stable stores of value. This uncertainty is pushing investors to explore assets perceived as less susceptible to traditional economic fluctuations.

Cryptocurrencies: A New Safe Haven?

While cryptocurrencies are notoriously volatile, their decentralized nature and limited supply are attractive to investors seeking protection from government policies and inflationary pressures. Bitcoin, the largest cryptocurrency by market capitalization, is often cited as "digital gold," echoing its perceived scarcity and potential for long-term value appreciation.

- Decentralization: Unlike fiat currencies controlled by central banks, cryptocurrencies operate on a decentralized blockchain technology, making them resistant to government manipulation and censorship.

- Scarcity: Many cryptocurrencies have a fixed supply, limiting their potential for inflation unlike fiat currencies which can be printed at will.

- Global Accessibility: Cryptocurrencies are accessible 24/7, regardless of geographical location or banking restrictions.

Beyond Bitcoin: Exploring the Altcoin Landscape

While Bitcoin dominates the conversation, other cryptocurrencies, known as altcoins, are also benefiting from the shift in investor sentiment. Stablecoins, pegged to the value of fiat currencies like the US dollar, offer a degree of stability lacking in more volatile assets. However, it's crucial to remember that even stablecoins carry inherent risks. Investors must diligently research and understand the risks associated with all cryptocurrencies before investing.

Risks and Considerations:

It's essential to acknowledge the inherent risks associated with investing in cryptocurrencies. Their price volatility is significant, and the market is susceptible to speculative bubbles and rapid price crashes. Regulatory uncertainty also poses a challenge, with governments worldwide still grappling with how to effectively regulate the digital asset space. Before diving into the crypto market, thorough research, risk assessment and diversification are crucial.

The Future of Safe Havens:

The growing acceptance of cryptocurrencies as a safe haven asset reflects a broader shift in investor behavior. As traditional financial systems face increasing uncertainty, investors are actively seeking alternatives offering resilience and protection against economic volatility. While the future remains uncertain, the current trend suggests that cryptocurrencies are playing an increasingly important role in the global financial landscape. However, it's imperative for investors to approach this new asset class with caution and a comprehensive understanding of the associated risks. The shift toward cryptocurrencies as safe haven assets is a developing story, and its long-term impact on global finance remains to be seen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Safe-Haven Crypto: Investors Flee Dollar, Embrace Digital Assets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eurovision Song Contest 2024 What To Expect In Switzerland

Apr 29, 2025

Eurovision Song Contest 2024 What To Expect In Switzerland

Apr 29, 2025 -

Income Allianz Deal Wps Lee Hsien Loong Says They Would Have Approved It Too

Apr 29, 2025

Income Allianz Deal Wps Lee Hsien Loong Says They Would Have Approved It Too

Apr 29, 2025 -

Lais Actions Exposed China Daily Editorial On Recent Protests

Apr 29, 2025

Lais Actions Exposed China Daily Editorial On Recent Protests

Apr 29, 2025 -

North Yorkshires Whitby Hosts Massive Gothic Festival

Apr 29, 2025

North Yorkshires Whitby Hosts Massive Gothic Festival

Apr 29, 2025 -

Jordon Hudson Defends Privacy Belichick Girlfriend Stops Interview Question

Apr 29, 2025

Jordon Hudson Defends Privacy Belichick Girlfriend Stops Interview Question

Apr 29, 2025

Latest Posts

-

Sonia Sidhus Path To Victory Analyzing The Brampton South Liberal Win

Apr 30, 2025

Sonia Sidhus Path To Victory Analyzing The Brampton South Liberal Win

Apr 30, 2025 -

Legal Showdown Dismissed Ftc Commissioners Demand Their Jobs Back

Apr 30, 2025

Legal Showdown Dismissed Ftc Commissioners Demand Their Jobs Back

Apr 30, 2025 -

Woo Commerce Phishing Campaign Exploits Fake Patches To Install Malware Backdoors

Apr 30, 2025

Woo Commerce Phishing Campaign Exploits Fake Patches To Install Malware Backdoors

Apr 30, 2025 -

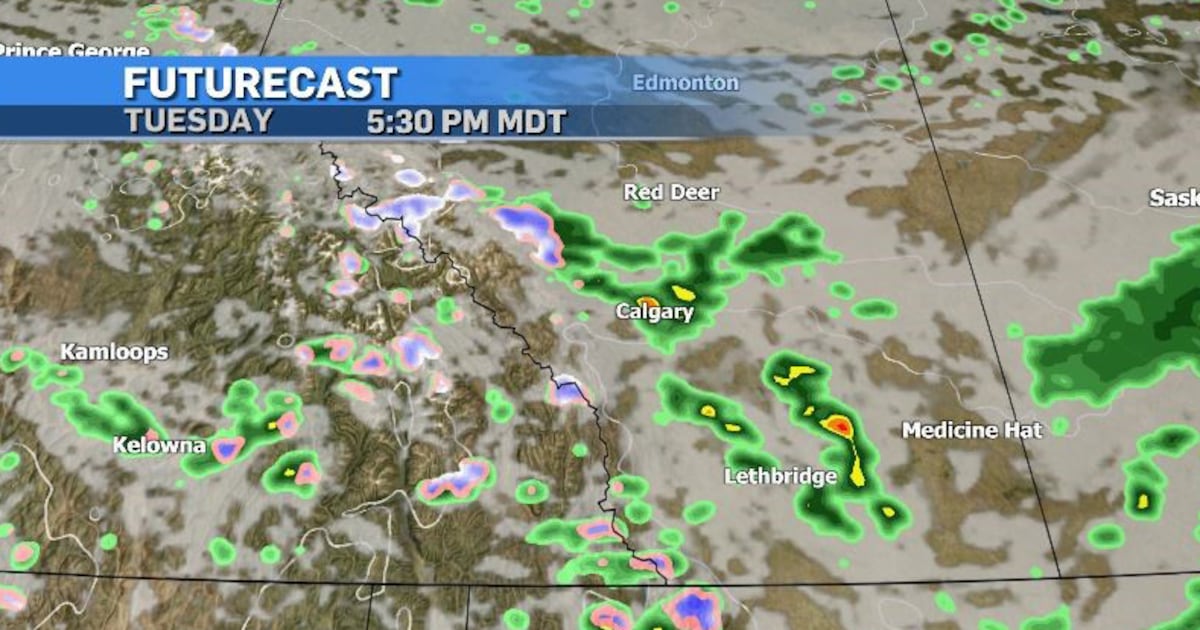

Thunderstorm Watch For Calgary Windy Conditions And Cloudy Skies Expected Tuesday

Apr 30, 2025

Thunderstorm Watch For Calgary Windy Conditions And Cloudy Skies Expected Tuesday

Apr 30, 2025 -

Matchday Focus Leeds Uniteds Home Fixture Form And Prospects

Apr 30, 2025

Matchday Focus Leeds Uniteds Home Fixture Form And Prospects

Apr 30, 2025