SEC Under Pressure From Robinhood: A New Framework For Tokenized RWAs?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SEC Under Pressure from Robinhood: A New Framework for Tokenized Real-World Assets?

The Securities and Exchange Commission (SEC) is facing mounting pressure, particularly from retail brokerage giant Robinhood, to clarify its stance on tokenized real-world assets (RWAs). This pressure comes amidst a burgeoning market for these assets, which represent a bridge between traditional finance and the decentralized world of blockchain technology. Robinhood's proactive engagement suggests a potential paradigm shift in how regulators approach the intersection of finance and crypto. Could this lead to a new framework for tokenized RWAs, fostering innovation while mitigating risk?

Robinhood's Proactive Approach:

Robinhood's recent actions indicate a strategic move towards actively shaping the regulatory landscape. Instead of passively awaiting SEC pronouncements, the company seems intent on engaging directly, pushing for a clearer definition and regulatory pathway for tokenized RWAs. This proactive approach reflects a growing sentiment within the industry – the need for collaborative regulatory development rather than reactive compliance. The company's considerable user base, largely comprised of retail investors, amplifies the urgency for clear guidelines. A lack of clarity creates significant uncertainty for both investors and platforms.

The Complexities of Tokenized RWAs:

Tokenized RWAs represent a complex challenge for regulators. Unlike cryptocurrencies, which are often viewed as speculative assets, RWAs are backed by tangible assets like real estate, art, or commodities. This inherent connection to the real world introduces unique regulatory considerations. Questions surrounding fractional ownership, valuation, and secondary market trading require careful consideration. The SEC's current regulatory framework, designed primarily for traditional securities, may be inadequate for the unique characteristics of tokenized RWAs.

Potential Benefits of a Clear Framework:

A clearly defined regulatory framework for tokenized RWAs offers several key advantages:

- Increased Investor Protection: Clear rules and regulations will protect investors from fraud and manipulation.

- Boosted Market Transparency: A structured framework enhances transparency, making it easier for investors to assess risks.

- Stimulated Innovation: Regulatory clarity fosters innovation by reducing uncertainty and encouraging investment in the sector.

- Enhanced Market Liquidity: A well-regulated market typically experiences improved liquidity, benefiting both buyers and sellers.

The Road Ahead: Collaboration and Clarity:

The ongoing dialogue between Robinhood and the SEC suggests a potential path towards a more collaborative regulatory approach. The SEC's response will be crucial in determining the future of tokenized RWAs in the United States. A balanced framework is needed – one that promotes innovation while safeguarding investors. Failure to provide clarity could stifle a potentially transformative sector, pushing development offshore and potentially hindering economic growth.

Keywords: SEC, Robinhood, Tokenized RWAs, Real-World Assets, Regulatory Framework, Cryptocurrency, Blockchain, Fractional Ownership, Investment, Securities Regulation, Fintech, Innovation, Market Liquidity, Investor Protection.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SEC Under Pressure From Robinhood: A New Framework For Tokenized RWAs?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sparks Performance Review Split Decisions And Individual Grades

May 23, 2025

Sparks Performance Review Split Decisions And Individual Grades

May 23, 2025 -

Hay Festival 2025 Preview Authors Events And Key Highlights

May 23, 2025

Hay Festival 2025 Preview Authors Events And Key Highlights

May 23, 2025 -

Okc Thunders Gilgeous Alexander Clinches Nba Mvp A Season Of Dominance

May 23, 2025

Okc Thunders Gilgeous Alexander Clinches Nba Mvp A Season Of Dominance

May 23, 2025 -

Microsofts Azure Embraces Xai Grok 3 5 Implications For Open Ai And The Ai Landscape

May 23, 2025

Microsofts Azure Embraces Xai Grok 3 5 Implications For Open Ai And The Ai Landscape

May 23, 2025 -

Open Source Llm Showdown Qwen 2 5 And Qwen 3 Surge Ahead

May 23, 2025

Open Source Llm Showdown Qwen 2 5 And Qwen 3 Surge Ahead

May 23, 2025

Latest Posts

-

Mission Impossible Dead Reckoning Part One Hayley Atwells Account Of Wildlife Related Filming Setbacks

May 23, 2025

Mission Impossible Dead Reckoning Part One Hayley Atwells Account Of Wildlife Related Filming Setbacks

May 23, 2025 -

Nrl Transfer News Galvins 2 Million Sacrifice Imminent

May 23, 2025

Nrl Transfer News Galvins 2 Million Sacrifice Imminent

May 23, 2025 -

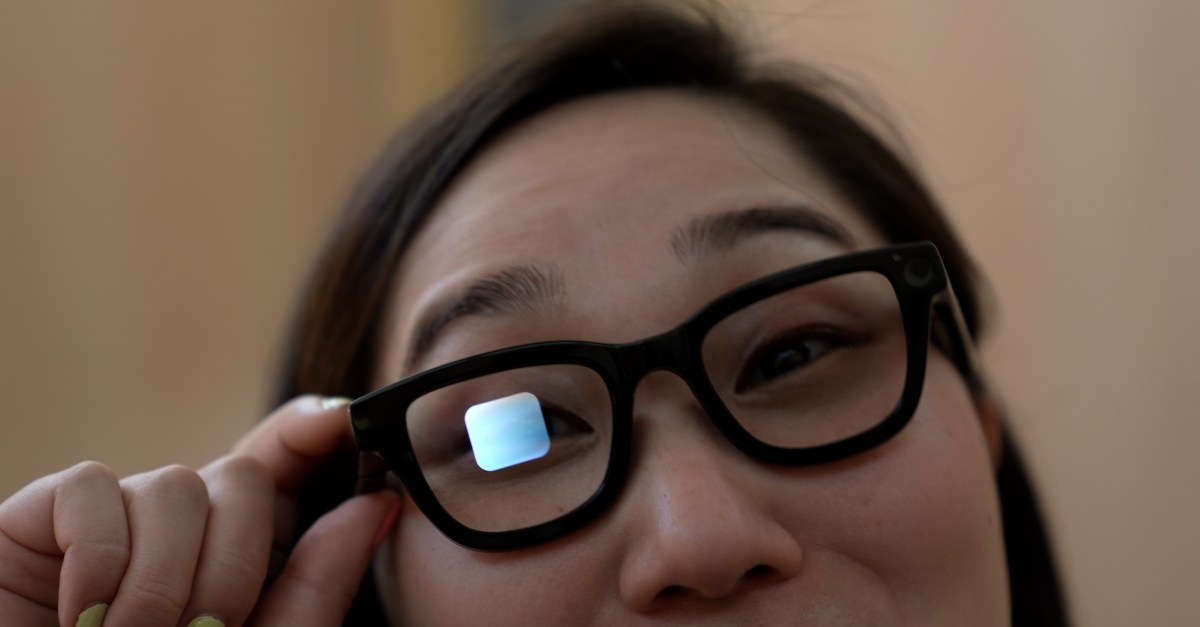

In Depth Look At Googles Ai Smart Glasses Prototype

May 23, 2025

In Depth Look At Googles Ai Smart Glasses Prototype

May 23, 2025 -

Sat Nav Issues Alert Silverstone Moto Gp Event

May 23, 2025

Sat Nav Issues Alert Silverstone Moto Gp Event

May 23, 2025 -

Animoca Brands And Astar Network A Strategic Partnership For Asian Ips In Web3

May 23, 2025

Animoca Brands And Astar Network A Strategic Partnership For Asian Ips In Web3

May 23, 2025