SEC's Peirce: The Case Against Classifying Most NFTs, Including Creator-Funded Projects, As Securities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SEC's Peirce: The Case Against Classifying Most NFTs, Including Creator-Funded Projects, as Securities

The Securities and Exchange Commission (SEC) Commissioner Hester Peirce has once again voiced her dissent against the broad classification of non-fungible tokens (NFTs) as securities. Her recent statements highlight a crucial debate within the regulatory landscape surrounding this burgeoning technology, particularly concerning the impact on creator-funded projects. Peirce argues that a blanket approach to NFT regulation stifles innovation and misunderstands the diverse nature of the NFT market.

This article delves into Commissioner Peirce's arguments, exploring why she believes the majority of NFTs shouldn't fall under securities laws and the potential ramifications of a more restrictive regulatory framework.

The Heart of the Matter: Howey Test and NFT Classification

The SEC's classification of assets as securities hinges largely on the Howey Test, a legal framework used to determine if an investment contract exists. This test considers four key elements: an investment of money, a common enterprise, an expectation of profits, and profits derived primarily from the efforts of others. Commissioner Peirce argues that many NFTs, especially those funded by creators directly, don't meet these criteria.

She emphasizes that many NFT projects function more like the sale of art or collectibles than investment contracts. Creators often retain full control over their projects, and the value of the NFT is not primarily dependent on the efforts of a centralized entity. This is in stark contrast to the situation with many initial coin offerings (ICOs), which were often deemed securities due to the significant involvement of promoters promising returns based on their efforts.

Creator-Funded Projects: A Special Case

Peirce's stance is particularly strong when it comes to creator-funded NFT projects. These projects often rely on direct sales to collectors, with the creator retaining significant creative control and not promising significant returns based on their future actions. Classifying these as securities, she contends, would stifle creativity and innovation within the NFT space, forcing creators to navigate complex and potentially prohibitive legal frameworks.

The Risks of Overregulation

Commissioner Peirce warns against the unintended consequences of overregulation. A broad classification of NFTs as securities could:

- Hinder Innovation: Creators may be discouraged from launching new projects due to the legal complexities and costs associated with securities compliance.

- Drive Projects Overseas: NFT creators may choose to launch their projects in jurisdictions with more favorable regulatory environments, potentially harming the US NFT market.

- Disadvantage Smaller Creators: The compliance costs associated with securities regulations would disproportionately affect smaller creators, potentially creating an uneven playing field.

A Call for a More Nuanced Approach

Instead of a blanket approach, Commissioner Peirce advocates for a more nuanced regulatory framework that takes into account the specific characteristics of each NFT project. She suggests a case-by-case analysis, focusing on the actual circumstances of each project rather than imposing a one-size-fits-all solution. This approach, she believes, would better protect investors while fostering innovation within the NFT ecosystem.

The Future of NFT Regulation

The debate surrounding NFT regulation remains ongoing. Commissioner Peirce's dissenting voice represents a crucial perspective, highlighting the importance of considering the diverse nature of the NFT market and avoiding overly broad regulatory interpretations that could stifle innovation and harm the growth of this emerging technology. The coming months and years will likely see further discussions and potential changes to the regulatory landscape, as policymakers grapple with the complexities of this new asset class. The outcome will significantly impact the future of the NFT industry and its role in the broader digital economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SEC's Peirce: The Case Against Classifying Most NFTs, Including Creator-Funded Projects, As Securities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lakers Pacers Trade Scenario Knecht For 16 1 Ppg Wing

May 23, 2025

Lakers Pacers Trade Scenario Knecht For 16 1 Ppg Wing

May 23, 2025 -

Bitcoin Cash Bch Rallies Then Pauses Whats Next For The Price

May 23, 2025

Bitcoin Cash Bch Rallies Then Pauses Whats Next For The Price

May 23, 2025 -

Ethical Questions Surround President Trumps Acceptance Of Luxurious Qatari Aircraft

May 23, 2025

Ethical Questions Surround President Trumps Acceptance Of Luxurious Qatari Aircraft

May 23, 2025 -

Analyzing Peter De Boers Success Strategies And Coaching Philosophies

May 23, 2025

Analyzing Peter De Boers Success Strategies And Coaching Philosophies

May 23, 2025 -

Google I O 2025 Deep Dive Into Android Xr Gemini Ai And Future Projects

May 23, 2025

Google I O 2025 Deep Dive Into Android Xr Gemini Ai And Future Projects

May 23, 2025

Latest Posts

-

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025 -

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025 -

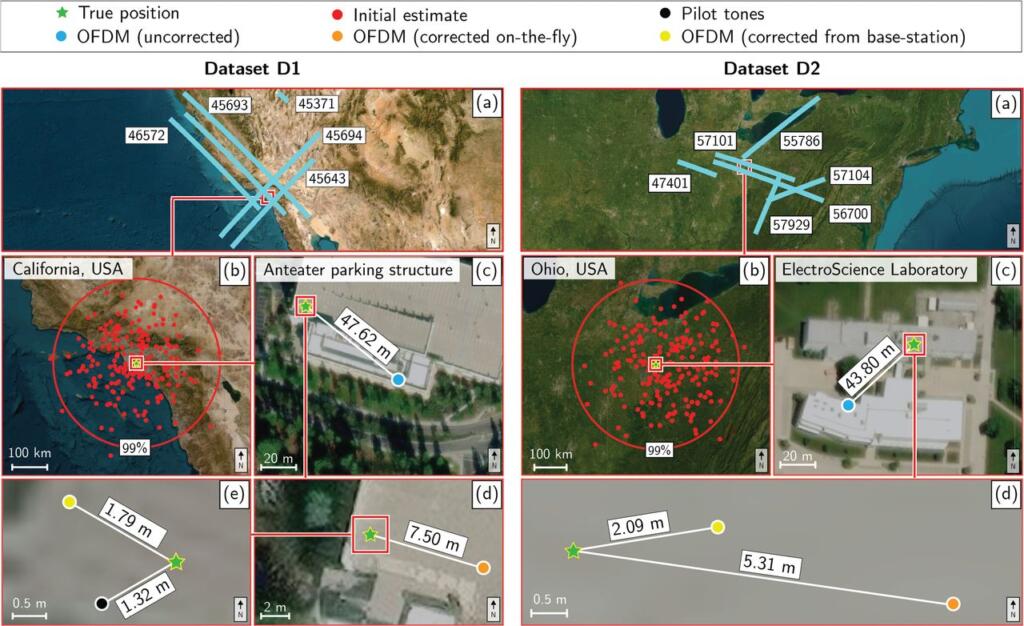

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025 -

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025 -

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025

Contamination Crisis Milk Recall Over Potentially Fatal Bacteria

May 23, 2025