Safe-Haven Crypto: US Investors Flee Dollar Amidst Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Safe-Haven Crypto: US Investors Flee Dollar Amidst Uncertainty

The US dollar's recent volatility has sent shockwaves through the financial markets, prompting a significant shift in investor behavior. As uncertainty mounts surrounding inflation, interest rates, and the overall economic outlook, many American investors are turning to cryptocurrencies – specifically Bitcoin – as a perceived safe-haven asset. This flight to digital assets highlights a growing distrust in traditional fiat currencies and a search for alternative stores of value.

The Dollar's Wobbly Foundation:

The US dollar's weakening position isn't a new phenomenon, but recent events have exacerbated existing concerns. High inflation rates, aggressive interest rate hikes by the Federal Reserve, and geopolitical instability have all contributed to a decline in investor confidence. This uncertainty has spurred a search for assets perceived as less vulnerable to these macroeconomic headwinds.

Bitcoin: A Digital Safe Haven?

While cryptocurrency markets are notoriously volatile, Bitcoin's decentralized nature and limited supply make it an attractive alternative for some investors. Unlike fiat currencies controlled by central banks, Bitcoin's price is determined by market forces, potentially making it a hedge against inflation and government intervention. This perception is driving a surge in demand, particularly among those seeking to diversify their portfolios away from the dollar.

Understanding the Investor Mindset:

The current situation reflects a fundamental shift in investor psychology. Traditional "safe-haven" assets like gold have historically been favored during times of economic turmoil. However, the rise of cryptocurrencies, particularly Bitcoin, is offering a new, technologically advanced option for those seeking to preserve capital amidst uncertainty. This move underscores a growing skepticism towards traditional financial institutions and a desire for greater control over one's finances.

Is Bitcoin Truly a Safe Haven? A Critical Perspective:

It's crucial to acknowledge that Bitcoin's volatility remains a significant concern. While it may offer protection against some forms of economic instability, it's not immune to market fluctuations. Regulatory uncertainty surrounding cryptocurrencies in various jurisdictions also poses a risk. Therefore, investing in Bitcoin should be approached with caution and a thorough understanding of the inherent risks involved.

Diversification and Risk Management:

Experts emphasize the importance of diversification as a core tenet of any sound investment strategy. Relying solely on Bitcoin, or any single asset, exposes investors to significant risk. A well-diversified portfolio that includes traditional assets alongside cryptocurrencies can help mitigate potential losses and optimize returns. Before investing in Bitcoin or any other cryptocurrency, thorough research and consultation with a qualified financial advisor are strongly recommended.

Key Takeaways:

- Dollar Weakness: The US dollar's weakening position is pushing investors towards alternative assets.

- Bitcoin's Appeal: Bitcoin's decentralized nature and limited supply are driving its adoption as a potential safe-haven asset.

- Risk vs. Reward: While Bitcoin offers potential benefits, its volatility and regulatory uncertainty require careful consideration.

- Diversification is Key: A well-diversified portfolio remains crucial for mitigating risk.

- Seek Professional Advice: Consult a financial advisor before making any significant investment decisions.

The current shift in investor sentiment towards cryptocurrencies like Bitcoin represents a significant development in the global financial landscape. As economic uncertainty persists, the role of digital assets as safe-haven investments will likely continue to be a topic of intense debate and scrutiny. Only time will tell whether Bitcoin truly lives up to its reputation as a reliable safe haven in turbulent times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Safe-Haven Crypto: US Investors Flee Dollar Amidst Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The New Frontier Of Gastronomy Electronic Taste Reproduction

Apr 30, 2025

The New Frontier Of Gastronomy Electronic Taste Reproduction

Apr 30, 2025 -

Ipl 2025 Faf Du Plessis Half Century Overshadows Dhoni Leads Dc Past Kkr

Apr 30, 2025

Ipl 2025 Faf Du Plessis Half Century Overshadows Dhoni Leads Dc Past Kkr

Apr 30, 2025 -

Tucson Area Residents Ordered To Evacuate As Wildfire Grows Amid Strong Winds

Apr 30, 2025

Tucson Area Residents Ordered To Evacuate As Wildfire Grows Amid Strong Winds

Apr 30, 2025 -

Your Guide To Power Court Key Information And Faqs

Apr 30, 2025

Your Guide To Power Court Key Information And Faqs

Apr 30, 2025 -

Record Breaking Dtes 574 Million Electric Rate Hike Application Under Scrutiny

Apr 30, 2025

Record Breaking Dtes 574 Million Electric Rate Hike Application Under Scrutiny

Apr 30, 2025

Latest Posts

-

Ronaldo And Al Nassr Face Kawasakis Defiant Challenge In Crucial Match

May 01, 2025

Ronaldo And Al Nassr Face Kawasakis Defiant Challenge In Crucial Match

May 01, 2025 -

Marvels New Release A Deep Dive Into The Films Success

May 01, 2025

Marvels New Release A Deep Dive Into The Films Success

May 01, 2025 -

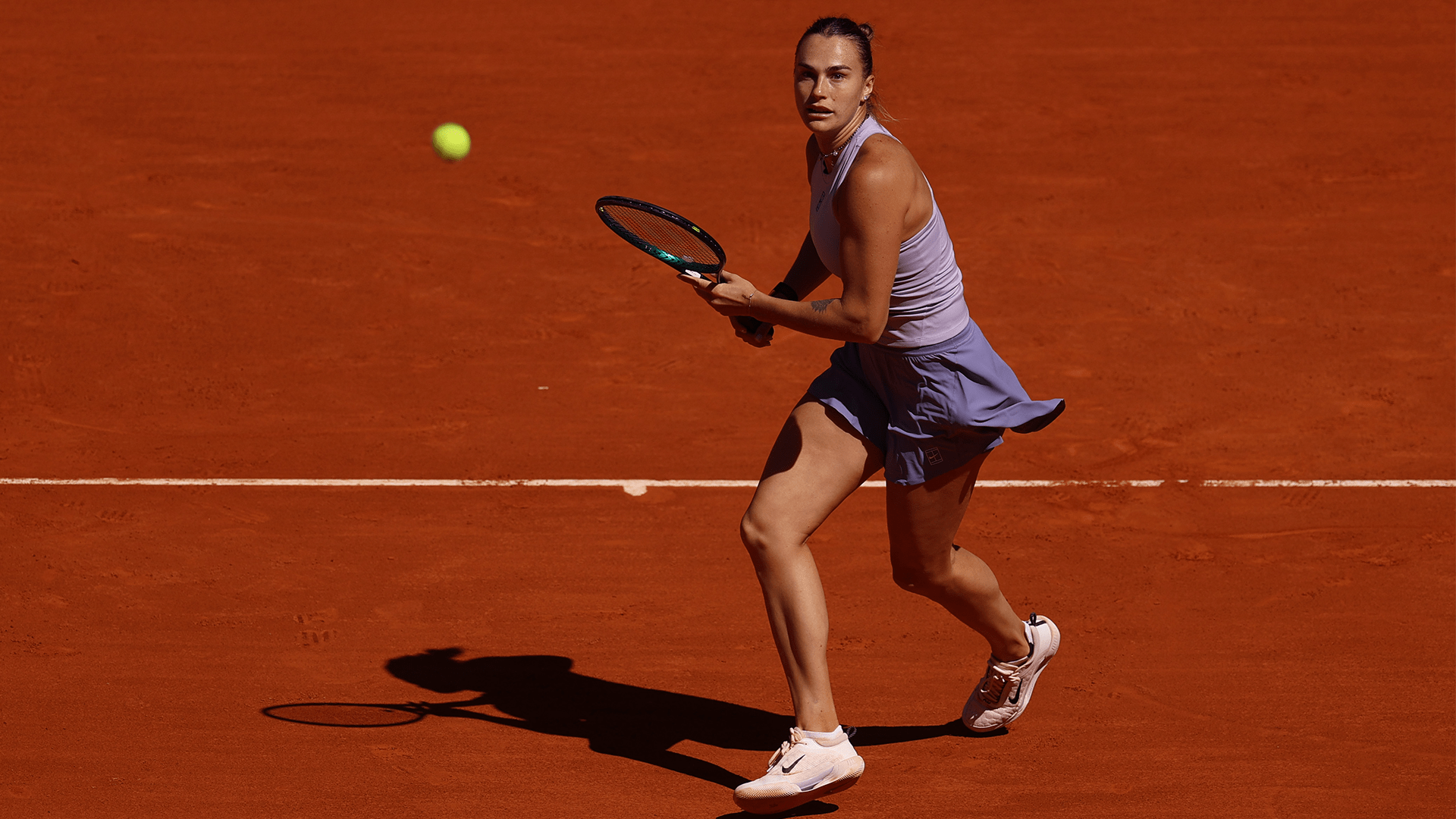

Aryna Sabalenka Vs Peyton Stearns Complete Madrid Open Match Guide

May 01, 2025

Aryna Sabalenka Vs Peyton Stearns Complete Madrid Open Match Guide

May 01, 2025 -

New York Jets Qb Jordan Travis Retires A Career Cut Short

May 01, 2025

New York Jets Qb Jordan Travis Retires A Career Cut Short

May 01, 2025 -

Top Ranked Sabalenka Defeats Stearns To Advance In Madrid

May 01, 2025

Top Ranked Sabalenka Defeats Stearns To Advance In Madrid

May 01, 2025