SEC's Peirce: The Case Against Classifying Many NFTs As Securities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SEC's Peirce: The Case Against Classifying Many NFTs as Securities

The Securities and Exchange Commission (SEC) is currently grappling with the burgeoning world of Non-Fungible Tokens (NFTs), facing the complex question of whether many should be classified as securities. Commissioner Hester Peirce, known for her often-dissenting, crypto-friendly views, has consistently argued against broad-brush regulation, advocating for a more nuanced approach. Her position offers a compelling counterpoint to the SEC's more cautious stance, sparking significant debate within the industry and beyond.

The SEC's Cautious Approach and the Howey Test

The SEC's primary concern revolves around investor protection. They utilize the Howey Test, a decades-old legal framework, to determine whether an investment constitutes a security. This test considers whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. Many NFTs, particularly those offered through initial NFT offerings (INO)s, could potentially meet this criteria, leading to SEC scrutiny and potential enforcement actions. The fear is that investors might be misled into believing they are purchasing something with inherent value, rather than a speculative asset.

Peirce's Argument for a More Nuanced Approach

Commissioner Peirce argues that applying the Howey Test rigidly to all NFTs is overly simplistic and potentially stifles innovation. She believes a blanket classification ignores the vast diversity within the NFT space. Many NFTs, she contends, are purely digital collectibles, similar to trading cards or artwork, without any expectation of profit derived from a third-party's efforts. Forcing these into the securities framework, she argues, is unnecessary and could have detrimental effects on the NFT market.

The Importance of Context and Functionality

Peirce emphasizes the critical need to consider the specific context and functionality of each NFT. A limited-edition digital artwork sold directly by the artist, for example, might not meet the Howey Test criteria, while an NFT offered as part of a project promising future returns clearly could. She advocates for a more flexible regulatory framework that allows for a case-by-case analysis, rather than a blanket rule that could inadvertently harm legitimate projects.

The Potential Impact of Overregulation

The potential consequences of overregulation are significant. A broad classification of NFTs as securities could:

- Stifle Innovation: Fear of regulatory uncertainty could deter creators and investors, hindering the development of innovative NFT projects.

- Drive Activity Offshore: Projects might relocate to jurisdictions with more favorable regulatory environments, reducing the US's influence in this rapidly growing sector.

- Harm Small Creators: The cost and complexity of complying with securities regulations could disproportionately impact smaller creators and artists.

The Ongoing Debate and Future Implications

The debate surrounding NFT regulation is far from over. The SEC's approach, while prioritizing investor protection, needs to balance this with fostering innovation. Peirce's dissenting voice provides a crucial perspective, urging a more nuanced approach that acknowledges the heterogeneity of the NFT market. The outcome of this debate will significantly impact the future of NFTs, shaping their development and influencing their adoption across various industries. The SEC's future decisions will be closely watched by investors, creators, and regulators worldwide. The future of NFT regulation hinges on finding a balance between safeguarding investors and fostering the growth of this dynamic technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SEC's Peirce: The Case Against Classifying Many NFTs As Securities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Top Asian Intellectual Properties Enter Web3 Via Animoca Brands And Astar Network Partnership

May 23, 2025

Top Asian Intellectual Properties Enter Web3 Via Animoca Brands And Astar Network Partnership

May 23, 2025 -

Us Faces Existential Threat Scientists Predict Devastating Mega Tsunami

May 23, 2025

Us Faces Existential Threat Scientists Predict Devastating Mega Tsunami

May 23, 2025 -

Nba Conference Finals Thunders Sga Fuels Game 1 Victory Over Timberwolves

May 23, 2025

Nba Conference Finals Thunders Sga Fuels Game 1 Victory Over Timberwolves

May 23, 2025 -

Vivid Sydney Shadows Eviction Of Homeless Community Kitchen

May 23, 2025

Vivid Sydney Shadows Eviction Of Homeless Community Kitchen

May 23, 2025 -

Martin Place Food Charity Displacement Vivid Sydneys Impact On Years Of Community Support

May 23, 2025

Martin Place Food Charity Displacement Vivid Sydneys Impact On Years Of Community Support

May 23, 2025

Latest Posts

-

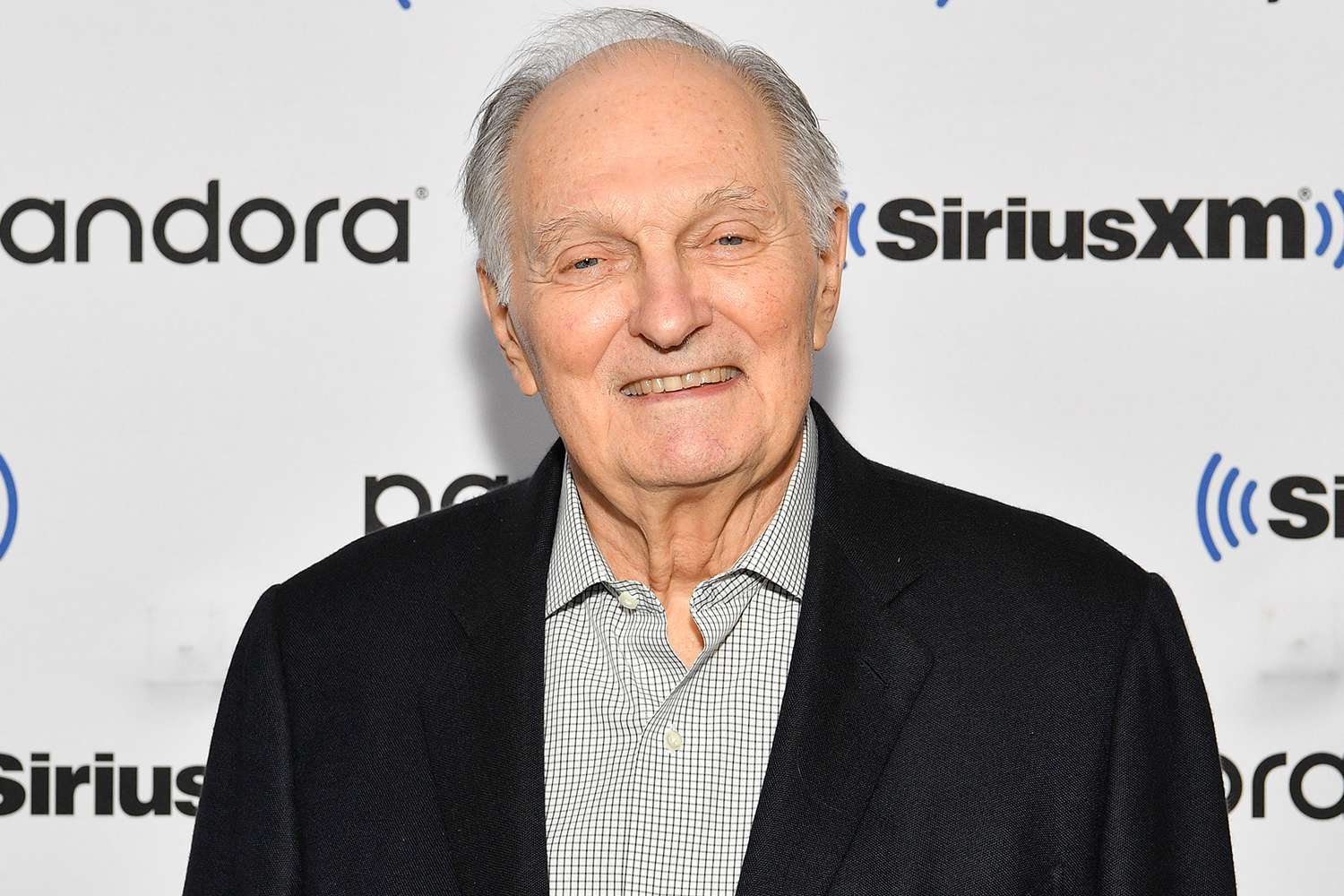

Alan Aldas Parkinsons Journey Challenges And Laughter At 89 Exclusive

May 23, 2025

Alan Aldas Parkinsons Journey Challenges And Laughter At 89 Exclusive

May 23, 2025 -

Revisiting A Classic Movie Show Name S New Tv Spot Underscores The Brutal Truth After 28 Years

May 23, 2025

Revisiting A Classic Movie Show Name S New Tv Spot Underscores The Brutal Truth After 28 Years

May 23, 2025 -

Nyt Wordle Today Solution And Hints For 1433 May 22

May 23, 2025

Nyt Wordle Today Solution And Hints For 1433 May 22

May 23, 2025 -

Bet Netflix A Critical Analysis Of The Manga Adaptation And Its Shortcomings

May 23, 2025

Bet Netflix A Critical Analysis Of The Manga Adaptation And Its Shortcomings

May 23, 2025 -

Bonus Podcast A Conversation On Reframing Black Historys Representation

May 23, 2025

Bonus Podcast A Conversation On Reframing Black Historys Representation

May 23, 2025