Seeking A 10% Dividend Yield? Top Analyst Picks For Income Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Seeking a 10% Dividend Yield? Top Analyst Picks for Income Investors

Are you tired of low interest rates and searching for substantial income from your investments? A 10% dividend yield might seem like a pipe dream, but for savvy income investors, it's a realistic goal – albeit one requiring careful research and a higher-than-average risk tolerance. This article explores the potential for achieving this impressive yield and highlights top analyst picks for investors seeking significant passive income.

The Allure (and Risks) of High-Yield Dividend Stocks:

High-dividend stocks offer the enticing prospect of substantial passive income, potentially outpacing inflation and providing a comfortable financial cushion. However, it's crucial to understand the inherent risks. Companies offering such high yields often face challenges, such as:

- Financial Instability: High dividend payouts can strain a company's cash flow, particularly if earnings are declining.

- High Debt Levels: Companies may rely on debt to fund dividends, increasing financial risk.

- Dividend Cuts: A company might be forced to reduce or eliminate its dividend if financial performance deteriorates.

Therefore, thorough due diligence is paramount. Don't solely focus on the yield; assess the company's fundamentals, growth prospects, and debt levels before investing.

Top Analyst Picks for 10% Dividend Yield Potential (Disclaimer: This is not financial advice):

While achieving a consistent 10% dividend yield requires careful portfolio diversification and potentially investing in higher-risk securities, several sectors offer potential candidates. Note that the actual yield may fluctuate based on market conditions and company performance. Always consult with a financial advisor before making investment decisions.

Real Estate Investment Trusts (REITs): REITs often offer high dividend yields due to their required distribution policies. Analysts are currently highlighting several REITs in specific niche sectors, such as data centers and self-storage facilities, as potential high-yield options. Research specific REITs thoroughly before investing.

Energy Sector: The energy sector, particularly companies involved in oil and gas production, can offer attractive dividend yields, especially during periods of high commodity prices. However, this sector is highly volatile and subject to significant price fluctuations. Careful analysis of company-specific risks is crucial.

High-Yield Bond Funds: While not individual stocks, high-yield bond funds (also known as junk bonds) can offer substantial income potential. However, these carry a higher default risk compared to investment-grade bonds. Understand the risk profile before investing.

Strategies for Achieving a 10% Dividend Yield:

- Diversification: Don't put all your eggs in one basket. Diversify across different sectors and companies to mitigate risk.

- Long-Term Perspective: High-yield dividend investing is a long-term strategy. Don't panic sell during market downturns.

- Regular Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation and risk level.

- Professional Advice: Consult with a qualified financial advisor to create a personalized investment strategy aligned with your risk tolerance and financial goals.

Conclusion:

Seeking a 10% dividend yield requires a sophisticated investment approach and a higher-than-average risk tolerance. By carefully researching potential investments, diversifying your portfolio, and understanding the inherent risks, income investors can potentially achieve this ambitious goal. Remember that past performance is not indicative of future results, and this article should not be considered financial advice. Always conduct thorough due diligence and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Seeking A 10% Dividend Yield? Top Analyst Picks For Income Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Taylan May Injury Closer To Nrl Field Recovery Details Inside

May 13, 2025

Taylan May Injury Closer To Nrl Field Recovery Details Inside

May 13, 2025 -

Childhood Obsession Explored In Despelotes Realistic Portrayal

May 13, 2025

Childhood Obsession Explored In Despelotes Realistic Portrayal

May 13, 2025 -

South Essex Bypass Long Delays Following Serious Accident

May 13, 2025

South Essex Bypass Long Delays Following Serious Accident

May 13, 2025 -

Farmer Wants A Wife 2025 Have The Winners Been Revealed

May 13, 2025

Farmer Wants A Wife 2025 Have The Winners Been Revealed

May 13, 2025 -

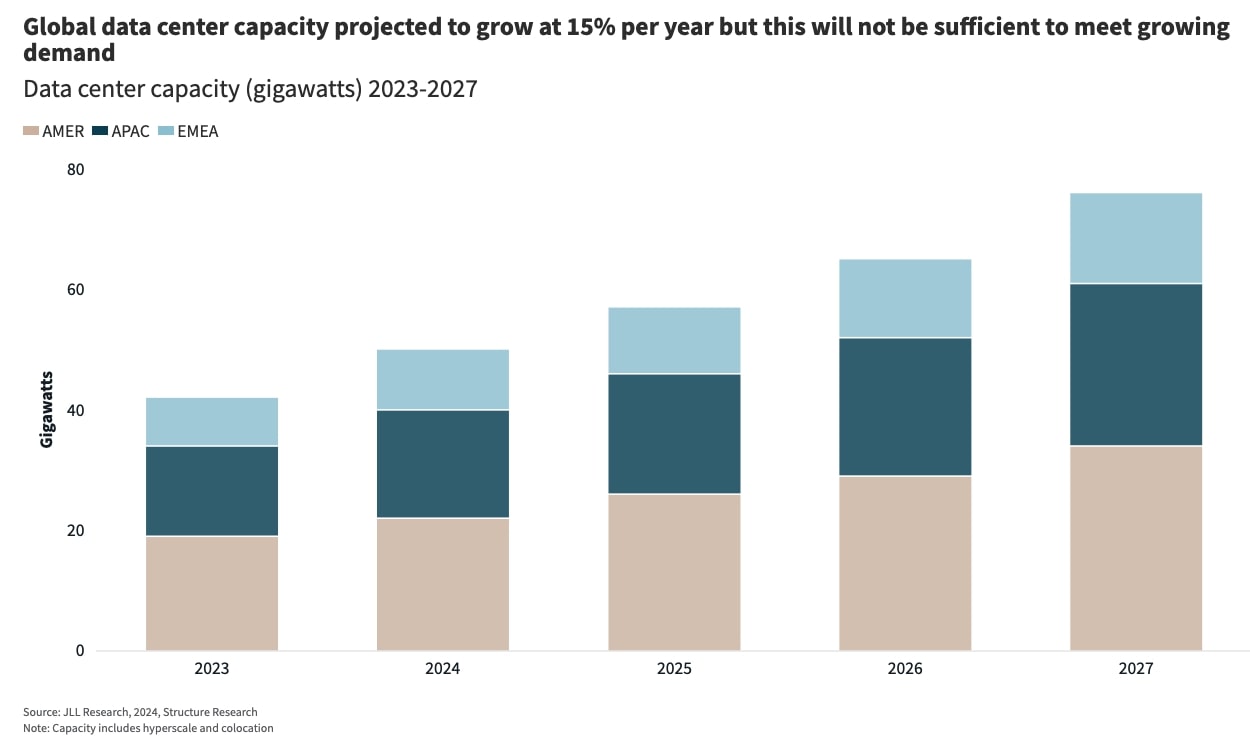

Despite Amazon And Microsoft Slowdowns Global Ai Data Center Market Booms

May 13, 2025

Despite Amazon And Microsoft Slowdowns Global Ai Data Center Market Booms

May 13, 2025

Latest Posts

-

Bad Thoughts Review Is Tom Seguras Netflix Special Worth Watching

May 13, 2025

Bad Thoughts Review Is Tom Seguras Netflix Special Worth Watching

May 13, 2025 -

Cbse Board Exam Results 2025 10th And 12th Check Your Scores Here

May 13, 2025

Cbse Board Exam Results 2025 10th And 12th Check Your Scores Here

May 13, 2025 -

Draper Vs Moutet Live Italian Open Score Updates And Highlights

May 13, 2025

Draper Vs Moutet Live Italian Open Score Updates And Highlights

May 13, 2025 -

Meta Stock Is Now The Time To Buy After The Us China Trade Deal

May 13, 2025

Meta Stock Is Now The Time To Buy After The Us China Trade Deal

May 13, 2025 -

Family Feud Tom Seguras Moms Explosive Reaction To His Latest Comedy Special

May 13, 2025

Family Feud Tom Seguras Moms Explosive Reaction To His Latest Comedy Special

May 13, 2025