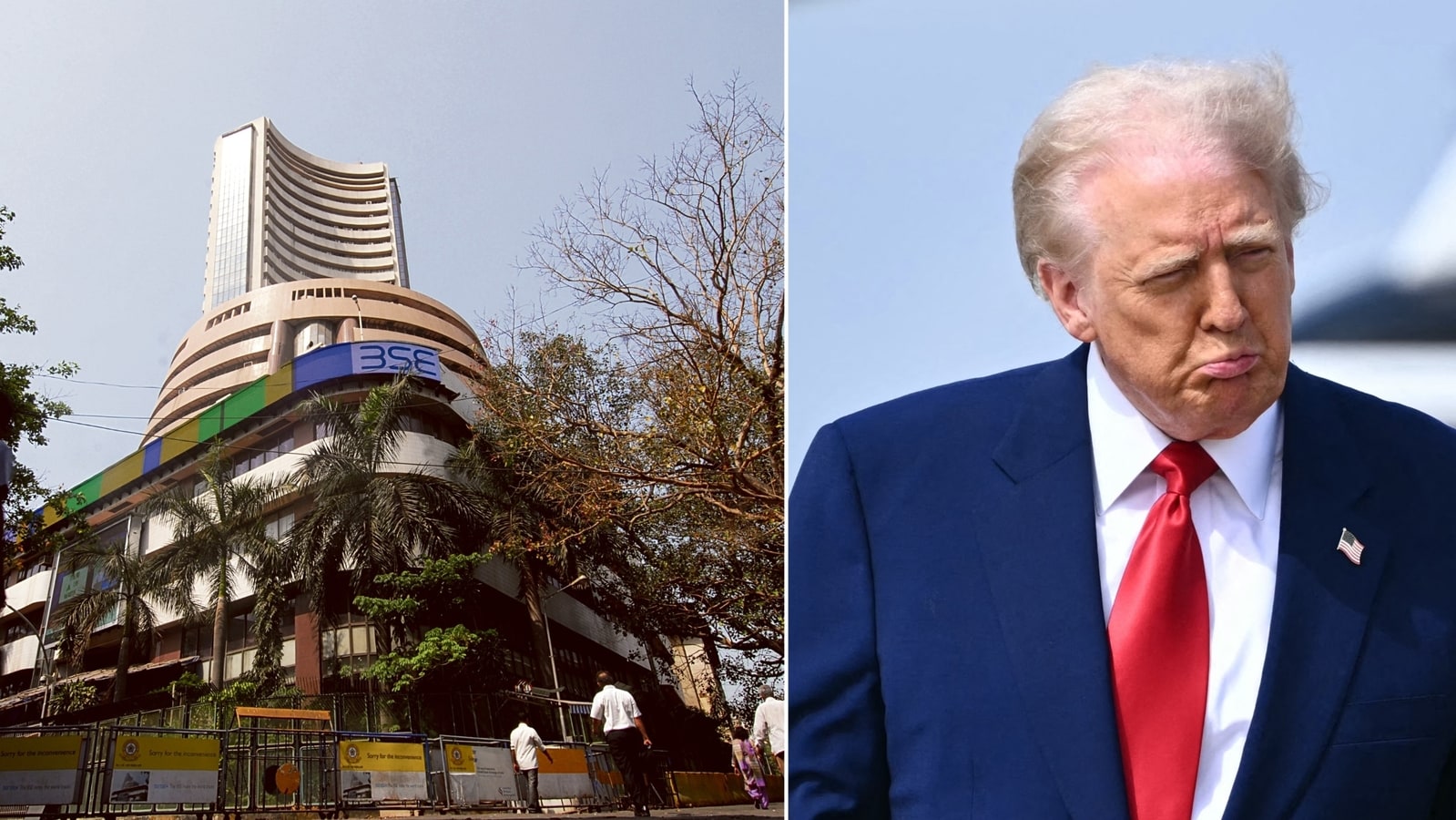

Sensex, Nifty Fall: Understanding Today's Sharp Decline In The Indian Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sensex, Nifty Fall: Understanding Today's Sharp Decline in the Indian Market

The Indian stock market experienced a significant downturn today, with both the Sensex and Nifty indices plunging sharply. This unexpected volatility has left investors wondering about the underlying causes and what the future holds. Understanding the reasons behind this decline is crucial for navigating the complexities of the Indian market.

Market Plunge: Key Factors Contributing to the Sensex and Nifty Fall

Several factors contributed to today's sharp decline in the Sensex and Nifty. While pinpointing a single cause is difficult, a confluence of events likely triggered the sell-off.

-

Global Market Sentiment: Negative global cues played a significant role. Concerns about rising inflation in major economies, coupled with potential interest rate hikes, created a risk-averse environment. This global uncertainty often ripples through emerging markets like India.

-

Rupee Depreciation: The weakening of the Indian Rupee against the US dollar further exacerbated the situation. A weaker rupee makes imports more expensive and can impact the profitability of Indian companies with significant foreign currency exposure.

-

Foreign Institutional Investor (FII) Outflows: FIIs have been net sellers in the Indian market recently. This outflow of foreign investment can put downward pressure on stock prices, particularly when combined with other negative factors.

-

Sector-Specific Concerns: Specific sectors within the Indian economy might have experienced negative news or disappointing performance, leading to targeted selling pressure. For example, concerns about rising input costs or slowing demand in certain industries could have triggered declines.

-

Profit-booking: After a period of sustained growth, some investors might have engaged in profit-booking, contributing to the sell-off. This is a normal market phenomenon, but it can amplify declines when combined with other negative factors.

Analyzing the Impact and Future Outlook

The sharp decline in the Sensex and Nifty raises concerns about the short-term outlook for the Indian market. However, it's important to avoid knee-jerk reactions and maintain a long-term perspective.

What should investors do?

- Stay Informed: Keep abreast of market developments and economic news to understand the evolving situation.

- Diversify your Portfolio: A diversified portfolio can mitigate risks associated with market volatility.

- Consult Financial Advisors: Seek professional advice before making any significant investment decisions.

- Avoid Panic Selling: Emotional decision-making can lead to poor investment outcomes.

Conclusion: Navigating Volatility in the Indian Stock Market

Today's decline in the Sensex and Nifty highlights the inherent volatility of the stock market. While the current downturn presents challenges, understanding the contributing factors and adopting a well-informed investment strategy is crucial for navigating these turbulent times. Investors should focus on long-term goals and avoid impulsive actions driven by short-term market fluctuations. The Indian economy remains fundamentally strong, and this dip may present opportunities for long-term investors. Continuous monitoring of the market and seeking expert advice remain key to successfully navigating the complexities of the Indian stock market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sensex, Nifty Fall: Understanding Today's Sharp Decline In The Indian Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ram Navami Feast 8 Lucky South Indian Dishes For Success

Apr 07, 2025

Ram Navami Feast 8 Lucky South Indian Dishes For Success

Apr 07, 2025 -

Indonesia Berduka Pengusaha Sukses Murdaya Poo Wafat

Apr 07, 2025

Indonesia Berduka Pengusaha Sukses Murdaya Poo Wafat

Apr 07, 2025 -

1 Billion Eu Fine For X Musks Platform Under Scrutiny For Disinformation

Apr 07, 2025

1 Billion Eu Fine For X Musks Platform Under Scrutiny For Disinformation

Apr 07, 2025 -

Analysis Why Kai Jones Shift To The Bench Could Be A Strategic Move

Apr 07, 2025

Analysis Why Kai Jones Shift To The Bench Could Be A Strategic Move

Apr 07, 2025 -

Perspectivas Economicas Copom Ipca Dados Da China E Industria Brasileira

Apr 07, 2025

Perspectivas Economicas Copom Ipca Dados Da China E Industria Brasileira

Apr 07, 2025