SEC Vs. Crypto: 2025 Legal Battles And Setbacks For The Agency

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SEC vs. Crypto: 2025 Legal Battles and Setbacks for the Agency

The ongoing conflict between the Securities and Exchange Commission (SEC) and the cryptocurrency industry is shaping up to be a defining legal battle of 2025. This year promises a series of crucial court cases and regulatory challenges that could significantly alter the landscape of digital assets in the United States, and potentially expose significant setbacks for the SEC's aggressive regulatory approach.

The SEC, under Chair Gary Gensler, has adopted a firm stance, classifying most cryptocurrencies as unregistered securities. This has led to numerous lawsuits against major players in the crypto space, resulting in a flurry of legal challenges that are far from resolved. The outcomes of these battles will not only impact individual companies but will set crucial precedents for the future regulation of the entire industry.

Ripple's Landmark Case and its Ripple Effect

The highly anticipated Ripple Labs vs. SEC case, ongoing since 2020, remains a pivotal point of contention. The ruling, expected to have significant implications for the entire crypto market, will determine the SEC's power to define which digital assets qualify as securities. A favorable ruling for Ripple could significantly weaken the SEC's authority and open the door for greater regulatory clarity, potentially even leading to a re-evaluation of past SEC enforcement actions. Conversely, a loss for Ripple could embolden the SEC and further solidify its aggressive regulatory stance.

Coinbase and Binance: Facing the SEC's Wrath

Major cryptocurrency exchanges Coinbase and Binance are also locked in significant legal battles with the SEC. Both companies face accusations of operating unregistered securities exchanges and offering unregistered securities to investors. These cases represent a direct challenge to the operational models of some of the largest crypto trading platforms in the world. The outcome will significantly influence the future structure and operation of cryptocurrency exchanges within the US. The SEC's success or failure in these cases will directly impact investor confidence and the overall stability of the crypto market.

The Challenges of Regulation in a Decentralized World

The SEC’s challenges extend beyond individual lawsuits. The decentralized nature of blockchain technology presents inherent difficulties in applying traditional securities regulations. The SEC's struggle to effectively regulate decentralized finance (DeFi) protocols and non-fungible tokens (NFTs) highlights this inherent challenge. The agency is grappling with how to regulate a technology that operates outside traditional financial structures, leading to potential regulatory gaps and a constant cat-and-mouse game with innovative projects.

Potential Setbacks and Future Implications for the SEC

Several factors could lead to setbacks for the SEC in 2025. These include:

- Judicial pushback: Courts may increasingly question the SEC’s broad interpretation of securities laws in the context of crypto assets.

- Legislative intervention: Congress may intervene with legislation that provides greater clarity and potentially limits the SEC's authority in the crypto space.

- International divergence: Different regulatory approaches globally could create a challenging environment for US-based crypto businesses and potentially weaken the SEC's influence.

The outcome of these legal battles will have far-reaching consequences. A series of losses for the SEC could lead to a re-evaluation of its regulatory strategy, potentially fostering a more collaborative approach with the industry. Conversely, continued success for the SEC could consolidate its authority but also risk stifling innovation and driving crypto activity overseas.

The SEC vs. crypto conflict in 2025 is not just a legal battle; it's a defining moment for the future of finance and technology. The coming months promise to be crucial in shaping the regulatory landscape of the cryptocurrency industry in the United States and beyond. Stay tuned for further updates as these significant legal cases unfold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SEC Vs. Crypto: 2025 Legal Battles And Setbacks For The Agency. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fc Bayern Startelf Enthuellt Fokus Auf Die Neue Defensive

Mar 30, 2025

Fc Bayern Startelf Enthuellt Fokus Auf Die Neue Defensive

Mar 30, 2025 -

John Abraham On Pathaans Bheege Honth Tere Meme A Romantic Classic

Mar 30, 2025

John Abraham On Pathaans Bheege Honth Tere Meme A Romantic Classic

Mar 30, 2025 -

Watch Canadiens Vs Panthers Game Time Tv Listings And Preview

Mar 30, 2025

Watch Canadiens Vs Panthers Game Time Tv Listings And Preview

Mar 30, 2025 -

Inter Vs Udinese Serie A Official Starting Lineups Revealed

Mar 30, 2025

Inter Vs Udinese Serie A Official Starting Lineups Revealed

Mar 30, 2025 -

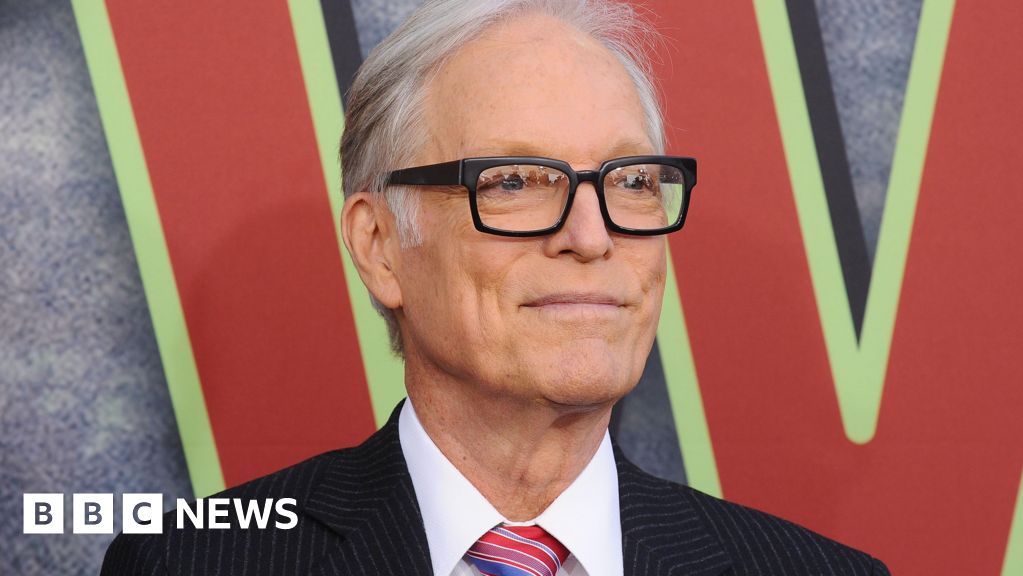

Beloved Actor Richard Chamberlain Passes Away At Age 90

Mar 30, 2025

Beloved Actor Richard Chamberlain Passes Away At Age 90

Mar 30, 2025