Sharp Decline In Dow Futures Signals Continuing Market Instability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

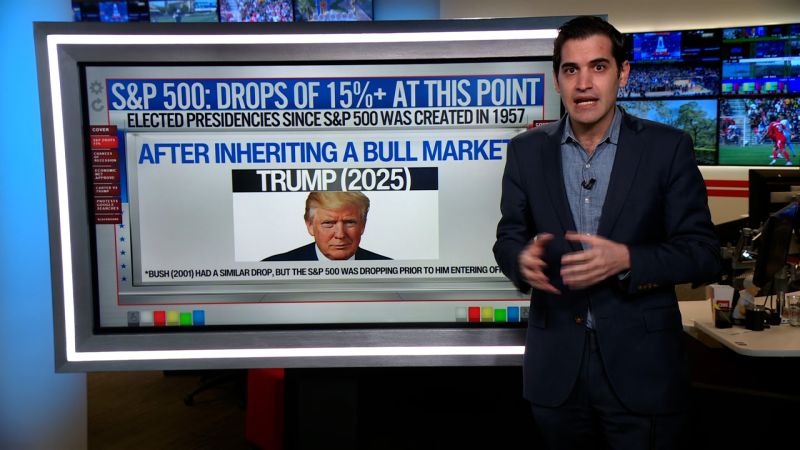

Sharp Decline in Dow Futures Signals Continuing Market Instability

Wall Street braces for another turbulent day as Dow futures plunge, fueling concerns about persistent market instability.

The pre-market trading session has painted a grim picture for investors, with Dow futures experiencing a sharp decline, signaling a potential continuation of the recent market volatility. This significant drop follows a week of fluctuating prices and heightened uncertainty, leaving many wondering if the worst is yet to come. The current situation underscores the fragility of the market and the lingering impact of several key economic factors.

What's driving the downturn?

Several interconnected factors contribute to this unsettling market trend. Experts point to several key culprits:

-

Inflationary Pressures: Persistent inflation continues to erode consumer spending power and squeeze corporate profit margins. The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes, while necessary, also contribute to economic slowdown and increased market uncertainty. The fear of a potential recession looms large.

-

Geopolitical Instability: The ongoing war in Ukraine, coupled with escalating geopolitical tensions in other regions, creates a volatile global landscape. These uncertainties impact supply chains, energy prices, and investor confidence, leading to market instability.

-

Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, while aimed at curbing inflation, are also slowing economic growth. Higher interest rates increase borrowing costs for businesses and consumers, potentially leading to reduced investment and spending.

-

Corporate Earnings Reports: Recent corporate earnings reports have been mixed, with some companies exceeding expectations while others fall short. Disappointing results from major companies can trigger sell-offs and contribute to overall market pessimism.

Analyzing the Dow Futures Drop:

The steep decline in Dow futures indicates a significant loss of investor confidence. This pre-market indicator suggests a potentially difficult day ahead for major indices. The severity of the drop suggests that investors are reacting to a combination of the factors mentioned above, leading to widespread selling.

What does this mean for investors?

The current market situation calls for caution and a well-defined investment strategy. Investors should:

- Diversify their portfolios: Spreading investments across different asset classes can help mitigate risk.

- Reassess risk tolerance: Given the increased volatility, investors may need to adjust their risk tolerance levels accordingly.

- Consult with financial advisors: Seeking professional advice can help navigate the complexities of the current market environment.

Looking Ahead:

The coming days and weeks will be crucial in determining the direction of the market. Close monitoring of economic indicators, geopolitical events, and corporate earnings will be essential for investors. While short-term predictions are inherently uncertain, the current decline in Dow futures underscores the need for vigilance and careful planning in the face of continuing market instability. The market's fragility highlights the importance of robust risk management and a long-term investment perspective. Only time will tell if this is a temporary correction or the start of a more significant downturn. However, the current situation serves as a stark reminder of the inherent risks involved in investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sharp Decline In Dow Futures Signals Continuing Market Instability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Altair Basic To Azure How Microsoft Endured For 50 Years

Apr 07, 2025

From Altair Basic To Azure How Microsoft Endured For 50 Years

Apr 07, 2025 -

Minecraft Movie Review Jason Momoas Performance Shines

Apr 07, 2025

Minecraft Movie Review Jason Momoas Performance Shines

Apr 07, 2025 -

Dan Biggars Rugby Career Ends Full Statement And Reaction

Apr 07, 2025

Dan Biggars Rugby Career Ends Full Statement And Reaction

Apr 07, 2025 -

Perang Dagang As China Bursa Hong Kong Terpuruk Sentuh Titik Terendah 2009

Apr 07, 2025

Perang Dagang As China Bursa Hong Kong Terpuruk Sentuh Titik Terendah 2009

Apr 07, 2025 -

1997 Echoes Hong Kong Stock Markets Dramatic Fall Amidst Tariff Worries

Apr 07, 2025

1997 Echoes Hong Kong Stock Markets Dramatic Fall Amidst Tariff Worries

Apr 07, 2025